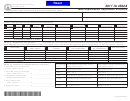

2011 IA 128 Special Instructions

Form IA 128 should be used if the regular research

supplemental credit cannot exceed 3% of line 29 for

activities credit is claimed. Form IA 128S is used only if

businesses with gross receipts exceeding $20 million.

the taxpayer elects to use the Alternative Simplified

Note: If you are a shareholder, partner, or beneficiary

Research Activities Credit. The alternative credit is

with a credit from two sources, such as from a sole

available for tax years beginning on or after January 1,

proprietorship and a partnership, figure the credit of the

2010.

proprietorship on form IA 128, lines 1 through 31, if you

are claiming the research credit. Then enter the pass-

Trades or Businesses that are under

through credit from the partnership on lines 32 and 33, if

Common Control

applicable.

For a group of trades or businesses under common

Any individual, estate, trust, organization, or corporation

control (whether or not incorporated), the credit for

claiming an Iowa credit for increasing research activities

increasing research activities is figured as if all the

or any S corporation, partnership, LLC, estate, or trust

organizations are one trade or business. The credit

that shares the credit among its shareholders, partners, or

figured for the group must then be shared among the

beneficiaries should attach this form to its Iowa income

members of the group on the basis of each member’s

tax return.

proportionate contribution to the increase in research

S corporations, partnerships, LLC’s, estates, and trusts

expenses.

that share the credit among their shareholders, partners,

Adjustments for Certain Acquisitions and

or beneficiaries must show on Schedule K-1, or on an

Dispositions

attachment to Schedule K-1, the credit for each

If a major portion of a trade or business is acquired or

shareholder, partner, or beneficiary.

disposed of, adjustments must be made to research

Innovative Renewable Energy Generation

expenses for the period before or after the acquisition or

Effective July 1, 2009, research activities under the High

disposition.

Quality Jobs Program or under the Enterprise Zone

Short Tax Year

Program include the development and deployment costs

For any short tax year, qualified research expenses are

of innovative renewable energy generation components

annualized.

manufactured or assembled in Iowa. This cannot include

components with more than 200 megawatts of installed

Apportionment of Credit

effective nameplate capacity. These costs are not eligible

The credit figured on lines 1 through 34 by a partner-

for the federal research credit. A separate form IA 128

ship, LLC, S corporation, estate, or trust is apportioned

must be completed to account for these costs, which can

to the individual partners, shareholders, or beneficiaries,

be included on lines 5 and 21 of the separate form IA

respectively. This apportioned credit is entered on line 32

128. The amount of the additional credit relating to these

of a separate form IA 128 to determine the allowed credit

costs is not eligible for the Supplemental Research

to be entered on their tax returns.

Activities Credit.

Supplemental Research Activities Credit

Example: An eligible business computes an Iowa

If research activities are conducted by eligible businesses

Research Activities Credit of $50,000 excluding any

under the New Jobs and Income Program, New Capital

costs relating to innovative renewable energy generation

Investment Program, High Quality Jobs Program, or the

components. When the costs relating to innovative

Enterprise Zone Program, a Supplemental Research

renewable energy generation components are included on

Activities Credit may be allowed. The maximum amount

lines 5 and 21, the Iowa credit is $75,000. The business

of the Supplemental Research Activities Credit is shown

is allowed a supplemental credit of $50,000 under the

in the contract entered into between the eligible business

original claim, which would result in an Iowa credit of

and the Economic Development Authority (EDA)

$100,000. This can be added to the additional credit

(formerly the Iowa Department of Economic

relating to the innovative renewable energy generation

Development). The amount of the supplemental credit

components of $25,000, resulting in a total Iowa

cannot exceed the credit amount shown on line 30 for

Research Activities Credit of $125,000.

awards issued by the EDA prior to July 1, 2010. For

Note: Effective July 1, 2009, the High Quality Job

awards made by the EDA on or after July 1, 2010, the

Creation Program changed its name to High Quality Jobs

supplemental credit cannot exceed 10% of line 29 for

Program.

businesses with gross receipts of $20 million or less. The

41-128b (10/04/11)

1

1 2

2 3

3