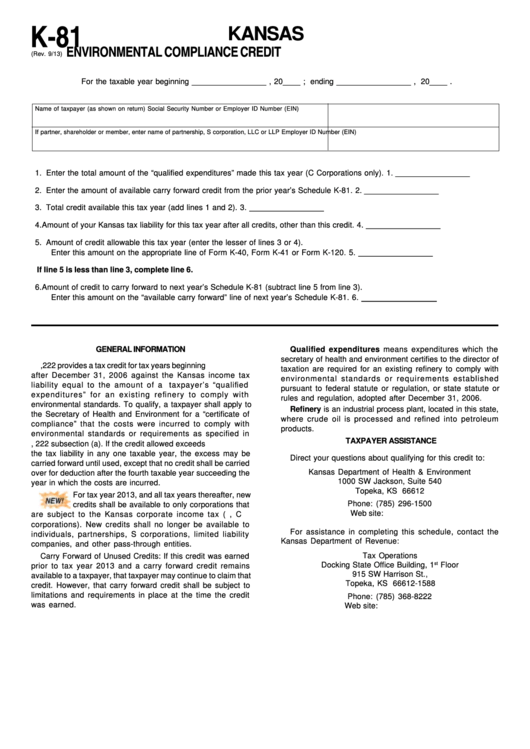

K-81

KANSAS

ENVIRONMENTAL COMPLIANCE CREDIT

(Rev. 9/13)

For the taxable year beginning _________________ , 20____ ; ending _________________ , 20____ .

Name of taxpayer (as shown on return)

Social Security Number or Employer ID Number (EIN)

If partner, shareholder or member, enter name of partnership, S corporation, LLC or LLP

Employer ID Number (EIN)

1. Enter the total amount of the “qualified expenditures” made this tax year (C Corporations only).

1. _________________

2. Enter the amount of available carry forward credit from the prior year’s Schedule K-81.

2. _________________

3. Total credit available this tax year (add lines 1 and 2).

3. _________________

4. Amount of your Kansas tax liability for this tax year after all credits, other than this credit.

4. _________________

5. Amount of credit allowable this tax year (enter the lesser of lines 3 or 4).

Enter this amount on the appropriate line of Form K-40, Form K-41 or Form K-120.

5. _________________

If line 5 is less than line 3, complete line 6.

6. Amount of credit to carry forward to next year’s Schedule K-81 (subtract line 5 from line 3).

____________

Enter this amount on the “available carry forward” line of next year’s Schedule K-81.

6.

Qualified expenditures means expenditures which the

GENERAL INFORMATION

secretary of health and environment certifies to the director of

K.S.A. 79-32,222 provides a tax credit for tax years beginning

taxation are required for an existing refinery to comply with

after December 31, 2006 against the Kansas income tax

environmental standards or requirements established

liability equal to the amount of a taxpayer’s “qualified

pursuant to federal statute or regulation, or state statute or

expenditures” for an existing refinery to comply with

rules and regulation, adopted after December 31, 2006.

environmental standards. To qualify, a taxpayer shall apply to

Refinery is an industrial process plant, located in this state,

the Secretary of Health and Environment for a “certificate of

where crude oil is processed and refined into petroleum

compliance” that the costs were incurred to comply with

products.

environmental standards or requirements as specified in

TAXPAYER ASSISTANCE

K.S.A. 79-32, 222 subsection (a). If the credit allowed exceeds

the tax liability in any one taxable year, the excess may be

Direct your questions about qualifying for this credit to:

carried forward until used, except that no credit shall be carried

Kansas Department of Health & Environment

over for deduction after the fourth taxable year succeeding the

1000 SW Jackson, Suite 540

year in which the costs are incurred.

Topeka, KS 66612

For tax year 2013, and all tax years thereafter, new

Phone: (785) 296-1500

credits shall be available to only corporations that

Web site: kdheks.gov

are subject to the Kansas corporate income tax (i.e., C

corporations). New credits shall no longer be available to

For assistance in completing this schedule, contact the

individuals, partnerships, S corporations, limited liability

Kansas Department of Revenue:

companies, and other pass-through entities.

Tax Operations

Carry Forward of Unused Credits: If this credit was earned

Docking State Office Building, 1

st

Floor

prior to tax year 2013 and a carry forward credit remains

915 SW Harrison St.,

available to a taxpayer, that taxpayer may continue to claim that

Topeka, KS 66612-1588

credit. However, that carry forward credit shall be subject to

limitations and requirements in place at the time the credit

Phone: (785) 368-8222

was earned.

Web site:

1

1