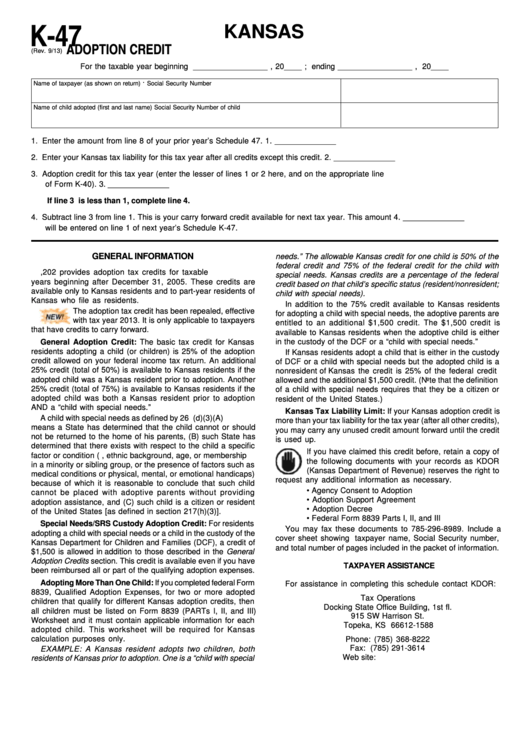

K-47

KANSAS

ADOPTION CREDIT

(Rev. 9/13)

For the taxable year beginning _________________ , 20____ ; ending _________________ , 20____

.

Name of taxpayer (as shown on return)

Social Security Number

Name of child adopted (first and last name)

Social Security Number of child

1. Enter the amount from line 8 of your prior year’s Schedule 47.

1.

______________

2. Enter your Kansas tax liability for this tax year after all credits except this credit.

2.

______________

3. Adoption credit for this tax year (enter the lesser of lines 1 or 2 here, and on the appropriate line

of Form K-40).

3.

______________

If line 3 is less than 1, complete line 4.

4. Subtract line 3 from line 1. This is your carry forward credit available for next tax year. This amount

4.

______________

will be entered on line 1 of next year’s Schedule K-47.

GENERAL INFORMATION

needs.” The allowable Kansas credit for one child is 50% of the

federal credit and 75% of the federal credit for the child with

K.S.A. 79-32,202 provides adoption tax credits for taxable

special needs. Kansas credits are a percentage of the federal

years beginning after December 31, 2005. These credits are

credit based on that child’s specific status (resident/nonresident;

available only to Kansas residents and to part-year residents of

child with special needs).

Kansas who file as residents.

In addition to the 75% credit available to Kansas residents

The adoption tax credit has been repealed, effective

for adopting a child with special needs, the adoptive parents are

with tax year 2013. It is only applicable to taxpayers

entitled to an additional $1,500 credit. The $1,500 credit is

that have credits to carry forward.

available to Kansas residents when the adoptive child is either

in the custody of the DCF or a “child with special needs.”

General Adoption Credit: The basic tax credit for Kansas

residents adopting a child (or children) is 25% of the adoption

If Kansas residents adopt a child that is either in the custody

credit allowed on your federal income tax return. An additional

of DCF or a child with special needs but the adopted child is a

25% credit (total of 50%) is available to Kansas residents if the

nonresident of Kansas the credit is 25% of the federal credit

adopted child was a Kansas resident prior to adoption. Another

allowed and the additional $1,500 credit. (Note that the definition

25% credit (total of 75%) is available to Kansas residents if the

of a child with special needs requires that they be a citizen or

adopted child was both a Kansas resident prior to adoption

resident of the United States.)

AND a “child with special needs.”

Kansas Tax Liability Limit: If your Kansas adoption credit is

A child with special needs as defined by 26 U.S.C. 23(d)(3)(A)

more than your tax liability for the tax year (after all other credits),

means a State has determined that the child cannot or should

you may carry any unused credit amount forward until the credit

not be returned to the home of his parents, (B) such State has

is used up.

determined that there exists with respect to the child a specific

If you have claimed this credit before, retain a copy of

factor or condition (i.e., ethnic background, age, or membership

the following documents with your records as KDOR

in a minority or sibling group, or the presence of factors such as

(Kansas Department of Revenue) reserves the right to

medical conditions or physical, mental, or emotional handicaps)

request any additional information as necessary.

because of which it is reasonable to conclude that such child

• Agency Consent to Adoption

cannot be placed with adoptive parents without providing

• Adoption Support Agreement

adoption assistance, and (C) such child is a citizen or resident

• Adoption Decree

of the United States [as defined in section 217(h)(3)].

• Federal Form 8839 Parts I, II, and III

Special Needs/SRS Custody Adoption Credit: For residents

You may fax these documents to 785-296-8989. Include a

adopting a child with special needs or a child in the custody of the

cover sheet showing taxpayer name, Social Security number,

Kansas Department for Children and Families (DCF), a credit of

and total number of pages included in the packet of information.

$1,500 is allowed in addition to those described in the General

Adoption Credits section. This credit is available even if you have

TAXPAYER ASSISTANCE

been reimbursed all or part of the qualifying adoption expenses.

Adopting More Than One Child: If you completed federal Form

For assistance in completing this schedule contact KDOR:

8839, Qualified Adoption Expenses, for two or more adopted

Tax Operations

children that qualify for different Kansas adoption credits, then

Docking State Office Building, 1st fl.

all children must be listed on Form 8839 (PARTs I, II, and III)

915 SW Harrison St.

Worksheet and it must contain applicable information for each

Topeka, KS 66612-1588

adopted child. This worksheet will be required for Kansas

calculation purposes only.

Phone: (785) 368-8222

Fax: (785) 291-3614

EXAMPLE: A Kansas resident adopts two children, both

Web site:

residents of Kansas prior to adoption. One is a “child with special

1

1