Return to Form

INSTRUCTIONS

If you hare sales or purchases or alternate fuels not subject to

WHO MAY FILE THIS REPORT

alternate fuel taxes, you may be subject to the Wisconsin sales/

All alternate fuels dealers and users licensed by the Wisconsin

use tax on the nontaxable gallons sold or purchased. This tax

Department of Revenue must complete and file this report with

does not apply to fuel used for agricultural purposes by a person

the department. A report must be filed even if no tax is due.

engaged in farming. For more information regarding your sales/

use tax liability, refer to Wisconsin Publication 222, which is avail-

DUE DATE

able at

Your report is due on the last day of the month following the

PAYMENT OF TAX

month or quarter covered by your report. To be timely filed, your

report must be postmarked by a United States Post Office on or

The tax must be paid with your return when it is filed unless you

before its due date and received by the department within five

pay by electronic funds transfer (EFT).

days of the due date.

Person must be registered with the department for making EFT

Late-filed reports: Reports not timely filed are subject to the fol-

payments of alternate fuels taxes. Permittees with annual alter-

lowing statutory late-filing fee, interest, and penalty.

nate fuels tax liabilities of $1,000 or more are required to pay by

1. A mandatory $10 late-filing fee.

EFT. Payments must be submitted according to the instructions

in our Electronic Funds Transfer Guide. Information about EFT

2. Interest on the tax due at the rate of 1.5% per month from the

can be obtained online at

due date of the report until the date paid.

eftgen.html.

3. A penalty of 5% of the tax due for each month the tax is unpaid

(not exceeding 25% of the tax due).

COMPLETING YOUR REPORT

Check the appropriate boxes for an ownership change and enter

ASSISTANCE AND FORMS

the requested information if changing ownership, name, or ad-

Information, forms, and assistance are available at our Madison

dress or cancelling your license.

office:

2135 Rimrock Road

COMPUTING THE ALTERNATE FUELS TAX DUE

Madison, Wisconsin

Note: For the purpose of this tax computation, cubic feet of

(608) 266-3223

compressed natural gas must be converted to equivalent gaso-

(608) 266-0064

line gallons.

FAX: (608) 261-7049

Wisconsin law imposes an alternate fuels tax on any alternate

or write to:

fuel placed into the supply tank of a licensed motor vehicle,

PO Box 8900

snowmobile, recreational motorboat, and all-terrain vehicle (ATV)

Madison WI 53708-8900

unless the ATV is registered for private use. Exceptions: The

tax is not imposed upon alternate fuel sold to the United States

E-mail: excise@revenue.wi.gov

(or its agencies) and common motor carriers for the urban mass

transportation of passengers.

INTERNET ADDRESS

You can access the department’s web site at

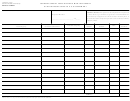

LINE 1. Enter in the appropriate columns the total taxable gallons

From this web site, you can:

of alternate fuels you sold during the reporting period, including

•

Complete electronic fill-in forms

bulk sales of alternate fuels to users who have authorized you to

•

Download forms, schedules, instructions, and publications

charge them the tax on bulk deliveries.

•

View answers to frequently asked questions

•

E-mail for assistance

LINE 2. Enter the total gallons of alternate fuels you placed into

the supply tanks of your own vehicles from your own Wisconsin

storage facilities.

RECORD KEEPING

You must keep a copy of your report and all records used in pre-

LINE 6. Add the tax amounts entered in each column on line 5,

paring the report for at least four years. You must keep them in

and enter the total on line 6. THIS IS THE ALTERNATE FUELS

a place and manner easily accessible for review by department

TAX YOU OWE.

personnel.

Sign and date your report, and indicate your telephone number.

AMENDED RETURNS

If you are filing an amended return, you must file a true, corrected

and complete return, including all previously reported unchanged

transactions. Do not file a return that only reports the changes.

POTENTIAL SALES/USE TAX LIABILITY

1

1 2

2