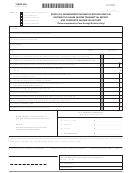

Form Pte-Wh - Kentucky Nonresident Income Tax Withholding On Distributive Share Income Page 2

ADVERTISEMENT

A pass-through entity must complete this form or approved substitute form for each nonresident individual, estate or trust

partner, member or shareholder; or each C corporation partner or member doing business in Kentucky only through its

ownership interest in the pass-through entity. Copy A of PTE-Wh must be attached to Form 740NP-Wh filed with the Kentucky

Department of Revenue. Copies B and C of Form PTE-Wh shall be furnished to each partner, member or shareholder by

the 15th day of the fourth month following the close of the taxable year.

INSTRUCTIONS

1.

Enter the pass-through entity’s federal employer identification number (FEIN).

2.

Enter the pass-through entity’s Kentucky Corporation/LLET Account Number.

3.

Enter the pass-through entity’s name, address and ZIP Code.

4.

Enter the partner’s, member’s or shareholder’s Social Security Number or FEIN. Check the box if a corporation.

5.

Enter the partner’s, member’s or shareholder’s name, address and ZIP Code.

6.

Enter the partner’s, member’s or shareholder’s distributive share income subject to withholding (from Kentucky

Schedule K-1, combine income and loss items and multiply by the apportionment fraction on Schedule A, Section I,

Line 12).

7.

Enter the amount on Line 6 multiplied by six percent (6%).

8.

Enter the partner’s, member’s or shareholder’s distributive share of credits.

9.

Enter the amount of Line 7 less Line 8. This is the amount of Kentucky income tax withheld.

INSTRUCTIONS TO MEMBER, PARTNER OR SHAREHOLDER

ATTACh Copy B of Form PTE-Wh to your nonresident Kentucky individual, estate, trust or C corporation income tax return

to claim the income tax withheld. A nonresident individual partner, member or shareholder of a pass-through entity doing

business in Kentucky must file a Form 740-NP , Kentucky Individual Income Tax Return Nonresident or Part-Year Resident,

and pay income tax on all Kentucky source income. An estate or trust partner, member or shareholder must file a Form

741, Kentucky Fiduciary Income Tax Return, and pay income tax on all Kentucky source income. A C corporation partner or

member must file Form 720, Kentucky Corporation Income Tax and LLET Return, and pay income tax on all of its income

allocated and apportioned to Kentucky as provided by KRS 141.120.

If a nonresident individual’s, estate’s or trust’s only Kentucky source income is distributive share income from pass-through

entities, the withholding on PTE-Wh and the payment of tax by the pass-through entities will satisfy the nonresident

individual’s, estate’s or trust’s Kentucky filing requirement as provided by KRS 141.020 and 141.180. A nonresident individual,

estate or trust may be able to claim a credit for tax paid on distributive share income to Kentucky on their resident state

return. Check with the resident state for allowable credits and any necessary verification required.

K

T

C

F

y

r

eep

his

opy

or

our

eCords

A pass-through entity must complete this form or approved substitute form for each nonresident individual, estate or trust

partner, member or shareholder; or each C corporation partner or member doing business in Kentucky only through its

ownership interest in the pass-through entity. Copy A of PTE-Wh must be attached to Form 740NP-Wh filed with the Kentucky

Department of Revenue. Copies B and C of Form PTE-Wh shall be furnished to each partner, member or shareholder by

the 15th day of the fourth month following the close of the taxable year.

INSTRUCTIONS

1.

Enter the pass-through entity’s federal employer identification number (FEIN).

2.

Enter the pass-through entity’s Kentucky Corporation/LLET Account Number.

3.

Enter the pass-through entity’s name, address and ZIP Code.

4.

Enter the partner’s, member’s or shareholder’s Social Security Number or FEIN. Check the box if a corporation.

5.

Enter the partner’s, member’s or shareholder’s name, address and ZIP Code.

6.

Enter the partner’s, member’s or shareholder’s distributive share income subject to withholding (from Kentucky

Schedule K-1, combine income and loss items and multiply by the apportionment fraction on Schedule A, Section I,

Line 12).

7.

Enter the amount on Line 6 multiplied by six percent (6%).

8.

Enter the partner’s, member’s or shareholder’s distributive share of credits.

9.

Enter the amount of Line 7 less Line 8. This is the amount of Kentucky income tax withheld.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2