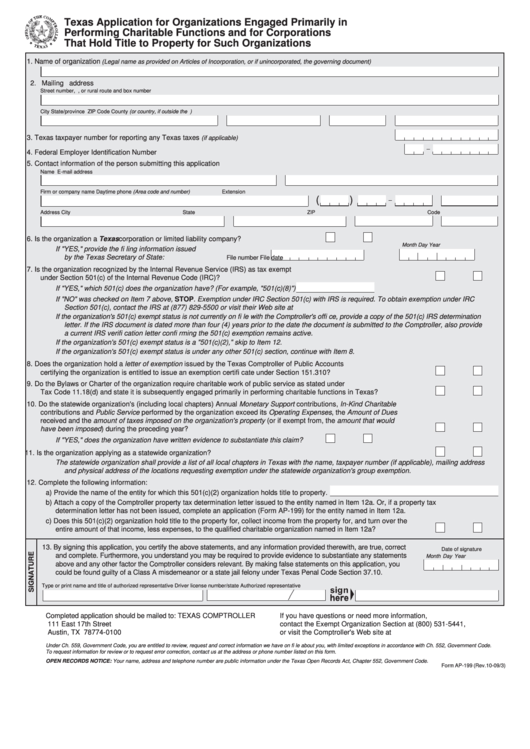

Texas Application for Organizations Engaged Primarily in

PRINT FORM

CLEAR FORM

Performing Charitable Functions and for Corporations

That Hold Title to Property for Such Organizations

1. Name of organization

(Legal name as provided on Articles of Incorporation, or if unincorporated, the governing document)

2. Mailing address

Street number, P.O. Box, or rural route and box number

City

State/province

ZIP Code

County (or country, if outside the U.S.)

3. Texas taxpayer number for reporting any Texas taxes

.............................................................................

(if applicable)

4. Federal Employer Identifi cation Number ......................................................................................................................... .

5. Contact information of the person submitting this application

Name

E-mail address

Firm or company name

Daytime phone (Area code and number)

Extension

(

)

Address

City

State

ZIP Code

6. Is the organization a Texas corporation or limited liability company? .....................................

YES

NO

Month

Day

Year

If "YES," provide the fi ling information issued

by the Texas Secretary of State: ...................................

File number

File date

7. Is the organization recognized by the Internal Revenue Service (IRS) as tax exempt

under Section 501(c) of the Internal Revenue Code (IRC)? .............................................................................................................

YES

NO

If "YES," which 501(c) does the organization have? (For example, "501(c)(8)")

If "NO" was checked on Item 7 above, STOP. Exemption under IRC Section 501(c) with IRS is required. To obtain exemption under IRC

Section 501(c), contact the IRS at (877) 829-5500 or visit their Web site at

If the organization's 501(c) exempt status is not currently on fi le with the Comptroller's offi ce, provide a copy of the 501(c) IRS determination

letter. If the IRS document is dated more than four (4) years prior to the date the document is submitted to the Comptroller, also provide

a current IRS verifi cation letter confi rming the 501(c) exemption remains active.

If the organization's 501(c) exempt status is a "501(c)(2)," skip to Item 12.

If the organization's 501(c) exempt status is under any other 501(c) section, continue with Item 8.

8. Does the organization hold a letter of exemption issued by the Texas Comptroller of Public Accounts

certifying the organization is entitled to issue an exemption certifi cate under Section 151.310? ......................................................

YES

NO

9. Do the Bylaws or Charter of the organization require charitable work of public service as stated under

Tax Code 11.18(d) and state it is subsequently engaged primarily in performing charitable functions in Texas? .............................

YES

NO

10. Do the statewide organization's (including local chapters) Annual Monetary Support contributions, In-Kind Charitable

contributions and Public Service performed by the organization exceed its Operating Expenses, the Amount of Dues

received and the amount of taxes imposed on the organization's property (or if exempt from, the amount that would

have been imposed) during the preceding year? ..............................................................................................................................

YES

NO

If "YES," does the organization have written evidence to substantiate this claim? ........

YES

NO

11. Is the organization applying as a statewide organization? ................................................................................................................

YES

NO

The statewide organization shall provide a list of all local chapters in Texas with the name, taxpayer number (if applicable), mailing address

and physical address of the locations requesting exemption under the statewide organization's group exemption.

12. Complete the following information:

a) Provide the name of the entity for which this 501(c)(2) organization holds title to property.

b) Attach a copy of the Comptroller property tax determination letter issued to the entity named in Item 12a. Or, if a property tax

determination letter has not been issued, complete an application (Form AP-199) for the entity named in Item 12a.

c) Does this 501(c)(2) organization hold title to the property for, collect income from the property for, and turn over the

entire amount of that income, less expenses, to the qualifi ed charitable organization named in Item 12a? ............................

YES

NO

13. By signing this application, you certify the above statements, and any information provided therewith, are true, correct

Date of signature

and complete. Furthermore, you understand you may be required to provide evidence to substantiate any statements

Month

Day

Year

above and any other factor the Comptroller considers relevant. By making false statements on this application, you

could be found guilty of a Class A misdemeanor or a state jail felony under Texas Penal Code Section 37.10.

Type or print name and title of authorized representative

Driver license number/state

Authorized representative

Completed application should be mailed to: TEXAS COMPTROLLER

If you have questions or need more information,

111 East 17th Street

contact the Exempt Organization Section at (800) 531-5441,

Austin, TX 78774-0100

or visit the Comptroller's Web site at

Under Ch. 559, Government Code, you are entitled to review, request and correct information we have on fi le about you, with limited exceptions in accordance with Ch. 552, Government Code.

To request information for review or to request error correction, contact us at the address or phone number listed on this form.

OPEN RECORDS NOTICE: Your name, address and telephone number are public information under the Texas Open Records Act, Chapter 552, Government Code.

Form AP-199 (Rev.10-09/3)

1

1