Schedule K-35 - Historic Preservation Credit

ADVERTISEMENT

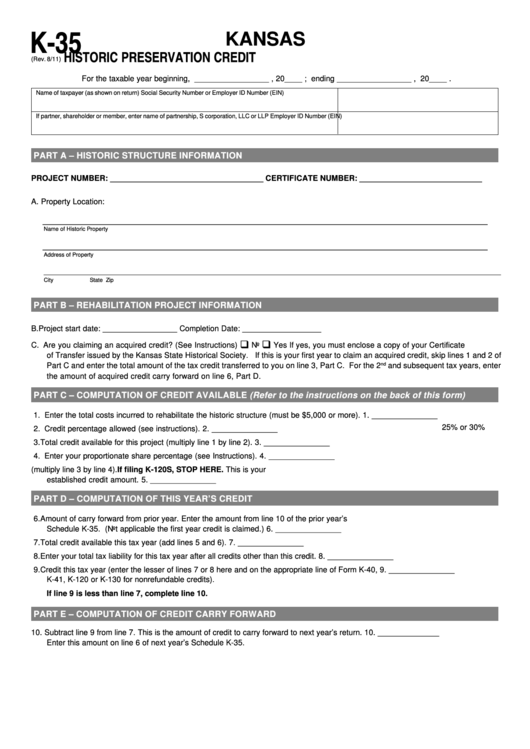

K-35

KANSAS

HISTORIC PRESERVATION CREDIT

(Rev. 8/11)

For the taxable year beginning, _________________ , 20____ ; ending _________________ , 20____ .

Name of taxpayer (as shown on return)

Social Security Number or Employer ID Number (EIN)

If partner, shareholder or member, enter name of partnership, S corporation, LLC or LLP

Employer ID Number (EIN)

PART A – HISTORIC STRUCTURE INFORMATION

PROJECT NUMBER: ___________________________________

CERTIFICATE NUMBER: ____________________________

A. Property Location:

______________________________________________________________________________

Name of Historic Property

______________________________________________________________________________

Address of Property

_________________________________________________________________________________________________________________________________________________

City

State

Zip

PART B – REHABILITATION PROJECT INFORMATION

B. Project start date: _________________

Completion Date: __________________

‰

‰

C. Are you claiming an acquired credit? (See Instructions)

No

Yes

If yes, you must enclose a copy of your Certificate

of Transfer issued by the Kansas State Historical Society. If this is your first year to claim an acquired credit, skip lines 1 and 2 of

Part C and enter the total amount of the tax credit transferred to you on line 3, Part C. For the 2

nd

and subsequent tax years, enter

the amount of acquired credit carry forward on line 6, Part D.

PART C – COMPUTATION OF CREDIT AVAILABLE (Refer to the instructions on the back of this form)

1. Enter the total costs incurred to rehabilitate the historic structure (must be $5,000 or more).

1. _______________

25% or 30%

2. Credit percentage allowed (see instructions).

2. _______________

3. Total credit available for this project (multiply line 1 by line 2).

3. _______________

4. Enter your proportionate share percentage (see Instructions).

4. _______________

5. Credit available to your return (multiply line 3 by line 4). If filing K-120S, STOP HERE. This is your

established credit amount.

5. _______________

PART D – COMPUTATION OF THIS YEAR’S CREDIT

6. Amount of carry forward from prior year. Enter the amount from line 10 of the prior year’s

Schedule K-35. (Not applicable the first year credit is claimed.)

6. _______________

7. Total credit available this tax year (add lines 5 and 6).

7. _______________

8. Enter your total tax liability for this tax year after all credits other than this credit.

8. _______________

9. Credit this tax year (enter the lesser of lines 7 or 8 here and on the appropriate line of Form K-40,

9. _______________

K-41, K-120 or K-130 for nonrefundable credits).

If line 9 is less than line 7, complete line 10.

PART E – COMPUTATION OF CREDIT CARRY FORWARD

10. Subtract line 9 from line 7. This is the amount of credit to carry forward to next year’s return.

10. ______________

Enter this amount on line 6 of next year’s Schedule K-35.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2