Instructions For Form Es-40 - Estimated Tax Payment Form - 2011

ADVERTISEMENT

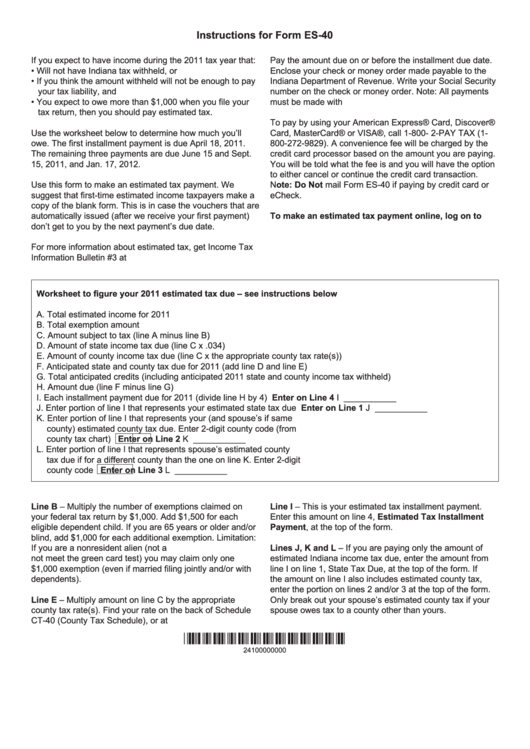

Instructions for Form ES-40

If you expect to have income during the 2011 tax year that:

Pay the amount due on or before the installment due date.

• Will not have Indiana tax withheld, or

Enclose your check or money order made payable to the

• If you think the amount withheld will not be enough to pay

Indiana Department of Revenue. Write your Social Security

your tax liability, and

number on the check or money order. Note: All payments

• You expect to owe more than $1,000 when you file your

must be made with U.S. funds.

tax return, then you should pay estimated tax.

To pay by using your American Express® Card, Discover®

Use the worksheet below to determine how much you’ll

Card, MasterCard® or VISA®, call 1-800- 2-PAY TAX (1-

owe. The first installment payment is due April 18, 2011.

800-272-9829). A convenience fee will be charged by the

The remaining three payments are due June 15 and Sept.

credit card processor based on the amount you are paying.

15, 2011, and Jan. 17, 2012.

You will be told what the fee is and you will have the option

to either cancel or continue the credit card transaction.

Use this form to make an estimated tax payment. We

Note: Do Not mail Form ES-40 if paying by credit card or

suggest that first-time estimated income taxpayers make a

eCheck.

copy of the blank form. This is in case the vouchers that are

automatically issued (after we receive your first payment)

To make an estimated tax

payment online, log on to

don’t get to you by the next payment’s due date.

For more information about estimated tax, get Income Tax

Information Bulletin #3 at

Worksheet to figure your 2011 estimated tax due – see instructions below

A. Total estimated income for 2011 .......................................................................................................... A ___________

B. Total exemption amount ....................................................................................................................... B ___________

C. Amount subject to tax (line A minus line B) .......................................................................................... C ___________

D. Amount of state income tax due (line C x .034) ................................................................................... D ___________

E. Amount of county income tax due (line C x the appropriate county tax rate(s)) .................................. E ___________

F. Anticipated state and county tax due for 2011 (add line D and line E) ................................................. F ___________

G. Total anticipated credits (including anticipated 2011 state and county income tax withheld) ............... G ___________

H. Amount due (line F minus line G) ......................................................................................................... H ___________

I. Each installment payment due for 2011 (divide line H by 4) .................................... Enter on Line 4

I ___________

J. Enter portion of line I that represents your estimated state tax due ..........................Enter on Line 1 J ___________

K. Enter portion of line I that represents your (and spouse’s if same

county) estimated county tax due. Enter 2-digit county code (from

county tax chart)

......................................................................................Enter on Line 2 K ___________

L. Enter portion of line I that represents spouse’s estimated county

tax due if for a different county than the one on line K. Enter 2-digit

county code

..............................................................................................Enter on Line 3 L ___________

Line B – Multiply the number of exemptions claimed on

Line I – This is your estimated tax installment payment.

your federal tax return by $1,000. Add $1,500 for each

Enter this amount on line 4, Estimated Tax Installment

eligible dependent child. If you are 65 years or older and/or

Payment, at the top of the form.

blind, add $1,000 for each additional exemption. Limitation:

If you are a nonresident alien (not a U.S. citizen and does

Lines J, K and L – If you are paying only the amount of

not meet the green card test) you may claim only one

estimated Indiana income tax due, enter the amount from

$1,000 exemption (even if married filing jointly and/or with

line I on line 1, State Tax Due, at the top of the form. If

dependents).

the amount on line I also includes estimated county tax,

enter the portion on lines 2 and/or 3 at the top of the form.

Line E – Multiply amount on line C by the appropriate

Only break out your spouse’s estimated county tax if your

county tax rate(s). Find your rate on the back of Schedule

spouse owes tax to a county other than yours.

CT-40 (County Tax Schedule), or at

*24100000000*

24100000000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1