Form Nd-1fa - 3-Year Averaging Method For Elected Farm Income

ADVERTISEMENT

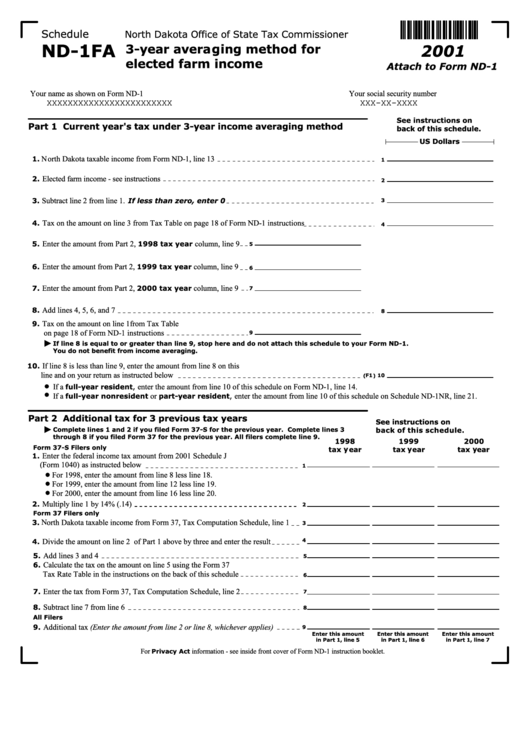

Schedule

North Dakota Office of State Tax Commissioner

ND-1FA

2001

3-year averaging method for

elected farm income

Attach to Form ND-1

Your name as shown on Form ND-1

Your social security number

XXXXXXXXXXXXXXXXXXXXXXXX

XXX-XX-XXXX

See instructions on

Part 1 Current year's tax under 3-year income averaging method

back of this schedule.

US Dollars

1.

North Dakota taxable income from Form ND-1, line 13

1

2.

Elected farm income - see instructions

2

3.

Subtract line 2 from line 1.

If less than zero, enter 0

3

4.

Tax on the amount on line 3 from Tax Table on page 18 of Form ND-1 instructions

4

5.

Enter the amount from Part 2,

1998 tax year

column, line 9

5

6.

Enter the amount from Part 2,

1999 tax year

column, line 9

6

7.

Enter the amount from Part 2,

2000 tax year

column, line 9

7

8.

Add lines 4, 5, 6, and 7

8

9.

Tax on the amount on line 1from Tax Table

on page 18 of Form ND-1 instructions

9

If line 8 is equal to or greater than line 9, stop here and do not attach this schedule to your Form ND-1.

You do not benefit from income averaging.

10.

If line 8 is less than line 9, enter the amount from line 8 on this

line and on your return as instructed below

(F1) 10

If a

full-year resident,

enter the amount from line 10 of this schedule on Form ND-1, line 14.

If a

full-year nonresident

or

part-year resident,

enter the amount from line 10 of this schedule on Schedule ND-1NR, line 21.

Part 2 Additional tax for 3 previous tax years

See instructions on

Complete lines 1 and 2 if you filed Form 37-S for the previous year. Complete lines 3

back of this schedule.

through 8 if you filed Form 37 for the previous year. All filers complete line 9.

1998

1999

2000

Form 37-S Filers only

tax year

tax year

tax year

1.

Enter the federal income tax amount from 2001 Schedule J

(Form 1040) as instructed below

1

For 1998, enter the amount from line 8 less line 18.

For 1999, enter the amount from line 12 less line 19.

For 2000, enter the amount from line 16 less line 20.

2.

Multiply line 1 by 14% (.14)

2

Form 37 Filers only

3.

North Dakota taxable income from Form 37, Tax Computation Schedule, line 1

3

4.

Divide the amount on line 2 of Part 1 above by three and enter the result

4

5.

Add lines 3 and 4

5

6.

Calculate the tax on the amount on line 5 using the Form 37

Tax Rate Table in the instructions on the back of this schedule

6

7.

Enter the tax from Form 37, Tax Computation Schedule, line 2

7

8.

Subtract line 7 from line 6

8

All Filers

9.

Additional tax (Enter the amount from line 2 or line 8, whichever applies)

9

Enter this amount

Enter this amount

Enter this amount

in Part 1, line 5

in Part 1, line 6

in Part 1, line 7

For

Privacy Act

information - see inside front cover of Form ND-1 instruction booklet.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1