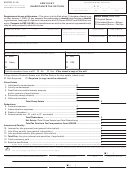

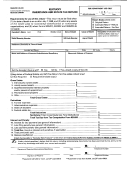

Form 92a200 - Kentucky Inheritance Tax Return Page 4

ADVERTISEMENT

INSTRUCTIONS

INDIVIDUALLY OwNED ASSETS

List life insurance payable to the insured or to the

All real proper ty individually owned must

estate. Life insurance payable to a designated

be lis ted in this schedule. For repor ting

beneficiary, including a testamentary or inter

agricultural or horticultural land, see General

vivos trustee, is tax-free.

Information—Valuation of Property—Fair Cash

and Agricultural.

List in this schedule other individually owned

items of the gross estate, such as debts due

Stocks and bonds individually owned are

decedent; business or partnership (attach balance

includable in this schedule. In case of inactive

sheet showing capital accounts); claims, exclusive

stock such as closely held corporations, explain

of those claimed under KRS 411.130 (wrongful

the method used in computing the value at the

death); rights; royalties; leaseholds; judgments;

date of death. A balance sheet, at a date nearest

shares in trust funds; contracts; household

the decedent’s death, together with a statement of

goods and personal effects, including antiques,

net earnings and dividends paid for the five-year

jewelry and collections of any type; farm products

period immediately preceding the date of death,

and growing crops; livestock; farm machinery;

must be supplied in support of these valuations.

automobiles; etc.

Dividends declared and of record in the decedent’s

name but not paid prior to death must be included

The value of an annuity or other payment made

in this schedule.

to a beneficiary of a deceased employee (other

than the executor or equivalent) under (1) an

United States bonds individually owned as well

exempt trust or qualified nontrusted annuity

as those payable upon death to another should

plan as described by the Internal Revenue Code

be included in this schedule. Indicate series,

or (2) a contract purchased by an educational or

maturity value and date of purchase of all United

charitable organization as referred to in Section

States bonds.

170(b)(1)(A)(ii) or (vi) of the Internal Revenue Code

or a religious organization exempt from tax under

In some instances, the estate will include stocks

Internal Revenue Code Section 501(a), is taxable

and bonds listed on a stock exchange that did not

in the proportion that the total contributions made

make sales on the date of the decedent’s death.

by the decedent bears to the total contributions

When this occurs, their value must be determined

made. The proceeds from a Retired Serviceman’s

on the date nearest to decedent’s death that the

Family Protection Plan or Survivor Benefit Plan

stock exchange made sales. For reporting stock

are exempt under KRS 140.015(2). Refer to KRS

of a corporation owning qualified real estate

140.063(3) and (4) regarding the taxation of

passing to a qualified person(s), see General

individual retirement accounts and annuities as

Information—Valuation of Property—Fair Cash

described in Section 408(a) and (b) of the Internal

and Agricultural.

Revenue Code. Lump-sum distributions of an IRA

are taxable.

Mortgages, notes and cash individually owned

must be listed in this schedule. List accrued

A ll o t h e r a n n u i t i e s , in c l u d in g d e f e r r e d

interest to date of death. The description of

compensation plans, or payments other than

mortgages and notes must include interest rate,

those described in the preceding paragraph made

the date the last payment of interest was made

to a beneficiary, executor or equivalent, are fully

preceding the date of the decedent’s death, and

taxable if the decedent retained ownership at

the due date of the mortgages or notes. If an

death such as the right to name or change the

account is held out of state, show name and

beneficiary and must be listed in this schedule.

address of financial institution on the tax return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17