Final Earned Income Tax Return Form - 2008

ADVERTISEMENT

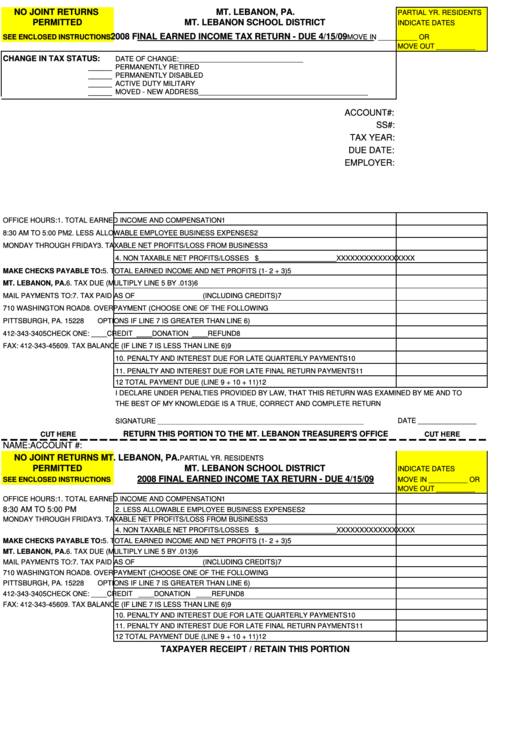

NO JOINT RETURNS

MT. LEBANON, PA.

PARTIAL YR. RESIDENTS

PERMITTED

MT. LEBANON SCHOOL DISTRICT

INDICATE DATES

2008 FINAL EARNED INCOME TAX RETURN - DUE 4/15/09

SEE ENCLOSED INSTRUCTIONS

MOVE IN __________ OR

MOVE OUT __________

CHANGE IN TAX STATUS:

DATE OF CHANGE:________________________________

_____

PERMANENTLY RETIRED

_____

PERMANENTLY DISABLED

_____

ACTIVE DUTY MILITARY

_____

MOVED - NEW ADDRESS____________________________________________

ACCOUNT#:

SS#:

TAX YEAR:

DUE DATE:

EMPLOYER:

OFFICE HOURS:

1. TOTAL EARNED INCOME AND COMPENSATION

1

8:30 AM TO 5:00 PM

2. LESS ALLOWABLE EMPLOYEE BUSINESS EXPENSES

2

MONDAY THROUGH FRIDAY

3. TAXABLE NET PROFITS/LOSS FROM BUSINESS

3

4. NON TAXABLE NET PROFITS/LOSSES $____________________

XXXXXXXXXXXXXXXXX

MAKE CHECKS PAYABLE TO:

5. TOTAL EARNED INCOME AND NET PROFITS (1- 2 + 3)

5

MT. LEBANON, PA.

6. TAX DUE (MULTIPLY LINE 5 BY .013)

6

MAIL PAYMENTS TO:

7. TAX PAID AS OF

(INCLUDING CREDITS)

7

710 WASHINGTON ROAD

8. OVERPAYMENT (CHOOSE ONE OF THE FOLLOWING

PITTSBURGH, PA. 15228

OPTIONS IF LINE 7 IS GREATER THAN LINE 6)

412-343-3405

CHECK ONE: ____CREDIT ____DONATION ____REFUND

8

FAX: 412-343-4560

9. TAX BALANCE (IF LINE 7 IS LESS THAN LINE 6)

9

10. PENALTY AND INTEREST DUE FOR LATE QUARTERLY PAYMENTS

10

11. PENALTY AND INTEREST DUE FOR LATE FINAL RETURN PAYMENTS

11

12 TOTAL PAYMENT DUE (LINE 9 + 10 + 11)

12

I DECLARE UNDER PENALTIES PROVIDED BY LAW, THAT THIS RETURN WAS EXAMINED BY ME AND TO

THE BEST OF MY KNOWLEDGE IS A TRUE, CORRECT AND COMPLETE RETURN

SIGNATURE _____________________________________________________

DATE _______________

RETURN THIS PORTION TO THE MT. LEBANON TREASURER'S OFFICE

CUT HERE

CUT HERE

NAME:

ACCOUNT #:

NO JOINT RETURNS

MT. LEBANON, PA.

PARTIAL YR. RESIDENTS

PERMITTED

MT. LEBANON SCHOOL DISTRICT

INDICATE DATES

2008 FINAL EARNED INCOME TAX RETURN - DUE 4/15/09

SEE ENCLOSED INSTRUCTIONS

MOVE IN __________ OR

MOVE OUT __________

OFFICE HOURS:

1. TOTAL EARNED INCOME AND COMPENSATION

1

8:30 AM TO 5:00 PM

2. LESS ALLOWABLE EMPLOYEE BUSINESS EXPENSES

2

MONDAY THROUGH FRIDAY

3. TAXABLE NET PROFITS/LOSS FROM BUSINESS

3

4. NON TAXABLE NET PROFITS/LOSSES $____________________

XXXXXXXXXXXXXXXXX

MAKE CHECKS PAYABLE TO:

5. TOTAL EARNED INCOME AND NET PROFITS (1- 2 + 3)

5

MT. LEBANON, PA.

6. TAX DUE (MULTIPLY LINE 5 BY .013)

6

MAIL PAYMENTS TO:

7. TAX PAID AS OF

(INCLUDING CREDITS)

7

710 WASHINGTON ROAD

8. OVERPAYMENT (CHOOSE ONE OF THE FOLLOWING

PITTSBURGH, PA. 15228

OPTIONS IF LINE 7 IS GREATER THAN LINE 6)

412-343-3405

CHECK ONE: ____CREDIT ____DONATION ____REFUND

8

FAX: 412-343-4560

9. TAX BALANCE (IF LINE 7 IS LESS THAN LINE 6)

9

10. PENALTY AND INTEREST DUE FOR LATE QUARTERLY PAYMENTS

10

11. PENALTY AND INTEREST DUE FOR LATE FINAL RETURN PAYMENTS

11

12 TOTAL PAYMENT DUE (LINE 9 + 10 + 11)

12

TAXPAYER RECEIPT / RETAIN THIS PORTION

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1