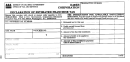

Form D-20es - Declaration Of Estimated Franchise Tax For Corporations - 2012 Page 5

ADVERTISEMENT

3. If you do not expect to have a balance due and you have not filed an ex-

• Voucher 1:

The fifteenth day of the

tension of time to file for your federal return and wish to request an exten-

fourth month of your taxable year;

sion for your DC franchise tax return, you should submit a Form FR-128

• Voucher 2:

The fifteenth day of the

sixth month of your taxable year;

Penalty and interest charges are imposed on any tax found owing and

not paid on time with the extension request.

• Voucher 3:

The fifteenth day of the

ninth month of your taxable year; and

________________________________________________________

• Voucher 4:

The fifteenth day of the

When are your vouchers due?

twelfth month of your taxable year.

File your vouchers by the following dates:

If the due date falls on a Saturday, Sunday, or legal holiday, the voucher

• Voucher 1:

April 15, 2012;

is due the next business day.

• Voucher 2:

June 15, 2012;

________________________________________________________

• Voucher 3:

September 15, 2012; and

How to file your return

• Voucher 4:

December 15, 2012

This booklet has all the vouchers and instructions you will need. It is

mailed to each registered taxpayer who filed estimated tax payments in the

Fiscal year taxpayers should file the declaration vouchers by the

previous year, except those who file electronically or use a substitute form.

following dates:

-3-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21