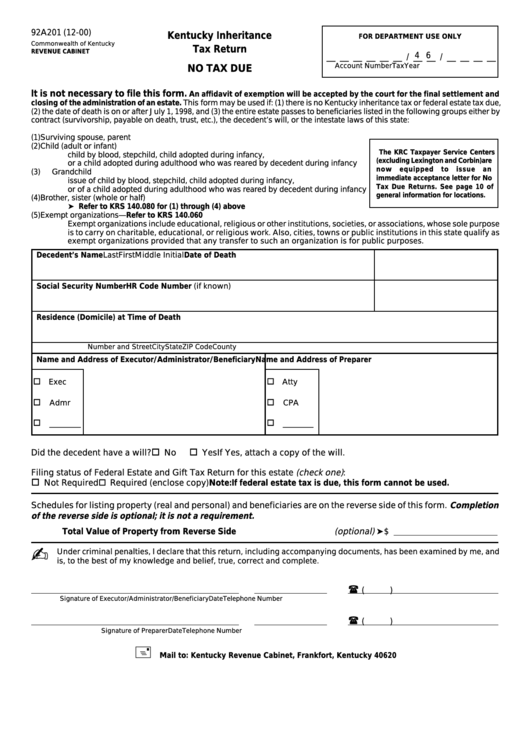

Form 92a201 - Kentucky Inheritance Tax Return

ADVERTISEMENT

92A201 (12-00)

Kentucky Inheritance

FOR DEPARTMENT USE ONLY

Commonwealth of Kentucky

Tax Return

REVENUE CABINET

4 6

__ __ __ __ __ __ / __ __ / __ __ __ __

Account Number

Tax

Year

NO TAX DUE

It is not necessary to file this form.

An affidavit of exemption will be accepted by the court for the final settlement and

closing of the administration of an estate. This form may be used if: (1) there is no Kentucky inheritance tax or federal estate tax due,

(2) the date of death is on or after July 1, 1998, and (3) the entire estate passes to beneficiaries listed in the following groups either by

contract (survivorship, payable on death, trust, etc.), the decedent’s will, or the intestate laws of this state:

(1)

Surviving spouse, parent

(2)

Child (adult or infant)

The KRC Taxpayer Service Centers

child by blood, stepchild, child adopted during infancy,

(excluding Lexington and Corbin)are

or a child adopted during adulthood who was reared by decedent during infancy

now

equipped

to

issue

an

(3)

Grandchild

immediate acceptance letter for No

issue of child by blood, stepchild, child adopted during infancy,

Tax Due Returns. See page 10 of

or of a child adopted during adulthood who was reared by decedent during infancy

general information for locations.

(4)

Brother, sister (whole or half)

Refer to KRS 140.080 for (1) through (4) above

(5)

Exempt organizations—Refer to KRS 140.060

Exempt organizations include educational, religious or other institutions, societies, or associations, whose sole purpose

is to carry on charitable, educational, or religious work. Also, cities, towns or public institutions in this state qualify as

exempt organizations provided that any transfer to such an organization is for public purposes.

Decedent’s Name Last

First

Middle Initial

Date of Death

Social Security Number

HR Code Number (if known)

Residence (Domicile) at Time of Death

Number and Street

City

State

ZIP Code

County

Name and Address of Executor/Administrator/Beneficiary

Name and Address of Preparer

o

o

Exec

Atty

o

o

Admr

CPA

o

o

________

________

o

o

Did the decedent have a will?

No

Yes If Yes, attach a copy of the will.

Filing status of Federal Estate and Gift Tax Return for this estate (check one) :

o

o Required (enclose copy)

Not Required

Note: If federal estate tax is due, this form cannot be used.

Schedules for listing property (real and personal) and beneficiaries are on the reverse side of this form. Completion

of the reverse side is optional; it is not a requirement.

Total Value of Property from Reverse Side ...................................... (optional)

$

Under criminal penalties, I declare that this return, including accompanying documents, has been examined by me, and

is, to the best of my knowledge and belief, true, correct and complete.

(

(

)

Signature of Executor/Administrator/Beneficiary

Date

Telephone Number

(

(

)

Signature of Preparer

Date

Telephone Number

+

Mail to: Kentucky Revenue Cabinet, Frankfort, Kentucky 40620

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2