Instructions For 2002 Schedule Nd-1fa - Calculation Of Tax Under 3-Year Averaging Method For Elected Farm Income

ADVERTISEMENT

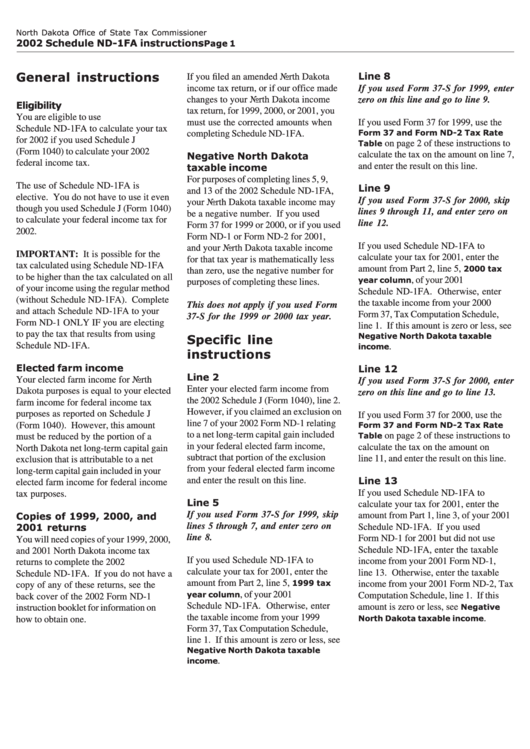

North Dakota Office of State Tax Commissioner

2002 Schedule ND-1FA instructions

Page 1

General instructions

Line 8

If you filed an amended North Dakota

income tax return, or if our office made

If you used Form 37-S for 1999, enter

changes to your North Dakota income

zero on this line and go to line 9.

Eligibility

tax return, for 1999, 2000, or 2001, you

You are eligible to use

must use the corrected amounts when

If you used Form 37 for 1999, use the

Schedule ND-1FA to calculate your tax

Form 37 and Form ND-2 Tax Rate

completing Schedule ND-1FA.

for 2002 if you used Schedule J

on page 2 of these instructions to

Table

(Form 1040) to calculate your 2002

calculate the tax on the amount on line 7,

Negative North Dakota

federal income tax.

and enter the result on this line.

taxable income

For purposes of completing lines 5, 9,

The use of Schedule ND-1FA is

Line 9

and 13 of the 2002 Schedule ND-1FA,

elective. You do not have to use it even

If you used Form 37-S for 2000, skip

your North Dakota taxable income may

though you used Schedule J (Form 1040)

lines 9 through 11, and enter zero on

be a negative number. If you used

to calculate your federal income tax for

line 12.

Form 37 for 1999 or 2000, or if you used

2002.

Form ND-1 or Form ND-2 for 2001,

If you used Schedule ND-1FA to

and your North Dakota taxable income

IMPORTANT: It is possible for the

calculate your tax for 2001, enter the

for that tax year is mathematically less

tax calculated using Schedule ND-1FA

amount from Part 2, line 5,

2000 tax

than zero, use the negative number for

to be higher than the tax calculated on all

, of your 2001

year column

purposes of completing these lines.

of your income using the regular method

Schedule ND-1FA. Otherwise, enter

(without Schedule ND-1FA). Complete

the taxable income from your 2000

This does not apply if you used Form

and attach Schedule ND-1FA to your

Form 37, Tax Computation Schedule,

37-S for the 1999 or 2000 tax year.

Form ND-1 ONLY IF you are electing

line 1. If this amount is zero or less, see

to pay the tax that results from using

Negative North Dakota taxable

Specific line

Schedule ND-1FA.

.

income

instructions

Elected farm income

Line 12

Line 2

Your elected farm income for North

If you used Form 37-S for 2000, enter

Enter your elected farm income from

Dakota purposes is equal to your elected

zero on this line and go to line 13.

the 2002 Schedule J (Form 1040), line 2.

farm income for federal income tax

However, if you claimed an exclusion on

purposes as reported on Schedule J

If you used Form 37 for 2000, use the

line 7 of your 2002 Form ND-1 relating

(Form 1040). However, this amount

Form 37 and Form ND-2 Tax Rate

to a net long-term capital gain included

on page 2 of these instructions to

Table

must be reduced by the portion of a

in your federal elected farm income,

calculate the tax on the amount on

North Dakota net long-term capital gain

subtract that portion of the exclusion

line 11, and enter the result on this line.

exclusion that is attributable to a net

from your federal elected farm income

long-term capital gain included in your

and enter the result on this line.

Line 13

elected farm income for federal income

If you used Schedule ND-1FA to

tax purposes.

Line 5

calculate your tax for 2001, enter the

If you used Form 37-S for 1999, skip

amount from Part 1, line 3, of your 2001

Copies of 1999, 2000, and

lines 5 through 7, and enter zero on

2001 returns

Schedule ND-1FA. If you used

line 8.

Form ND-1 for 2001 but did not use

You will need copies of your 1999, 2000,

Schedule ND-1FA, enter the taxable

and 2001 North Dakota income tax

If you used Schedule ND-1FA to

income from your 2001 Form ND-1,

returns to complete the 2002

calculate your tax for 2001, enter the

line 13. Otherwise, enter the taxable

Schedule ND-1FA. If you do not have a

amount from Part 2, line 5,

1999 tax

income from your 2001 Form ND-2, Tax

copy of any of these returns, see the

, of your 2001

year column

Computation Schedule, line 1. If this

back cover of the 2002 Form ND-1

Schedule ND-1FA. Otherwise, enter

amount is zero or less, see

Negative

instruction booklet for information on

the taxable income from your 1999

.

how to obtain one.

North Dakota taxable income

Form 37, Tax Computation Schedule,

line 1. If this amount is zero or less, see

Negative North Dakota taxable

.

income

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2