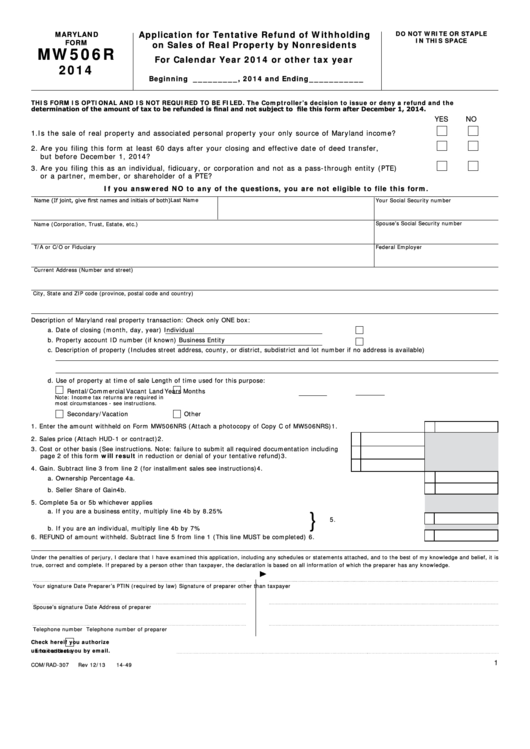

Application for Tentative Refund of Withholding

DO NOT WRITE OR STAPLE

MARYLAND

IN THIS SPACE

FORM

on Sales of Real Property by Nonresidents

MW506R

For Calendar Year 2014 or other tax year

2014

Beginning _________ , 2014 and Ending ___________

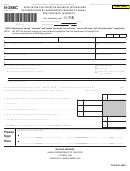

THIS FORM IS OPTIONAL AND IS NOT REQUIRED TO BE FILED. The Comptroller’s decision to issue or deny a refund and the

determination of the amount of tax to be refunded is final and not subject to appeal. DO NOT file this form after December 1, 2014.

YES

NO

1. Is the sale of real property and associated personal property your only source of Maryland income?

2. Are you filing this form at least 60 days after your closing and effective date of deed transfer,

but before December 1, 2014?

3. Are you filing this as an individual, fidicuary, or corporation and not as a pass-through entity (PTE)

or a partner, member, or shareholder of a PTE?

If you answered NO to any of the questions, you are not eligible to file this form.

Name (If joint, give first names and initials of both)

Last Name

Your Social Security number

Spouse’s Social Security number

Name (Corporation, Trust, Estate, etc.)

T/A or C/O or Fiduciary

Federal Employer I.D. Number

Current Address (Number and street)

City, State and ZIP code (province, postal code and country)

Description of Maryland real property transaction:

Check only ONE box:

a. Date of closing (month, day, year)

Individual

b. Property account ID number (if known)

Business Entity

c. Description of property (Includes street address, county, or district, subdistrict and lot number if no address is available)

d. Use of property at time of sale

Length of time used for this purpose:

Rental/Commercial

Vacant Land

Years

Months

Note: Income tax returns are required in

most circumstances - see instructions.

Secondary/Vacation

Other

1. Enter the amount withheld on Form MW506NRS (Attach a photocopy of Copy C of MW506NRS) . . . . . . . . . . . . . . . . . . . . . . 1.

2. Sales price (Attach HUD-1 or contract) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.

3. Cost or other basis (See instructions. Note: failure to submit all required documentation including

page 2 of this form will result in reduction or denial of your tentative refund) . . . . . . . . . . . . . . . . 3.

4. Gain. Subtract line 3 from line 2 (for installment sales see instructions) . . . . . . . . . . . . . . . . . . . . . 4.

a. Ownership Percentage . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4a.

b. Seller Share of Gain . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4b.

5. Complete 5a or 5b whichever applies

}

a. If you are a business entity, multiply line 4b by 8.25% . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . 5.

b. If you are an individual, multiply line 4b by 7% . . . . . . . . . . . . . . . . . . . . . . . . .

6. REFUND of amount withheld. Subtract line 5 from line 1 (This line MUST be completed) . . . . . . . . . . . . . . . . . . . . . . . . . . . 6.

Under the penalties of perjury, I declare that I have examined this application, including any schedules or statements attached, and to the best of my knowledge and belief, it is

true, correct and complete. If prepared by a person other than taxpayer, the declaration is based on all information of which the preparer has any knowledge.

Your signature

Date

Preparer’s PTIN (required by law)

Signature of preparer other than taxpayer

Spouse’s signature

Date

Address of preparer

Telephone number

Telephone number of preparer

Check here

if you authorize

us to contact you by email.

Email address

1

COM/RAD-307

Rev 12/13

14-49

1

1 2

2