Schedule K-1-T(2) Beneficiary'S Instructions

ADVERTISEMENT

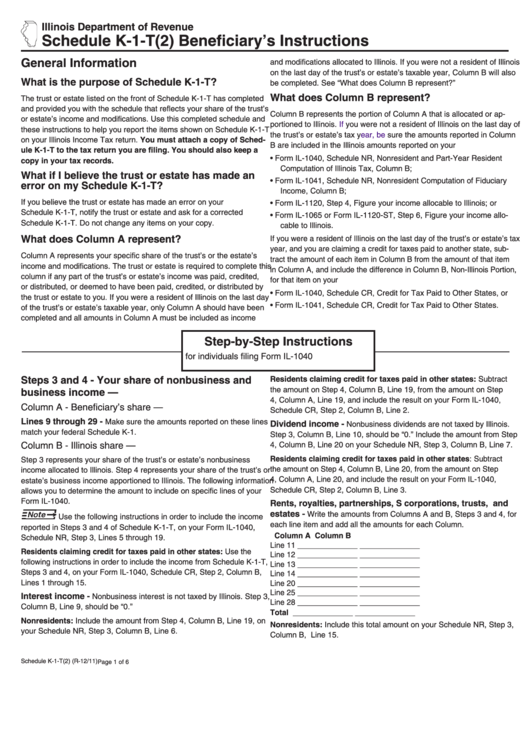

Illinois Department of Revenue

Schedule K-1-T(2) Beneficiary’s Instructions

General Information

and modifications allocated to Illinois. If you were not a resident of Illinois

on the last day of the trust’s or estate’s taxable year, Column B will also

What is the purpose of Schedule K-1-T?

be completed. See “What does Column B represent?”

What does Column B represent?

The trust or estate listed on the front of Schedule K-1-T has completed

and provided you with the schedule that reflects your share of the trust’s

Column B represents the portion of Column A that is allocated or ap-

or estate’s income and modifications. Use this completed schedule and

portioned to Illinois.

If

you were not a resident of Illinois on the last day of

these instructions to help you report the items shown on Schedule K-1-T

the trust’s or estate’s tax

year, be

sure the amounts reported in Column

on your Illinois Income Tax return. You must attach a copy of Sched-

B are included in the Illinois amounts reported on your

ule K-1-T to the tax return you are filing. You should also keep a

• Form IL-1040, Schedule NR, Nonresident and Part-Year Resident

copy in your tax records.

Computation of Illinois Tax, Column B;

What if I believe the trust or estate has made an

• Form IL-1041, Schedule NR, Nonresident Computation of Fiduciary

error on my Schedule K-1-T?

Income, Column B;

If you believe the trust or estate has made an error on your

• Form IL-1120, Step 4, Figure your income allocable to Illinois; or

Schedule K-1-T, notify the trust or estate and ask for a corrected

• Form IL-1065 or Form IL-1120-ST, Step 6, Figure your income allo-

Schedule K-1-T. Do not change any items on your copy.

cable to Illinois.

What does Column A represent?

If you were a resident of Illinois on the last day of the trust’s or estate’s tax

year, and you are claiming a credit for taxes paid to another state, sub-

Column A represents your specific share of the trust’s or the estate’s

tract the amount of each item in Column B from the amount of that item

income and modifications. The trust or estate is required to complete this

in Column A, and include the difference in Column B, Non-Illinois Portion,

column if any part of the trust’s or estate’s income was paid, credited,

for that item on your

or distributed, or deemed to have been paid, credited, or distributed by

• Form IL-1040, Schedule CR, Credit for Tax Paid to Other States, or

the trust or estate to you. If you were a resident of Illinois on the last day

• Form IL-1041, Schedule CR, Credit for Tax Paid to Other States.

of the trust’s or estate’s taxable year, only Column A should have been

completed and all amounts in Column A must be included as income

Step-by-Step Instructions

for individuals filing Form IL-1040

Steps 3 and 4 - Your share of nonbusiness and

Residents claiming credit for taxes paid in other states: Subtract

the amount on Step 4, Column B, Line 19, from the amount on Step

business income —

4, Column A, Line 19, and include the result on your Form IL-1040,

Column A - Beneficiary’s share —

Schedule CR, Step 2, Column B, Line 2.

Lines 9 through 29 -

Make sure the amounts reported on these lines

Dividend income -

Nonbusiness dividends are not taxed by Illinois.

match your federal Schedule K-1.

Step 3, Column B, Line 10, should be “0.” Include the amount from Step

Column B - Illinois share —

4, Column B, Line 20 on your Schedule NR, Step 3, Column B, Line 7.

Residents claiming credit for taxes paid in other states: Subtract

Step 3 represents your share of the trust’s or estate’s nonbusiness

the amount on Step 4, Column B, Line 20, from the amount on Step

income allocated to Illinois. Step 4 represents your share of the trust’s or

4, Column A, Line 20, and include the result on your Form IL-1040,

estate’s business income apportioned to Illinois. The following information

Schedule CR, Step 2, Column B, Line 3.

allows you to determine the amount to include on specific lines of your

Form IL-1040.

Rents, royalties, partnerships, S corporations, trusts, and

estates -

Write the amounts from Columns A and B, Steps 3 and 4, for

Use the following instructions in order to include the income

each line item and add all the amounts for each Column.

reported in Steps 3 and 4 of Schedule K-1-T, on your Form IL-1040,

Column A

Column B

Schedule NR, Step 3, Lines 5 through 19.

Line 11

______________

______________

Residents claiming credit for taxes paid in other states: Use the

Line 12

______________

______________

following instructions in order to include the income from Schedule K-1-T,

Line 13

______________

______________

Steps 3 and 4, on your Form IL-1040, Schedule CR, Step 2, Column B,

Line 14

______________

______________

Lines 1 through 15.

Line 20

______________

______________

Line 25

______________

______________

Interest income -

Nonbusiness interest is not taxed by Illinois. Step 3,

Line 28

______________

______________

Column B, Line 9, should be “0.”

Total

______________

______________

Nonresidents: Include the amount from Step 4, Column B, Line 19, on

Nonresidents: Include this total amount on your Schedule NR, Step 3,

your Schedule NR, Step 3, Column B, Line 6.

Column B, Line 15.

Schedule K-1-T(2) (R-12/11)

Page 1 of 6

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6