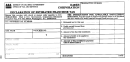

Form D-20es - Declaration Of Estimated Franchise Tax For Corporations - 2012 Page 7

ADVERTISEMENT

Refer to the Electronic Funds Transfer (EFT) Payment Guide available

(YYMMDD) for corporate estimated tax payments.

on the DC website at for instructions

• ACH Debit. ACH debit is for registered eTSC business taxpayers

for electronic payments. The electronic taxpayer service center (eTSC)

only. There is no fee. Taxpayers’ bank routing and account num-

does not allow the use of foreign bank accounts.

bers are stored within their on-line eTSC account. They can use

this account to pay any existing liability. They give OTR the right to

Payment options are as follows:

debit the money from their bank account.

• Electronic check (e-check). E-check is similar to ACH debit, but it

• Credit Card. The taxpayer may pay the amount owed using Visa,

is a one-time transaction where the taxpayer provides the banking

MasterCard, Discover or American Express. You will be charged

information at the time of payment instead of storing the informa-

a fee that is paid directly to the District’s credit card service pro-

tion. There is no fee for business e-check payments.

vider. Payment is effective on the day it is charged.

• ACH Credit. ACH credit is for business taxpayers only. There is no

Note: Dishonored payments. Make sure your check or electronic pay-

fee charged by OTR, but the taxpayer’s bank may charge a fee.

ment will clear. You will be charged a $65 fee if your check or electronic

The taxpayer directly credits OTR’s bank account. The taxpayer

payment is not honored by your financial institution and returned to OTR.

does not need to be eTSC registered to use this payment type, and

there is no need to access the website.

Note: When making ACH credit payments through your bank, please

use the correct tax type code (00250) and tax period ending date

-5-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21