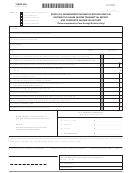

740NP-WH-ES

Page 3

40A201ES (10-12)

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

Fiscal Year Filers—For pass-through entities filing on a fiscal year basis, the payment dates are the 15

day of the

th

sixth month, 15

day of the ninth month and 15

day of the 12

month.

th

th

th

INDIVIDUAL PARTNER, MEMBER OR SHAREHOLDER—If a pass-through entity’s estimated tax for the taxable year

can reasonably be expected to exceed $500 for an individual partner, member or shareholder before April 2, the

following payment dates are applicable:

First installment

April 15

25% of Estimated Tax due

Second installment

June 15

25% of Estimated Tax due

Third installment

September 15

25% of Estimated Tax due

Fourth installment

January 15

25% of Estimated Tax due

If Income Changes—If a pass-through entity’s estimated tax for the taxable year can reasonably be expected to exceed

$500 for an individual partner, member or shareholder after April 1 and before June 2, the following payment dates

are applicable:

First installment

June 15

50% of Estimated Tax due

Second installment

September 15

25% of Estimated Tax due

Third installment

January 15

25% of Estimated Tax due

If a pass-through entity’s estimated tax for the taxable year can reasonably be expected to exceed $500 for an individual

partner, member or shareholder after June 1 and before September 2, the following payment dates are applicable:

First installment

September 15

75% of Estimated Tax due

Second installment

January 15

25% of Estimated Tax due

If a pass-through entity’s estimated tax for the taxable year can reasonably be expected to exceed $500 for an

individual partner, member or shareholder after September 1 and before January 1, 100% of the estimated tax is

due on January 15.

Fiscal Year Filers—For pass-through entities filing on a fiscal year basis, the payment dates are the 15

day of the

th

fourth month, 15

day of the sixth month, 15

day of the ninth month and 15

day of the first month after the close

th

th

th

of the fiscal year.

NOTE: If a payment date falls on a holiday or weekend, the applicable payment date is the next working day.

MAKE CHECK PAYABLE TO: KENTUCKY STATE TREASURER

MAIL TO: KENTUCKY DEPARTMENT OF REVENUE, FRANKFORT, KENTUCKY 40619-0004

1

1 2

2 3

3