1350

1350

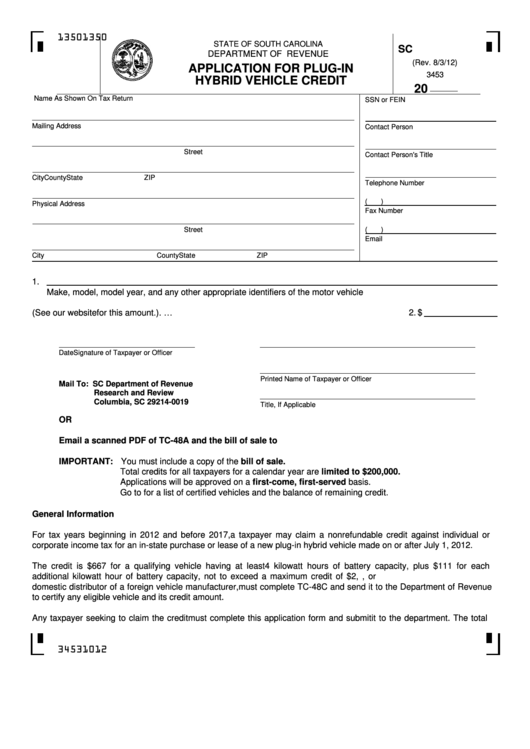

STATE OF SOUTH CAROLINA

SC SCH.TC-48A

DEPARTMENT OF REVENUE

(Rev. 8/3/12)

APPLICATION FOR PLUG-IN

3453

HYBRID VEHICLE CREDIT

20

Name As Shown On Tax Return

SSN or FEIN

Mailing Address

Contact Person

Street

Contact Person's Title

City

County

State

ZIP

Telephone Number

(

)

Physical Address

Fax Number

Street

(

)

Email

City

County

State

ZIP

1.

Make, model, model year, and any other appropriate identifiers of the motor vehicle

2. $

2. Enter the amount of tentative credit (See our website for this amount.). …......

Date

Signature of Taxpayer or Officer

Printed Name of Taxpayer or Officer

Mail To: SC Department of Revenue

Research and Review

Columbia, SC 29214-0019

Title, If Applicable

OR

Email a scanned PDF of TC-48A and the bill of sale to

IMPORTANT: You must include a copy of the bill of sale.

Total credits for all taxpayers for a calendar year are limited to $200,000.

Applications will be approved on a first-come, first-served basis.

Go to for a list of certified vehicles and the balance of remaining credit.

General Information

For tax years beginning in 2012 and before 2017, a taxpayer may claim a nonrefundable credit against individual or

corporate income tax for an in-state purchase or lease of a new plug-in hybrid vehicle made on or after July 1, 2012.

The credit is $667 for a qualifying vehicle having at least 4 kilowatt hours of battery capacity, plus $111 for each

additional kilowatt hour of battery capacity, not to exceed a maximum credit of $2,000. The vehicle manufacturer, or

domestic distributor of a foreign vehicle manufacturer, must complete TC-48C and send it to the Department of Revenue

to certify any eligible vehicle and its credit amount.

Any taxpayer seeking to claim the credit must complete this application form and submit it to the department. The total

34531012

1

1 2

2