FORM

INSTRUCTIONS FOR PPLIC TION FOR TENT TIVE REFUND OF WITHHOLDING

2011

MW506R

ON S LES OF RE L PROPERTY BY NONRESIDENTS

The Comptroller’s decision to deny or grant in part a tentative refund is final and not subject to appeal.

GENER L INSTRUCTIONS

SPECIFIC INSTRUCTIONS

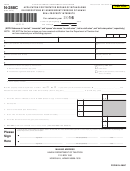

Line 4. Subtract the amount on line 3 from

the amount on line 2. However, if you are

THIS FORM IS OPTION L ND IS

reporting a gain under the installment

NOT REQUIRED TO BE FILED.

t the top of Form MW506R, enter the

method for federal income tax purposes,

tax year of the transferor/seller if other than a

attach a separate sheet that lists the pay-

calendar year.

IMPORT NT: If Form MW506R is filed, the

ments received during the tax year and the

transferor/seller must still file a Maryland

gross profit percentage. Multiply the amount

Enter the name, address and identifica-

income tax return (Form 500, 504 or 505)

of the payments by the gross profit percent-

tion number (social security number or feder-

after the end of the tax year, report the entire

age and enter the result on line 4.

al employer identification number) of the

income for the year (from all sources, includ-

transferor/seller applying for a refund of the

ing the transfer), and pay any additional tax

Line 4a. If there were multiple owners, enter

amount withheld. The name and identification

due on the income or request an additional

your percentage of ownership of the property.

number entered must be the same as the

refund.

If you were the only owner, enter 100%.

name and identification number entered for

the transferor/seller on the Form MW506NRS.

Purpose of Form

Line 4b. Multiply line 4 by line 4a to deter-

If the identification number on the

mine your share of the capital gain.

The income tax withheld at closing and

MW506NRS is incorrect, enter the correct

paid to the Clerk is claimed on the Maryland

identification number and attach an explana-

Line 5a. If you are a C corporation, or an

income tax return filed by transferor for the

tion to the form. If the transferor/seller was

entity that is taxed for federal purposes as a

tax year in which the transfer of the real

issued an individual taxpayer identification

C corporation, multiply the amount on line 4

property and associated personal property in

number (ITIN) by the IRS, enter the ITIN.

by 8.25% and enter this amount on line 5.

Maryland is sold. You may elect to receive a

refund of excess income tax withheld prior to

Enter the information describing the

Line 5b. If you are an individual, multiply the

filing the income tax return. Use Form

Maryland real property transaction.

amount on line 4 by 6.75% and enter this

MW506R to apply for a refund of the amount

amount on line 5.

of tax withheld on the sale or transfer of

Line a. Enter the date of the closing.

Maryland real property interests by a nonresi-

Line 6. Subtract the amount on line 5 from

dent individual or nonresident entity which is

Line b. Enter the Maryland property account

the amount on line 1. If an overpayment is

in excess of the transferor/seller’s tax liability

ID number assigned by the State Department

shown on line 6, the Revenue dministration

for the transaction. Form MW506R may be

of ssessments and Taxation, if known.

Division will refund any amount of $1.00 or

filed not less than 60 days after the date the

more.

tax withheld is paid to the Clerk of the Circuit

Line c. Enter the description of the property.

Court. Form MW506R may NOT be filed if

Include the street address, county, or district,

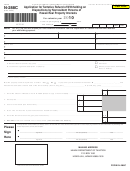

Signature(s)

the transfer occurs after November 1, 2011.

subdistrict, and lot numbers if no address is

ny Form MW506R that is filed for a transfer

available.

Form MW506R must be signed by an

occuring after November 1, 2011 will be

individual (both taxpayer and spouse, if filing

rejected.

Line d. Enter use of property at the time of

a joint income tax return), or a responsible

settlement and specify length of use.

officer of the company or corporation.

IMPORT NT: The tentative refund calcula-

tions is limited to the Schedule for

Check the box applicable to the type of tax-

Your signature(s) signifies that your appli-

Computation of Cost or Other Basis, without

payer.

cation, including all attachments, is, to the

regard to the federal exclusion for a principal

best of your knowledge and belief, true, cor-

residence.

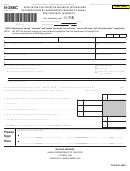

Line 1. Enter the amount of tax withheld and

rect and complete, under the penalties of

reported on Line 8i of the Form MW506NRS.

perjury.

Who May File an pplication

photocopy of Copy C of the Form

MW506NRS must be attached to the Form.

n individual, fiduciary, or C corporation

If a power of attorney is necessary, com-

Retain the original Copy C with your tax

transferor/seller may file Form MW506R.

plete federal Form 2848 and attach to your

records.

pass-through entity transferor/seller may not

application.

file Form MW506R.

Line 2. Enter the gross sales price from the

Where to File

sale. ttach a copy of the HUD-1 closing

NOTE: Generally, any claim for refund or

statement from the sale of this property.

credit for overpayment of taxes must be filed

File the completed Form MW506R with

within three years from the date the return is

the:

Line 3. In general, the cost or adjusted basis

filed or within two years from the date the tax

is the cost of the property plus purchase

is paid, whichever is later.

Comptroller of Maryland

commissions and improvements, minus

Revenue dministration Division

depreciation (if applicable). Increase the cost

ttn: NRS Special Refunds

or other basis by any expense of sale, such

P.O. Box 2031

as commissions and state transfer taxes.

nnapolis, MD 21404-2031

Complete the Schedule for Computation of

Cost or Other Basis on the bottom of Form

dditional Information

MW506R and enter the amount from line d

on line 3. Purchase price and improvement

documentation is required.

For additional information visit

, e-mail

If the property was inherited, enter the value

nrshelp@comp.state.md.us or call

of the property at the date of death. This fig-

1-800-MDT XES (1-800-638-2937) or 410-

ure is generally obtained through a certified

260-7980 in Central Maryland.

appraisal done within 6 months of date of

death.

printout from the State Department

of ssessments and Taxation, from that time

frame, is also acceptable.

1

1 2

2