TEXAS APPLICATION FOR REFUND OF STATE TAXES

PAID BY PERSON OWNING CERTAIN ABATED PROPERTY

COMPTROLLER OF PUBLIC ACCOUNTS

GENERAL INFORMATION

WHO MAY APPLY: A person who meets the following three conditions may apply for a refund:

1. paid property taxes to a school district on property that is located in a reinvestment zone established under Chapter 312;

2. is exempt in whole or in part from property tax imposed by a city or county under a tax abatement agreement established under Chapter 312; and

3. is not in a tax abatement agreement entered into with a school district.

If you entered into a tax abatement before January 1, 1996, OR if you moved the business before applying for this refund, you are not entitled to

a refund. If you entered into more than one tax abatement agreement for the same property or have different abatement percentages for real and

personal property, a separate claim must be filed for each agreement or each percentage. If the property subject to a tax abatement agreement is

in more than one school district, a separate claim must be filed for each school district.

WHEN TO APPLY: An application for refund must be postmarked or delivered before August 1 of the year following the tax year. (For example, when

filing for a refund of property taxes paid for tax year 1997, the application must be postmarked by July 31, 1998.)

WHAT TAXES CAN BE REFUNDED: The refund is equal to the amount of property taxes you would not have paid had you entered into a school

district abatement agreement with terms identical to the city or county abatement agreement, not to exceed the net state sales and use taxes and

state franchise taxes paid or collected and remitted during that calendar year. The refund amount may also be limited by a statewide appropriation

per year for this refund program.

HOW TO FILE: After completing all items on this form, send the original Application For Refund and one complete copy of the information requested

in Step 5 to the following address:

Comptroller of Public Accounts

Property Tax Division

P.O. Box 13528

Austin, Texas 78711-3528.

FOR ASSISTANCE: Call 1-800-252-9121 toll free, or 512/305-9999, for assistance or to request forms. From a Telecommunications Device for the

Deaf (TDD), call 1-800-248-4099 or 512/463-4621.

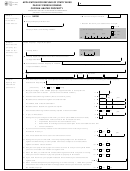

SPECIFIC INSTRUCTIONS (Please print or type):

Item c.

Enter the 11-digit taxpayer number issued by the Comptroller

Items y-z. Disclose if your business has moved out of this reinvestment

of Public Accounts. If you do not have a number previously as-

zone; if yes, enter the date moved (Item z).

signed by the state, use one of the following: Social Security Num-

ber, if you are a sole owner of a business, or a Federal Employer’s

Items aa-ee. Answer the five questions regarding the business in the

Identification (FEI) number, if you are a corporation, partnership, or

abatement agreement.

other entity.

Item bb. Disclose if your company has paid in lieu of taxes, or any other

Item d.

Enter your business name and mailing address.

payment, including a gift, grant, donation, or provision of in-kind

service to a municipality or county with which you have executed a

Item e.

Enter the tax year subject to this claim.

tax abatement agreement. The above does not apply to a payment

that is a tax, fee, or charge for services provided by the municipality

Item f.

Blacken this box if your mailing address has changed.

or county, or to payments pursuant to a contract with an industrial

district under Chapter 42 or chapter 43, Local Government Code,

Items h-k. Enter the legal description, the county appraisal district parcel

or to a payment that in any year of the agreement does not in the

identification number and school district of the abated property as

aggregate exceed $5,000 in value.

shown on your tax bill or tax receipt.

Item 1a. Enter the total appraised value of the property in the city or

Items l-o. Enter the physical address of the abated property.

county abatement agreement for this claim year.

Item p-q. Enter the name of the city or county that originated the abate-

Item 1b. Enter the initial base comparison year appraised value of the

ment agreement that is the subject of this application and check if a

property in the city or county abatement agreement.

city or county is named.

Item 1c. Subtract Item 1b from Item 1a.

Item r1. Enter the percentage of the abated property’s appraised value

that is exempt in the city or county abatement agreement. Round to

Item 1d. Multiply Item 1c by the percentage of value abated in the abate-

the nearest whole number.

ment agreement (Item r).

Item r2. Enter the period of the abatement agreement (may not exceed

Item 2.

Enter the school district tax rate for the calendar year subject

10 years).

to the claim, as shown on the tax bill or tax receipt.

Item s-u. Enter the dates (Items s and t) that this abatement agreement

Item 3.

Potential refund amount. Multiply Item 1d by Item 2, then mul-

was entered into or was last modified and the date (Item u) that it

tiply the result by .01.

will expire.

Item 4.

Enter the total amount of school taxes paid during this calen-

Item v-w. Acknowledge if this abatement agreement has expired or been

dar year as shown on your tax receipt.

canceled; if yes, enter the date expired or canceled (Item w).

Items ff-jj. Sign and date the application, certifying that you meet all

Item x.

Concerning the abatement agreement referenced in Item p,

eligibility requirements. If the form is completed by a duly autho-

enter (1) if you established a new business, (2) if you expanded

rized agent of the taxpayer, please attach a Power of Attorney or

your current business, (3) if you modernized your existing business

other written authorization for the representative’s action on behalf

to retain jobs in this reinvestment zone, or (4) none of these. Please

of the taxpayer, or the application will be returned as “incomplete.”

enter only one number. If more than one number applies enter the

one most appropriate.

Be sure to attach all documents listed in Step 5.

AP-186-1 (11-98/2)

1

1 2

2 3

3