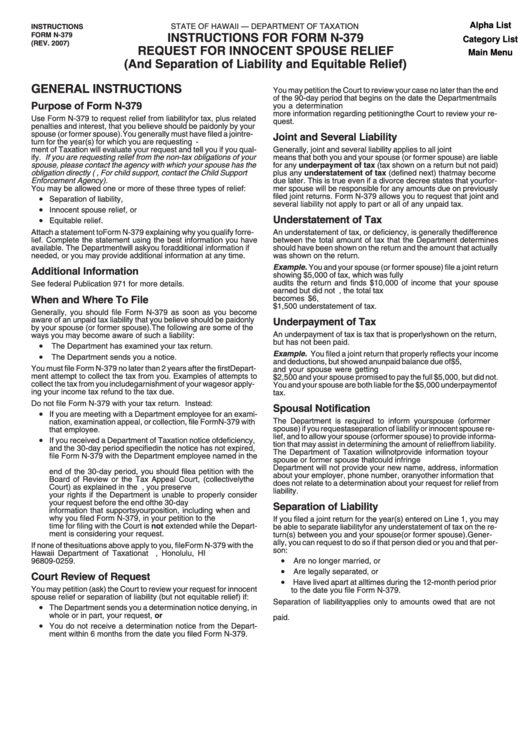

Instructions For Form N-379 - Request For Innocent Spouse Relief

ADVERTISEMENT

Alpha List

STATE OF HAWAII — DEPARTMENT OF TAXATION

INSTRUCTIONS

FORM N-379

INSTRUCTIONS FOR FORM N-379

Category List

(REV. 2007)

REQUEST FOR INNOCENT SPOUSE RELIEF

Main Menu

(And Separation of Liability and Equitable Relief)

GENERAL INSTRUCTIONS

You may petition the Court to review your case no later than the end

of the 90-day period that begins on the date the Department mails

Purpose of Form N-379

you a determination notice. Contact your District Tax Office for

more information regarding petitioning the Court to review your re-

Use Form N-379 to request relief from liability for tax, plus related

quest.

penalties and interest, that you believe should be paid only by your

spouse (or former spouse). You generally must have filed a joint re-

Joint and Several Liability

turn for the year(s) for which you are requesting relief. The Depart-

ment of Taxation will evaluate your request and tell you if you qual-

Generally, joint and several liability applies to all joint returns. This

ify. If you are requesting relief from the non-tax obligations of your

means that both you and your spouse (or former spouse) are liable

spouse, please contact the agency with which your spouse has the

for any underpayment of tax (tax shown on a return but not paid)

obligation directly (i.e., For child support, contact the Child Support

plus any understatement of tax (defined next) that may become

Enforcement Agency).

due later. This is true even if a divorce decree states that your for-

You may be allowed one or more of these three types of relief:

mer spouse will be responsible for any amounts due on previously

•

filed joint returns. Form N-379 allows you to request that joint and

Separation of liability,

several liability not apply to part or all of any unpaid tax.

•

Innocent spouse relief, or

•

Understatement of Tax

Equitable relief.

Attach a statement to Form N-379 explaining why you qualify for re-

An understatement of tax, or deficiency, is generally the difference

lief. Complete the statement using the best information you have

between the total amount of tax that the Department determines

available. The Department will ask you for additional information if

should have been shown on the return and the amount that actually

needed, or you may provide additional information at any time.

was shown on the return.

Example. You and your spouse (or former spouse) file a joint return

Additional Information

showing $5,000 of tax, which was fully paid. The Department later

audits the return and finds $10,000 of income that your spouse

See federal Publication 971 for more details.

earned but did not report. With the additional income, the total tax

When and Where To File

becomes $6,500. You and your spouse are both liable for the

$1,500 understatement of tax.

Generally, you should file Form N-379 as soon as you become

aware of an unpaid tax liability that you believe should be paid only

Underpayment of Tax

by your spouse (or former spouse). The following are some of the

An underpayment of tax is tax that is properly shown on the return,

ways you may become aware of such a liability:

but has not been paid.

•

The Department has examined your tax return.

•

Example. You filed a joint return that properly reflects your income

The Department sends you a notice.

and deductions, but showed an unpaid balance due of $5,000. You

You must file Form N-379 no later than 2 years after the first Depart-

and your spouse were getting divorced. You gave your spouse

ment attempt to collect the tax from you. Examples of attempts to

$2,500 and your spouse promised to pay the full $5,000, but did not.

collect the tax from you include garnishment of your wages or apply-

You and your spouse are both liable for the $5,000 underpayment of

ing your income tax refund to the tax due.

tax.

Do not file Form N-379 with your tax return. Instead:

Spousal Notification

•

If you are meeting with a Department employee for an exami-

The Department is required to inform your spouse (or former

nation, examination appeal, or collection, file Form N-379 with

spouse) if you request a separation of liability or innocent spouse re-

that employee.

lief, and to allow your spouse (or former spouse) to provide informa-

•

If you received a Department of Taxation notice of deficiency,

tion that may assist in determining the amount of relief from liability.

and the 30-day period specified in the notice has not expired,

The Department of Taxation will not provide information to your

file Form N-379 with the Department employee named in the

spouse or former spouse that could infringe on your privacy. The

notice. Attach a copy of the notice to Form N-379. Before the

Department will not provide your new name, address, information

end of the 30-day period, you should file a petition with the

about your employer, phone number, or any other information that

Board of Review or the Tax Appeal Court, (collectively the

does not relate to a determination about your request for relief from

Court) as explained in the notice. By doing so, you preserve

liability.

your rights if the Department is unable to properly consider

your request before the end of the 30-day period. Include the

Separation of Liability

information that supports your position, including when and

why you filed Form N-379, in your petition to the Court. The

If you filed a joint return for the year(s) entered on Line 1, you may

time for filing with the Court is not extended while the Depart-

be able to separate liability for any understatement of tax on the re-

ment is considering your request.

turn(s) between you and your spouse (or former spouse). Gener-

ally, you can request to do so if that person died or you and that per-

If none of the situations above apply to you, file Form N-379 with the

son:

Hawaii Department of Taxation at P.O. Box 259, Honolulu, HI

•

96809-0259.

Are no longer married, or

•

Are legally separated, or

Court Review of Request

•

Have lived apart at all times during the 12-month period prior

You may petition (ask) the Court to review your request for innocent

to the date you file Form N-379.

spouse relief or separation of liability (but not equitable relief) if:

Separation of liability applies only to amounts owed that are not

•

The Department sends you a determination notice denying, in

paid. The Department cannot give you a refund of amounts already

whole or in part, your request, or

paid.

•

You do not receive a determination notice from the Depart-

ment within 6 months from the date you filed Form N-379.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2