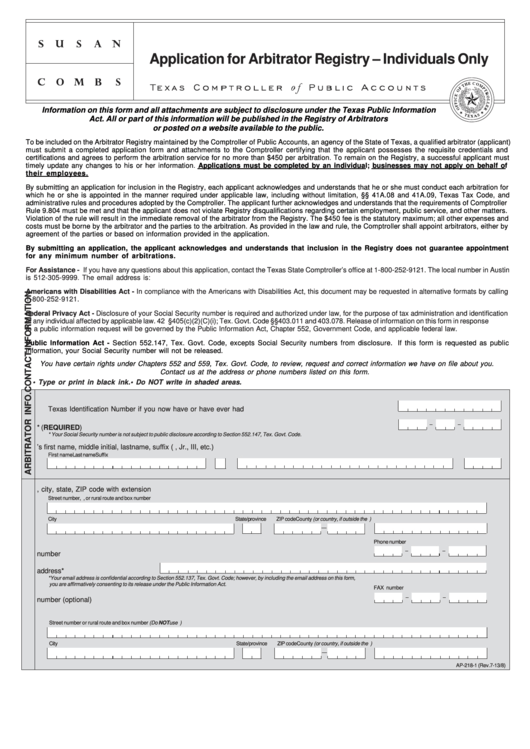

PRINT FORM

CLEAR FORM

Application for Arbitrator Registry – Individuals Only

Information on this form and all attachments are subject to disclosure under the Texas Public Information

Act. All or part of this information will be published in the Registry of Arbitrators

or posted on a website available to the public.

To be included on the Arbitrator Registry maintained by the Comptroller of Public Accounts, an agency of the State of Texas, a qualified arbitrator (applicant)

must submit a completed application form and attachments to the Comptroller certifying that the applicant possesses the requisite credentials and

certifications and agrees to perform the arbitration service for no more than $450 per arbitration. To remain on the Registry, a successful applicant must

timely update any changes to his or her information. Applications must be completed by an individual; businesses may not apply on behalf of

their employees.

By submitting an application for inclusion in the Registry, each applicant acknowledges and understands that he or she must conduct each arbitration for

which he or she is appointed in the manner required under applicable law, including without limitation, §§ 41A.08 and 41A.09, Texas Tax Code, and

administrative rules and procedures adopted by the Comptroller. The applicant further acknowledges and understands that the requirements of Comptroller

Rule 9.804 must be met and that the applicant does not violate Registry disqualifications regarding certain employment, public service, and other matters.

Violation of the rule will result in the immediate removal of the arbitrator from the Registry. The $450 fee is the statutory maximum; all other expenses and

costs must be borne by the arbitrator and the parties to the arbitration. As provided in the law and rule, the Comptroller shall appoint arbitrators, either by

agreement of the parties or based on information provided in the application.

By submitting an application, the applicant acknowledges and understands that inclusion in the Registry does not guarantee appointment

for any minimum number of arbitrations.

For Assistance - If you have any questions about this application, contact the Texas State Comptroller’s office at 1-800-252-9121. The local number in Austin

is 512-305-9999. The email address is: ptad.cpa@cpa.state.tx.us

Americans with Disabilities Act - In compliance with the Americans with Disabilities Act, this document may be requested in alternative formats by calling

1-800-252-9121.

Federal Privacy Act - Disclosure of your Social Security number is required and authorized under law, for the purpose of tax administration and identification

of any individual affected by applicable law. 42 U.S.C. §405(c)(2)(C)(i); Tex. Govt. Code §§403.011 and 403.078. Release of information on this form in response

to a public information request will be governed by the Public Information Act, Chapter 552, Government Code, and applicable federal law.

Public Information Act - Section 552.147, Tex. Govt. Code, excepts Social Security numbers from disclosure. If this form is requested as public

information, your Social Security number will not be released.

You have certain rights under Chapters 552 and 559, Tex. Govt. Code, to review, request and correct information we have on file about you.

Contact us at the address or phone numbers listed on this form.

• Type or print in black ink.

• Do NOT write in shaded areas.

1. Taxpayer number for reporting any Texas tax OR

Texas Identification Number if you now have or have ever had one .......................................................................

2. Social Security number* (REQUIRED) .........................................................................................................................

* Your Social Security number is not subject to public disclosure according to Section 552.147, Tex. Govt. Code.

3. Individual’s first name, middle initial, last name, suffix (i.e., Jr., III, etc.)

First name

M.I.

Last name

Suffix

4. Mailing address, city, state, ZIP code with extension

Street number, P.O. Box, or rural route and box number

City

State/province

ZIP code

County (or country, if outside the U.S.)

Phone number

5. Daytime phone number .................................................................................................................................

6. Email address* ................................

*Your email address is confidential according to Section 552.137, Tex. Govt. Code; however, by including the email address on this form,

you are affirmatively consenting to its release under the Public Information Act.

FAX number

7. FAX number (optional) ..................................................................................................................................

8. Physical location

Street number or rural route and box number (Do NOT use P.O. Box)

City

State/province

ZIP code

County (or country, if outside the U.S.)

AP-218-1 (Rev.7-13/8)

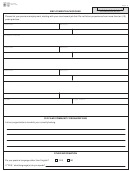

1

1 2

2 3

3 4

4 5

5 6

6