l

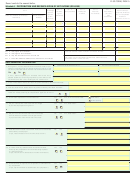

D-30 FORM, PAGE 2

*110300120002*

Taxpayer Name:

FEIN or SSN:

ENTER DOLLAR AMOUNTS ONLY

.

$

00

23

23 Net income.

Line 10 minus Line 22.

Fill in if minus:

.

$

00

24

24 Net operating loss deduction

for years before 2000.

.

00

$

25

25 Net income after NOL deduction.

Line 23 minus Line 24.

Fill in if minus:

.

00

$

26a

26 (a) Non-business

income/state

adjustment.

Fill in if minus:

Attach statement.

.

00

$

26b

(b) Minus: Related expenses.

Attach an allocation statement.

.

00

$

26c

(c) Subtract Line 26(b) from Line 26(a).

Fill in if minus:

.

$

00

27

27 Net income from trade or business subject to

Fill in if minus:

apportionment

. Line 25 minus Line 26(c).

.

28

28 DC apportionment factor

from D-30, Schedule F, Col 3, Line 6.

.

$

00

29

29 Net income from trade or business apportioned to DC.

Fill in if minus:

Multiply Line 27 by the factor on Line 28.

.

00

$

30

30 Portion of Line 26(c) attributable to DC.

Fill in if minus:

Attach statement.

.

$

00

31

31 Total District net income (loss).

Fill in if minus:

Combine Lines 29 and 30.

.

$

00

32

32 Salary for owner(s) / member(s) services

from D-30, Schedule J, Column 4.

.

$

00

33

33 Exemption.

33a

Maximum is $5000.

Enter days in DC.

If fewer than 365 days in DC, see page 10 for amount to claim.

.

$

00

34

34 Total taxable income before apportioned NOL deduction

Fill in if minus:

Line 31 minus total of Lines 32 and 33.

.

$

00

35

35 Apportioned NOL deduction.

Losses occurring for year 2000 and later.

.

$

00

36

36 Total

District

taxable income.

Line 34 minus Line 35.

Fill in if minus:

.

37 Tax

$

00

9.975% of Line 36.

Minimum tax is $250, unless DC gross receipts

37

is greater than $1M, then minimum tax is $1,000.

.

$

00

38

38 Minus nonrefundable credits

from Schedule UB, Line 14.

.

$

00

39

39 Net tax

See instructions for minimum requirements.

40 Payments and refundable credits:

.

$

00

40a

(a) Tax paid, if any, with request for an extension of time to file or

paid with original return if this is an amended return.

.

$

00

40b

(b) 2011 estimated franchise tax payments.

.

$

00

40c

(c) Refundable credits

from Schedule UB, Line 17.

.

$

00

41

41 Add lines 40(a), (b) and (c).

.

$

00

42

42 Tax due.

If Line 39 amount is larger, subtract Line 41 from Line 39.

Will this payment come from an account outside the U.S.?

Yes

No See page 7.

.

$

00

43

43 Overpayment.

If Line 41 amount is larger, subtract Line 39 from Line 41.

.

$

00

44

44 Amount you want to apply to your 2012 estimated franchise tax.

.

$

00

45

45 Amount to be refunded.

Line 43 minus Line 44.

Will this refund go to an account outside of the U.S.?

Yes

No See page 7.

Payment due return – mail return and payment to Office of Tax and Revenue, PO Box 679, Washington, DC 20044-0679.

Refund or no payment due return – mail retun to Office of Tax and Revenue, PO Box 221, Washington, DC 20044-0221.

Your return is due by the 15th day of the fourth month following the close of your tax year. PO Box mail labels are provided with the return envelope.

Under penalties of law, I declare that I have examined this return and, to the best of my knowledge, it is correct. Declaration of paid preparer is based on the information available to the preparer.

PLEASE

SIGN

HERE

Telephone number of person to contact

Officer’s signature

Title

Date

PAID

PREPARER

Preparer’s signature (if other than taxpayer)

Date

Firm name

Firm address

ONLY

If you want to allow the preparer to discuss this return

Preparer’s PTIN

with the Office of Tax and Revenue fill in the oval.

l

l

2011 D-30 P2

Revised 01/12

Unincorporated Business Franchise Tax Return page 2

File order 4

1

1 2

2 3

3 4

4 5

5 6

6 7

7