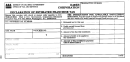

Form D-20es - Declaration Of Estimated Franchise Tax For Corporations - 2012 Page 3

ADVERTISEMENT

General Instructions

Declaration of Estimated Franchise Tax for Corporations

________________________________________________________

Use the record of payments worksheet on page 9 to plan how much of

Who must file a Form D-20ES?

the overpayment you will apply to each payment.

________________________________________________________

A corporation must file a declaration of estimated franchise tax voucher if

its District of Columbia (DC) franchise tax liability is expected to exceed

Could you be charged a penalty or fee?

$1,000 for the taxable year.

If you underestimate your tax, you will be charged an underpayment rate

_________________________________________________________

of 10% per year compounded daily when your estimated tax payments

do not equal:

Applying an overpayment from your prior DC corporation fran-

chise tax return.

• At least 90% of your 2012 corporation franchise tax; or

You can apply the full amount of any overpayment of tax from your prior

• 110% of your 2011 DC corporation franchise tax for a

year’s DC corporation franchise tax return to the first payment of your

12-month period.

estimated taxes or you can spread it across the four payments any way

you choose. You may not do this if you have requested or received a

You will be charged a penalty if any statement made on the voucher is

refund of this overpayment.

not true and accurate to the best of your knowledge.

-1-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21