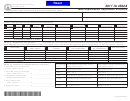

2011 IA 128 Line Instructions

PART I -

PART II -

Computation of Credit

Percentage of Research Activities

for Increasing Research Activities

Occurring within Iowa

Line 1. Enter the amounts you paid or incurred to

Lines 17, 18, 21, 22, and 23. For these lines, enter

energy research consortia. In general, an energy

only that portion of lines 1, 2, 5, 6, and 7 respectively

research consortium is any organization described in

that are for qualified expenses occurring in Iowa.

section 501(c)(3) of the Internal Revenue Code (IRC)

Line 19. Enter the amount on line 3 that is attributable

exempt from tax under section 501(a) of the IRC,

to Iowa sources. For purposes of apportionment, the

organized and operated primarily to conduct energy

amount on line 3 should be prorated by the amount on

research, and not a private foundation.

line 18 divided by the amount on line 2.

Line 2. Corporations other than S corporations,

Line 24. Enter the amount on line 8 that is attributable

personal holding companies, and service organizations

to Iowa sources. For purposes of apportionment, the

enter cash payments to a qualified university or

amount on line 8 should be prorated by the ratio of

scientific research organization pursuant to a written

contract services performed in Iowa to total qualified

contract.

contract expenses. Do not include any expenses that

Line 3. Enter the base period amount as defined in

are already reflected in line 2 or line 18.

section 41(c) of the Internal Revenue Code. A portion

Line 30. Enter this figure on the IA 148 Tax Credits

of this amount not to exceed the amount on line 2 can

Schedule under Part II using tax credit code 58.

also be treated as a contract research expense on line 8

Line 31. Enter this figure on the IA 148 Tax Credits

of this form subject to the 65% or 75% limitation.

Schedule under Part II using tax credit code 59

Line 4. If line 2 is greater than line 3, enter the

Line 32. If the taxpayer has received any pass-through

difference. If line 3 is greater than line 2, enter zero.

Research Activities Credit from a partnership, LLC, S

Line 5. Enter any wages paid or incurred to an

corporation, estate, or trust, indicate that amount on

employee for qualified services performed by such

this line. Also enter the amount of line 32 on Part II of

employee.

the IA 148 Tax Credits Schedule using tax credit code

Line 6. Enter the amounts paid or incurred for supplies

58, and provide the pass-through name and FEIN in

used in the conduct of qualified research.

Part IV of the IA 148 Tax Credits Schedule. If the

taxpayer has received multiple pass-through Research

Line 7. Enter the amount paid or incurred to another

Activities Credit(s), sum all credits and enter on this

person for the right to use computers in the conduct of

line, but list the claims separately on Part II of the IA

qualified research. This entry must be reduced by any

148 Tax Credits Schedule, providing each pass-

amount you receive or accrue from any other person

through name and FEIN in Part IV.

for the right to use substantially identical personal

property.

Line 33. If the taxpayer has received any pass-through

Supplemental Research Activities Credit from a

Line 8. Include 65% of any amount paid or incurred

partnership, LLC, S corporation, estate, or trust,

for qualified research performed on your behalf. Also,

indicate that amount on this line. Also enter the

include 65% of that portion of line 3 that does not

amount of line 33 on Part II of the IA 148 Tax Credits

exceed line 2. Use 75% in place of 65% for payments

Schedule using tax credit code 59, and provide the

made to a qualified research consortium.

pass-through name and FEIN in Part IV of the IA 148

Line 10. Enter the fixed-base percentage, not to

Tax Credits Schedule. If the taxpayer has received

exceed 16%. See section 41 (c) of the Internal

multiple pass-through Supplemental Research

Revenue Code.

Activities Credit(s), sum all credits and enter on this

Line 11. Enter the average annual gross receipts for

line, but list the claims separately on Part II of the IA

the four tax years preceding the tax year for which the

148 Tax Credits Schedule, providing each pass-

credit is being determined. For any short year you may

through name and FEIN in Part IV.

be required to annualize gross receipts. See IRC

sections 41(c)(1)(b) and 41(f)(4) for details.

The IA 148 Tax Credits Schedule must be completed.

41-128c (08/23/11)

1

1 2

2 3

3