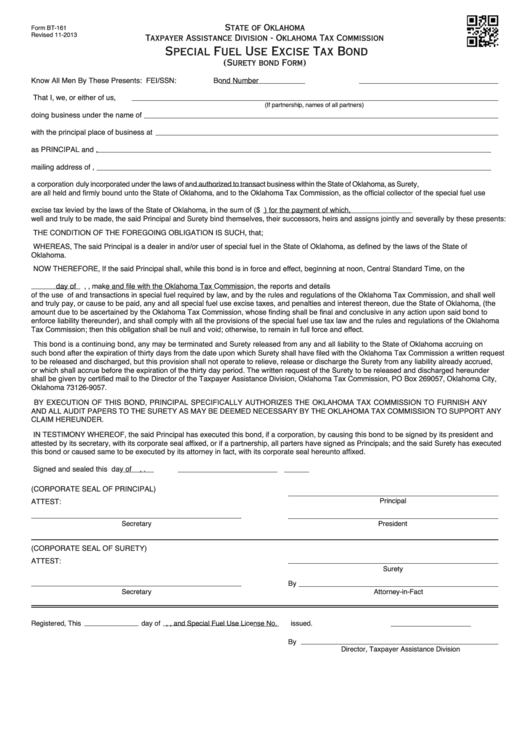

State of Oklahoma

Form BT-161

Revised 11-2013

Taxpayer Assistance Division - Oklahoma Tax Commission

Special Fuel Use Excise Tax Bond

(Surety bond Form)

Know All Men By These Presents:

FEI/SSN:

Bond Number

That I, we, or either of us,

(If partnership, names of all partners)

doing business under the name of

with the principal place of business at

as PRINCIPAL and

,

mailing address of

,

a corporation duly incorporated under the laws of

and authorized to transact business within the State of Oklahoma, as Surety,

are all held and firmly bound unto the State of Oklahoma, and to the Oklahoma Tax Commission, as the official collector of the special fuel use

excise tax levied by the laws of the State of Oklahoma, in the sum of ($

) for the payment of which,

well and truly to be made, the said Principal and Surety bind themselves, their successors, heirs and assigns jointly and severally by these presents:

THE CONDITION OF THE FOREGOING OBLIGATION IS SUCH, that;

WHEREAS, The said Principal is a dealer in and/or user of special fuel in the State of Oklahoma, as defined by the laws of the State of

Oklahoma.

NOW THEREFORE, If the said Principal shall, while this bond is in force and effect, beginning at noon, Central Standard Time, on the

day of

,

, make and file with the Oklahoma Tax Commission, the reports and details

of the use of and transactions in special fuel required by law, and by the rules and regulations of the Oklahoma Tax Commission, and shall well

and truly pay, or cause to be paid, any and all special fuel use excise taxes, and penalties and interest thereon, due the State of Oklahoma, (the

amount due to be ascertained by the Oklahoma Tax Commission, whose finding shall be final and conclusive in any action upon said bond to

enforce liability thereunder), and shall comply with all the provisions of the special fuel use tax law and the rules and regulations of the Oklahoma

Tax Commission; then this obligation shall be null and void; otherwise, to remain in full force and effect.

This bond is a continuing bond, any may be terminated and Surety released from any and all liability to the State of Oklahoma accruing on

such bond after the expiration of thirty days from the date upon which Surety shall have filed with the Oklahoma Tax Commission a written request

to be released and discharged, but this provision shall not operate to relieve, release or discharge the Surety from any liability already accrued,

or which shall accrue before the expiration of the thirty day period. The written request of the Surety to be released and discharged hereunder

shall be given by certified mail to the Director of the Taxpayer Assistance Division, Oklahoma Tax Commission, PO Box 269057, Oklahoma City,

Oklahoma 73126-9057.

BY EXECUTION OF THIS BOND, PRINCIPAL SPECIFICALLY AUTHORIZES THE OKLAHOMA TAX COMMISSION TO FURNISH ANY

AND ALL AUDIT PAPERS TO THE SURETY AS MAY BE DEEMED NECESSARY BY THE OKLAHOMA TAX COMMISSION TO SUPPORT ANY

CLAIM HEREUNDER.

IN TESTIMONY WHEREOF, the said Principal has executed this bond, if a corporation, by causing this bond to be signed by its president and

attested by its secretary, with its corporate seal affixed, or if a partnership, all parters have signed as Principals; and the said Surety has executed

this bond or caused same to be executed by its attorney in fact, with its corporate seal hereunto affixed.

Signed and sealed this

day of

,

.

(CORPORATE SEAL OF PRINCIPAL)

Principal

ATTEST:

Secretary

President

(CORPORATE SEAL OF SURETY)

ATTEST:

Surety

By

Secretary

Attorney-in-Fact

Registered, This

day of

,

, and Special Fuel Use License No.

issued.

By

Director, Taxpayer Assistance Division

1

1