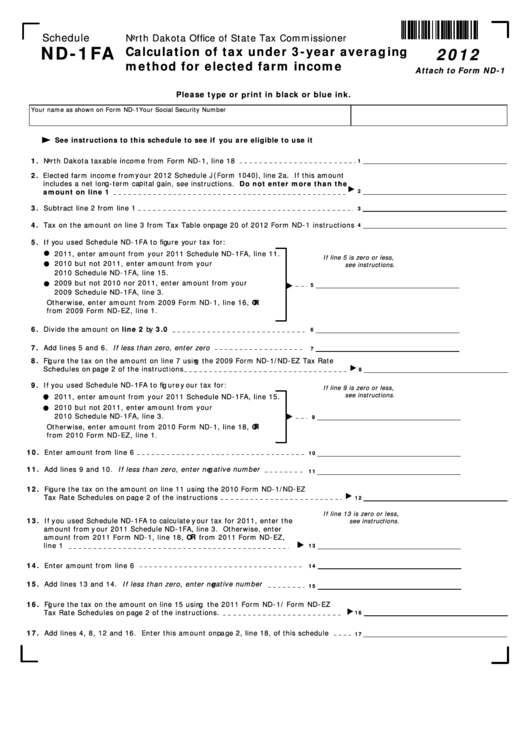

Schedule

North Dakota Office of State Tax Commissioner

ND-1FA

Calculation of tax under 3-year averaging

2012

method for elected farm income

Attach to Form ND-1

Please type or print in black or blue ink.

Your name as shown on Form ND-1

Your Social Security Number

See instructions to this schedule to see if you are eligible to use it

1. North Dakota taxable income from Form ND-1, line 18

1

2. Elected farm income from your 2012 Schedule J (Form 1040), line 2a. If this amount

includes a net long-term capital gain, see instructions. Do not enter more than the

amount on line 1

2

3. Subtract line 2 from line 1

3

4. Tax on the amount on line 3 from Tax Table on page 20 of 2012 Form ND-1 instructions

4

5. If you used Schedule ND-1FA to figure your tax for:

2011, enter amount from your 2011 Schedule ND-1FA, line 11.

If line 5 is zero or less,

2010 but not 2011, enter amount from your

see instructions.

2010 Schedule ND-1FA, line 15.

2009 but not 2010 nor 2011, enter amount from your

5

2009 Schedule ND-1FA, line 3.

Otherwise, enter amount from 2009 Form ND-1, line 16, OR

from 2009 Form ND-EZ, line 1.

6. Divide the amount on line 2 by 3.0

6

7. Add lines 5 and 6. If less than zero, enter zero

7

8. Figure the tax on the amount on line 7 using the 2009 Form ND-1/ND-EZ Tax Rate

Schedules on page 2 of the instructions

8

9. If you used Schedule ND-1FA to figure your tax for:

If line 9 is zero or less,

see instructions.

2011, enter amount from your 2011 Schedule ND-1FA, line 15.

2010 but not 2011, enter amount from your

2010 Schedule ND-1FA, line 3.

9

Otherwise, enter amount from 2010 Form ND-1, line 18, OR

from 2010 Form ND-EZ, line 1.

10. Enter amount from line 6

10

11. Add lines 9 and 10. If less than zero, enter negative number

11

12. Figure the tax on the amount on line 11 using the 2010 Form ND-1/ND-EZ

Tax Rate Schedules on page 2 of the instructions

12

If line 13 is zero or less,

13. If you used Schedule ND-1FA to calculate your tax for 2011, enter the

see instructions.

amount from your 2011 Schedule ND-1FA, line 3. Otherwise, enter

amount from 2011 Form ND-1, line 18, OR from 2011 Form ND-EZ,

line 1

13

14. Enter amount from line 6

14

15. Add lines 13 and 14. If less than zero, enter negative number

15

16. Figure the tax on the amount on line 15 using the 2011 Form ND-1/ Form ND-EZ

Tax Rate Schedules on page 2 of the instructions.

16

17. Add lines 4, 8, 12 and 16. Enter this amount on page 2, line 18, of this schedule

17

1

1 2

2 3

3 4

4