Form N-379 - Request For Innocent Spouse Relief - 1998

ADVERTISEMENT

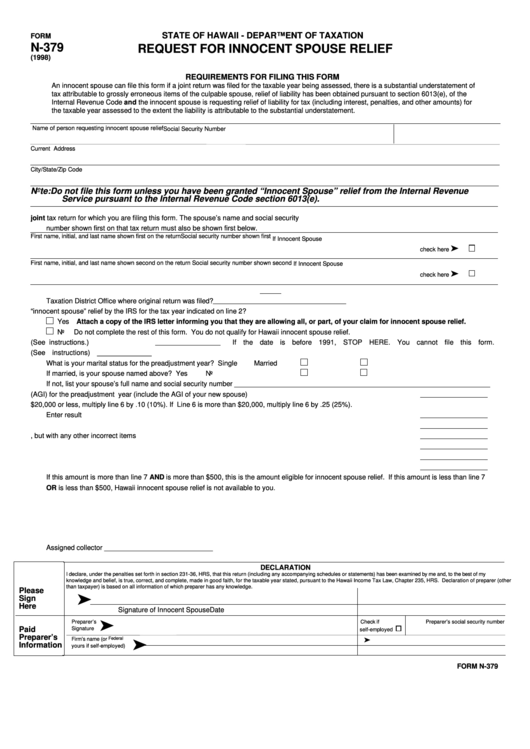

STATE OF HAWAII - DEPARTMENT OF TAXATION

FORM

N-379

REQUEST FOR INNOCENT SPOUSE RELIEF

(1998)

REQUIREMENTS FOR FILING THIS FORM

An innocent spouse can file this form if a joint return was filed for the taxable year being assessed, there is a substantial understatement of

tax attributable to grossly erroneous items of the culpable spouse, relief of liability has been obtained pursuant to section 6013(e), of the

Internal Revenue Code and the innocent spouse is requesting relief of liability for tax (including interest, penalties, and other amounts) for

the taxable year assessed to the extent the liability is attributable to the substantial understatement.

Name of person requesting innocent spouse relief

Social Security Number

Current Address

City/State/Zip Code

Note: Do not file this form unless you have been granted “Innocent Spouse” relief from the Internal Revenue

Service pursuant to the Internal Revenue Code section 6013(e).

1. Enter the following information exactly as shown on the joint tax return for which you are filing this form. The spouse’s name and social security

number shown first on that tax return must also be shown first below.

First name, initial, and last name shown first on the return

Social security number shown first

If Innocent Spouse

check here

First name, initial, and last name shown second on the return

Social security number shown second

If Innocent Spouse

check here

2. Enter tax year for which you are requesting innocent spouse relief 19

Taxation District Office where original return was filed?

3. Have you been granted “innocent spouse” relief by the IRS for the tax year indicated on line 2?

Yes

Attach a copy of the IRS letter informing you that they are allowing all, or part, of your claim for innocent spouse relief.

No

Do not complete the rest of this form. You do not qualify for Hawaii innocent spouse relief.

4. Adjustment year (See instructions.)

If the date is before 1991, STOP HERE. You cannot file this form.

5. Preadjustment year (See instructions) ______________

What is your marital status for the preadjustment year? ............................................

Single

Married

If married, is your spouse named above? ..................................................................

Yes

No

If not, list your spouse’s full name and social security number __________________________________________________________________

6. Enter your adjusted gross income (AGI) for the preadjustment year (include the AGI of your new spouse) ..........................

7. If Line 6 is $20,000 or less, multiply line 6 by .10 (10%). If Line 6 is more than $20,000, multiply line 6 by .25 (25%).

Enter result here.......................................................................................................................................................................

8. Enter your total tax including all changed items .......................................................................................................................

9. Figure what your tax would be without any grossly erroneous items, but with any other incorrect items ................................

10. Subtract line 9 from line 8. This is the understatment of tax due to grossly erroneous items ..................................................

11. Enter the penalties and interest related to the amount on line 10 ............................................................................................

12. Add lines 10 and 11 .................................................................................................................................................................

If this amount is more than line 7 AND is more than $500, this is the amount eligible for innocent spouse relief. If this amount is less than line 7

OR is less than $500, Hawaii innocent spouse relief is not available to you.

Assigned collector ____________________________

DECLARATION

I declare, under the penalties set forth in section 231-36, HRS, that this return (including any accompanying schedules or statements) has been examined by me and, to the best of my

knowledge and belief, is true, correct, and complete, made in good faith, for the taxable year stated, pursuant to the Hawaii Income Tax Law, Chapter 235, HRS. Declaration of preparer (other

than taxpayer) is based on all information of which preparer has any knowledge.

Please

Sign

Here

Signature of Innocent Spouse

Date

Preparer’s

Check if

Preparer’s social security number

Paid

Signature

self-employed

Preparer’s

Firm’s name (or

Federal

E.I. No.

Information

yours if self-employed)

FORM N-379

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2