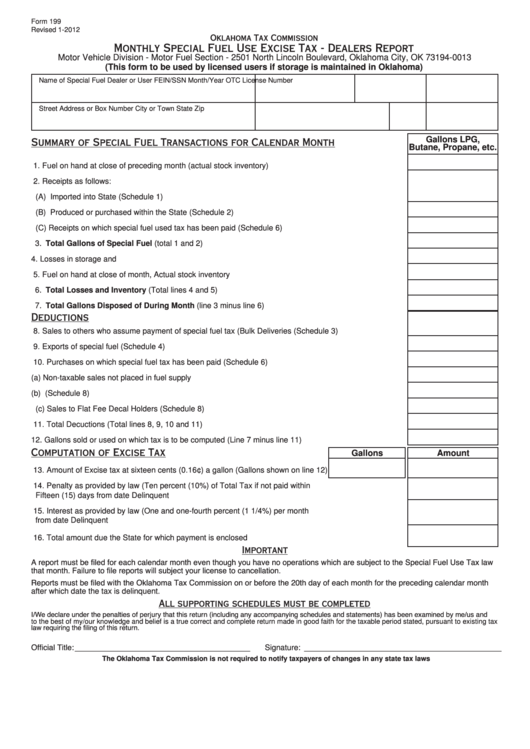

Form 199

Revised 1-2012

Oklahoma Tax Commission

Monthly Special Fuel Use Excise Tax - Dealers Report

Motor Vehicle Division - Motor Fuel Section - 2501 North Lincoln Boulevard, Oklahoma City, OK 73194-0013

(This form to be used by licensed users if storage is maintained in Oklahoma)

Name of Special Fuel Dealer or User

FEIN/SSN

Month/Year

OTC License Number

Street Address or Box Number

City or Town

State

Zip

Summary of Special Fuel Transactions for Calendar Month

Gallons LPG,

Butane, Propane, etc.

1. Fuel on hand at close of preceding month (actual stock inventory) ............................................................

2. Receipts as follows:

(A) Imported into State (Schedule 1) ..........................................................................................................

(B) Produced or purchased within the State (Schedule 2) .........................................................................

(C) Receipts on which special fuel used tax has been paid (Schedule 6) ..................................................

3. Total Gallons of Special Fuel (total 1 and 2) ............................................................................................

4. Losses in storage and handling...................................................................................................................

5. Fuel on hand at close of month, Actual stock inventory ..............................................................................

6. Total Losses and Inventory (Total lines 4 and 5) ......................................................................................

7. Total Gallons Disposed of During Month (line 3 minus line 6) ................................................................

Deductions

8. Sales to others who assume payment of special fuel tax (Bulk Deliveries (Schedule 3) ............................

9. Exports of special fuel (Schedule 4) ............................................................................................................

10. Purchases on which special fuel tax has been paid (Schedule 6) ..............................................................

(a) Non-taxable sales not placed in fuel supply tanks................................................................................

(b) U.S. Government Sales (Schedule 8) ..................................................................................................

(c) Sales to Flat Fee Decal Holders (Schedule 8) .....................................................................................

11. Total Decuctions (Total lines 8, 9, 10 and 11) ..............................................................................................

12. Gallons sold or used on which tax is to be computed (Line 7 minus line 11) ..............................................

Computation of Excise Tax

Gallons

Amount

13. Amount of Excise tax at sixteen cents (0.16¢) a gallon (Gallons shown on line 12)

14. Penalty as provided by law (Ten percent (10%) of Total Tax if not paid within

Fifteen (15) days from date Delinquent .......................................................................................................

15. Interest as provided by law (One and one-fourth percent (1 1/4%) per month

from date Delinquent ...................................................................................................................................

16. Total amount due the State for which payment is enclosed ........................................................................

Important

A report must be filed for each calendar month even though you have no operations which are subject to the Special Fuel Use Tax law

that month. Failure to file reports will subject your license to cancellation.

Reports must be filed with the Oklahoma Tax Commission on or before the 20th day of each month for the preceding calendar month

after which date the tax is delinquent.

All supporting schedules must be completed

I/We declare under the penalties of perjury that this return (including any accompanying schedules and statements) has been examined by me/us and

to the best of my/our knowledge and belief is a true correct and complete return made in good faith for the taxable period stated, pursuant to existing tax

law requiring the filing of this return.

Official Title: ________________________________________

Signature: _____________________________________________

The Oklahoma Tax Commission is not required to notify taxpayers of changes in any state tax laws

1

1