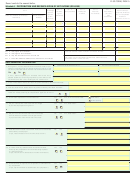

D-30 FORM, PAGE 5

Round cents to the nearest dollar.

Schedule J - DISTRIBUTIon AnD REConCILIATIon of nET InCoME (oR LoSS)

Col. 2

Col. 8

Col. 3

Col. 5

Col. 6

Col. 7

Col. 4

Col. 1

Percentage

Total Income (or

Percent-

Net Income

Salary Claimed

Exemption

Net Loss

of Time

Loss) Not Taxable to

age of

(or Loss)

Claimed

DC Sources

Devoted

the Unincorporated

Ownership

from

Social Security

Name and Address of Owner(s)/

to this

Business

Outside DC

Number

Member(s)

Business

(Add Cols. 4 thru 7)

%

%

$

$

$

$

$

TOTAL . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

$

$

$

$

Col. 4 - See page 9 of Instructions.

Enter total taxable income as shown on Line 34 of D-30.

$

Col. 5 - See page 10 of Instructions.

Col. 6 - Any loss amount from Line 31 of D-30.

Net income of Unincorporated Business from both within and

Col. 7 - Enter the difference between Line 25 and Line 31 of D-30.

outside DC (from Line 25 of D-30) . . . . . . . . . . . . . . . . . . . . . . . . .

$

SUPPLEMEnTAL InfoRMATIon

3. DATE BUSINESS BEGAN

2. PRINCIPAL BUSINESS ACTIVITY

1. During 2011, has the Internal Revenue Service made or pro-

posed any adjustments to your federal income tax returns, or did

you file any amended returns with the Internal Revenue Service?

5. TERMINATION DATE

4. IF BUSINESS HAS TERMINATED, STATE REASON

Yes

No

If “Yes”, submit separately an amended Form D-30 and a

6. TYPE OF OWNERSHIP (sole proprietor, partnership, etc.)

detailed statement, concerning adjustments, to the Office of Tax

and Revenue, PO Box 7572, Washington, DC 20044-7572.

7. Place where federal income tax return for period covered by this return was filed:

8. Name(s) under which federal return for period covered by this return was filed:

9. Have you filed annual Federal Information Returns, (forms Yes No

If no, please state reason:

1096 and 1099) pertaining to compensation payments for 2011?

10. Is this return reported on the accrual basis?

Yes

No

If no, fill in the method used:

Cash basis

Other (specify)

11. Did you withhold DC income tax from the wages

Yes

No

If no, state reason:

of your DC employees during 2011?

12. Did you file a franchise tax return for the business

Yes

No

If no, state reason:

with the District of Columbia for the year 2010?

If yes, enter name under which return was filed:

13. Does this return include income from more than one business

Yes

No

conducted by the taxpayer?

(If yes, list businesses and net income (loss) of each.)

14. Is income from any other business or business interest

Yes

No

owned by the proprietors of this business being reported

in a separate return?

(If yes, list names and addresses of the other businesses.)

15. Is this business an adjunct of a corporation, or affiliated with Yes

No

any corporation?

(If yes, explain affiliation to stockholders and proprietors.)

1

1 2

2 3

3 4

4 5

5 6

6 7

7