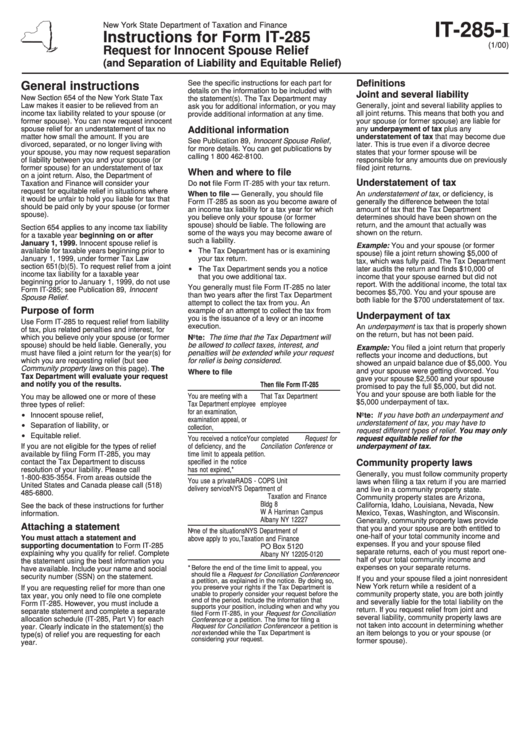

Instructions For Form It-285 - Request For Innocent Spouse Relief

ADVERTISEMENT

New York State Department of Taxation and Finance

IT-285-I

Instructions for Form IT-285

(1/00)

Request for Innocent Spouse Relief

(and Separation of Liability and Equitable Relief)

Definitions

See the specific instructions for each part for

General instructions

details on the information to be included with

Joint and several liability

New Section 654 of the New York State Tax

the statement(s). The Tax Department may

Law makes it easier to be relieved from an

Generally, joint and several liability applies to

ask you for additional information, or you may

income tax liability related to your spouse (or

all joint returns. This means that both you and

provide additional information at any time.

former spouse). You can now request innocent

your spouse (or former spouse) are liable for

spouse relief for an understatement of tax no

any underpayment of tax plus any

Additional information

matter how small the amount. If you are

understatement of tax that may become due

See Publication 89, Innocent Spouse Relief ,

divorced, separated, or no longer living with

later. This is true even if a divorce decree

for more details. You can get publications by

your spouse, you may now request separation

states that your former spouse will be

calling 1 800 462-8100.

of liability between you and your spouse (or

responsible for any amounts due on previously

former spouse) for an understatement of tax

filed joint returns.

When and where to file

on a joint return. Also, the Department of

Understatement of tax

Taxation and Finance will consider your

Do not file Form IT-285 with your tax return.

request for equitable relief in situations where

When to file — Generally, you should file

An understatement of tax , or deficiency, is

it would be unfair to hold you liable for tax that

Form IT-285 as soon as you become aware of

generally the difference between the total

should be paid only by your spouse (or former

an income tax liability for a tax year for which

amount of tax that the Tax Department

spouse).

you believe only your spouse (or former

determines should have been shown on the

spouse) should be liable. The following are

return, and the amount that actually was

Section 654 applies to any income tax liability

some of the ways you may become aware of

shown on the return.

for a taxable year beginning on or after

such a liability.

January 1, 1999. Innocent spouse relief is

Example: You and your spouse (or former

$

available for taxable years beginning prior to

The Tax Department has or is examining

spouse) file a joint return showing $5,000 of

January 1, 1999, under former Tax Law

your tax return.

tax, which was fully paid. The Tax Department

section 651(b)(5). To request relief from a joint

$

The Tax Department sends you a notice

later audits the return and finds $10,000 of

income tax liability for a taxable year

that you owe additional tax.

income that your spouse earned but did not

beginning prior to January 1, 1999, do not use

report. With the additional income, the total tax

You generally must file Form IT-285 no later

Form IT-285; see Publication 89, Innocent

becomes $5,700. You and your spouse are

than two years after the first Tax Department

Spouse Relief .

both liable for the $700 understatement of tax.

attempt to collect the tax from you. An

Purpose of form

example of an attempt to collect the tax from

Underpayment of tax

you is the issuance of a levy or an income

Use Form IT-285 to request relief from liability

execution.

An underpayment is tax that is properly shown

of tax, plus related penalties and interest, for

on the return, but has not been paid.

which you believe only your spouse (or former

Note: The time that the Tax Department will

spouse) should be held liable. Generally, you

be allowed to collect taxes, interest, and

Example: You filed a joint return that properly

must have filed a joint return for the year(s) for

penalties will be extended while your request

reflects your income and deductions, but

which you are requesting relief (but see

for relief is being considered.

showed an unpaid balance due of $5,000. You

Community property laws on this page). The

and your spouse were getting divorced. You

Where to file

Tax Department will evaluate your request

gave your spouse $2,500 and your spouse

and notify you of the results.

If...

Then file Form IT-285 with...

promised to pay the full $5,000, but did not.

You and your spouse are both liable for the

You are meeting with a

That Tax Department

You may be allowed one or more of these

$5,000 underpayment of tax.

Tax Department employee employee

three types of relief:

for an examination,

$

Innocent spouse relief,

Note: If you have both an underpayment and

examination appeal, or

understatement of tax, you may have to

$

Separation of liability, or

collection,

request different types of relief. You may only

$

Equitable relief.

Your completed Request for

request equitable relief for the

You received a notice

If you are not eligible for the types of relief

of deficiency, and the

Conciliation Conference or

underpayment of tax.

available by filing Form IT-285, you may

time limit to appeal

a petition.

contact the Tax Department to discuss

specified in the notice

Community property laws

resolution of your liability. Please call

has not expired,*

Generally, you must follow community property

1-800-835-3554. From areas outside the

You use a private

RADS - COPS Unit

laws when filing a tax return if you are married

United States and Canada please call (518)

delivery service

NYS Department of

and live in a community property state.

485-6800.

Taxation and Finance

Community property states are Arizona,

Bldg 8

California, Idaho, Louisiana, Nevada, New

See the back of these instructions for further

W A Harriman Campus

Mexico, Texas, Washington, and Wisconsin.

information.

Albany NY 12227

Generally, community property laws provide

Attaching a statement

that you and your spouse are both entitled to

None of the situations

NYS Department of

one-half of your total community income and

You must attach a statement and

above apply to you,

Taxation and Finance

expenses. If you and your spouse filed

supporting documentation to Form IT-285

PO Box 5120

separate returns, each of you must report one-

explaining why you qualify for relief. Complete

Albany NY 12205-0120

half of your total community income and

the statement using the best information you

expenses on your separate returns.

* Before the end of the time limit to appeal, you

have available. Include your name and social

should file a Request for Conciliation Conference or

security number (SSN) on the statement.

If you and your spouse filed a joint nonresident

a petition, as explained in the notice. By doing so,

New York return while a resident of a

If you are requesting relief for more than one

you preserve your rights if the Tax Department is

unable to properly consider your request before the

community property state, you are both jointly

tax year, you only need to file one complete

end of the period. Include the information that

and severally liable for the total liability on the

Form IT-285. However, you must include a

supports your position, including when and why you

return. If you request relief from joint and

separate statement and complete a separate

filed Form IT-285, in your Request for Conciliation

several liability, community property laws are

allocation schedule (IT-285, Part V) for each

Conference or a petition. The time for filing a

not taken into account in determining whether

Request for Conciliation Conference or a petition is

year. Clearly indicate in the statement(s) the

not extended while the Tax Department is

an item belongs to you or your spouse (or

type(s) of relief you are requesting for each

considering your request.

former spouse).

year.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2