Credit For Educational Opportunity Worksheet For Employers - 2011

ADVERTISEMENT

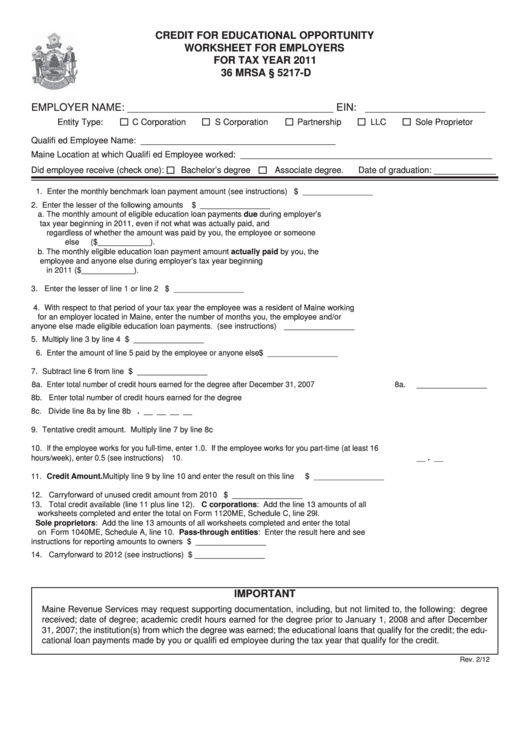

CREDIT FOR EDUCATIONAL OPPORTUNITY

WORKSHEET FOR EMPLOYERS

FOR TAX YEAR 2011

36 MRSA § 5217-D

EMPLOYER NAME: ____________________________________ EIN: _____________________

Entity Type:

C Corporation

S Corporation

Partnership

LLC

Sole Proprietor

Qualifi ed Employee Name: _________________________________________

Maine Location at which Qualifi ed Employee worked: _____________________________________________________

Did employee receive (check one):

Bachelor’s degree

Associate degree.

Date of graduation: _____________

1. Enter the monthly benchmark loan payment amount (see instructions) .............................................

1. $ ________________

2. Enter the lesser of the following amounts ........................................................................................... 2. $ ________________

a. The monthly amount of eligible education loan payments due during employer’s

tax year beginning in 2011, even if not what was actually paid, and

regardless of whether the amount was paid by you, the employee or someone

else ($____________).

b. The monthly eligible education loan payment amount actually paid by you, the

employee and anyone else during employer’s tax year beginning

in 2011 ($____________).

3. Enter the lesser of line 1 or line 2 ......................................................................................................... 3. $ ________________

4. With respect to that period of your tax year the employee was a resident of Maine working

for an employer located in Maine, enter the number of months you, the employee and/or

anyone else made eligible education loan payments. (see instructions) ............................................. 4.

________________

5. Multiply line 3 by line 4 .......................................................................................................................... 5. $ ________________

6. Enter the amount of line 5 paid by the employee or anyone else ............................................................ 6. $ ________________

7. Subtract line 6 from line 5...................................................................................................................... 7. $ ________________

8a. Enter total number of credit hours earned for the degree after December 31, 2007 ................................... 8a.

________________

8b. Enter total number of credit hours earned for the degree ..................................................................... 8b.

________________

8c. Divide line 8a by line 8b ....................................................................................................................... 8c.

__ . __ __ __ __

9. Tentative credit amount. Multiply line 7 by line 8c ................................................................................ 9.

________________

10. If the employee works for you full-time, enter 1.0. If the employee works for you part-time (at least 16

hours/week), enter 0.5 (see instructions) .....................................................................................................

10.

__ . __

11. Credit Amount. Multiply line 9 by line 10 and enter the result on this line ....................................... 11. $ ________________

12. Carryforward of unused credit amount from 2010 ................................................................................ 12. $ ________________

13. Total credit available (line 11 plus line 12). C corporations: Add the line 13 amounts of all

worksheets completed and enter the total on Form 1120ME, Schedule C, line 29l.

Sole proprietors: Add the line 13 amounts of all worksheets completed and enter the total

on Form 1040ME, Schedule A, line 10. Pass-through entities: Enter the result here and see

instructions for reporting amounts to owners ........................................................................................ 13. $ ________________

14. Carryforward to 2012 (see instructions) ................................................................................................ 14. $ ________________

IMPORTANT

Maine Revenue Services may request supporting documentation, including, but not limited to, the following: degree

received; date of degree; academic credit hours earned for the degree prior to January 1, 2008 and after December

31, 2007; the institution(s) from which the degree was earned; the educational loans that qualify for the credit; the edu-

cational loan payments made by you or qualifi ed employee during the tax year that qualify for the credit.

Rev. 2/12

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3