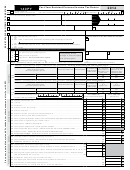

Arizona Form 140py - Part-Year Resident Personal Income Tax Return - 2011 Page 2

ADVERTISEMENT

ARIZONA FORM

Part-Year Resident Personal Income Tax Return

FOR

140PY

CALENDAR YEAR

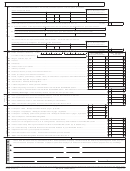

M M D D Y Y Y Y

M M D D Y Y Y Y

2011

OR FISCAL YEAR BEGINNING

AND ENDING

.

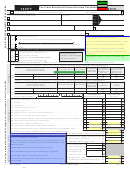

Check box 82F if filing under extension

82F

Your First Name and Initial

Last Name

Your Social Security No.

You must

1

enter your

Spouse’s First Name and Initial (if box 4 or 6 checked)

Last Name

Spouse’s Social Security No.

SSN(s).

1

Current Home Address - number and street, rural route

Apt. No. Daytime Phone (with area code)

Home Phone (with area code)

2

94

City, Town or Post Office

State

Zip Code

3

REVENUE USE ONLY. DO NOT MARK IN THIS AREA.

4

Married filing joint return

NAME OF QUALIFYING CHILD OR DEPENDENT

Head of household .......................... ►

5

Married filing separate return. Enter spouse’s name and Social Security No. above.

6

7

Single

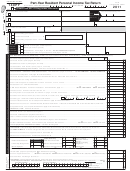

88

8

Age 65 or over (you and/or spouse)

Enter the

number

9

Blind (you and/or spouse)

claimed.

Dependents. From page 2, line A2 –

10

do not include self or spouse.

Do not put a

81

80

from page 2, line A5.

check mark.

11

Qualifying parents and grandparents

12-13 Residency Status

: 12

Part-Year Resident Other than Active Military

13

Part-Year Resident Active Military

(check one)

00

14 Federal adjusted gross income

...................................................................

14

(from your federal return)

00

(from page 2, line B19)

15 Arizona income

.................................................................................................................................... 15

00

(from page 2, line C24)

16 Additions to income

............................................................................................................................. 16

17 Subtractions from income (from page 2, line D36) ............................................................................................................... 17

00

00

Add lines 15 and 16 then subtract line 17

18 Arizona adjusted gross income:

............................................................................ 18

I

S

00

See instructions, pages 15 and 16

19 Deductions. Check box and enter amount.

....

ITEMIZED

STANDARD 19

19

19

00

See page 16 of the instructions

20 Personal exemptions.

.............................................................................................................. 20

00

Subtract lines 19 and 20 from line 18. If less than zero, enter zero

21 Arizona taxable income:

......................................................... 21

00

22 Compute the tax using Tax Table X or Y ............................................................................................................................... 22

23 Tax from recapture of credits from Arizona Form 301, Part II, line 34 .................................................................................. 23

00

00

Add lines 22 and 23

24 Subtotal of tax:

........................................................................................................................................ 24

00

See instructions, page 17

25 - 26 Clean Elections Fund Tax Reduction:

.........................

1

YOURSELF

2

SPOUSE 26

25

25

27 Reduced tax: Subtract line 26 from line 24 .......................................................................................................................... 27

00

28 Family income tax credit from worksheet on page 18 of the instructions ............................................................................. 28

00

29 Credits from Arizona Form 301, Part II, line 65, or Forms 310, 321, 322 and 323 if Form 301 is not required .................... 29

00

3

3

3

3

30

Enter form number of each credit claimed

30 Credit type:

................

00

(from worksheet on page 20 of the instructions)

31 Clean Elections Fund Tax Credit

........................................................................ 31

00

Subtract lines 28, 29 and 31 from line 27. If the sum of lines 28, 29 and 31 is more than line 27, enter zero

32 Balance of income tax:

... 32

00

(from worksheet on page 20 of instructions)

33 Unpaid Arizona use tax

........................................................................................... 33

00

Add lines 32 and 33

34 Balance of tax:

...................................................................................................................................... 34

00

35 Arizona income tax withheld during 2011 ............................................................................................................................. 35

00

36 Arizona estimated tax payments for 2011 ............................................................................................................................. 36

00

37 2011 Arizona extension payment (Form 204) ....................................................................................................................... 37

00

From worksheet on page 21 of the instructions

38 Increased Excise Tax Credit:

.............................................................................. 38

39 Other refundable credits: Check the box(es) and enter the amount ..........................

00

1

Form 308-I

2

Form 342 39

39

39

00

Add lines 35 through 39

40 Total payments/refundable credits:

............................................................................................... 40

00

If line 34 is larger than line 40, subtract line 40 from line 34, and enter amount of tax due. Skip lines 42, 43 and 44

41 TAX DUE:

............. 41

00

If line 40 is larger than line 34, subtract line 34 from line 40, and enter amount of overpayment

42 OVERPAYMENT:

............................. 42

00

43 Amount of line 42 to be applied to 2012 estimated tax ......................................................................................................... 43

00

Subtract line 43 from line 42

44 Balance of overpayment:

............................................................................................................. 44

Aid to Education

45 - 55 Voluntary Gifts to ...........................

00

00

45

Arizona Wildlife .............

46

(entire refund only) .........

Domestic Violence

0 00

00

00

Citizens Clean Elections ..

Child Abuse Prevention ...

47

48

Shelter .........................

49

Neighbors Helping

00

00

00

50

51

52

I Didn’t Pay Enough Fund

National Guard Relief Fund

Neighbors .....................

00

00

00

Special Olympics ...........

Veterans’ Donations Fund

Political Gift ..................

53

54

55

56 Check only one if making a political gift: ...............

1

Democratic

2

Green

3

Libertarian

4

Republican

56

56

56

56

00

57 Estimated payment penalty and MSA withdrawal penalty .................................................................................................... 57

58 Check applicable boxes .....

1

2

3

4

Annualized/Other

Farmer or Fisherman

Form 221 attached

MSA Penalty

58

58

58

58

00

59 Total of lines 45 through 55 and 57 ....................................................................................................................................... 59

00

60 REFUND:

Subtract line 59 from line 44. If less than zero, enter amount owed on line 61

................................................................ 60

if your deposit will be ultimately placed in a foreign account; see instructions ..........

A

A

Direct Deposit of Refund: Check box

60

60

ROUTING NUMBER

ACCOUNT NUMBER

C

Checking or

98

S

Savings

00

Add lines 41 and 59.

Make check payable to Arizona Department of Revenue; include SSN on payment

61 AMOUNT OWED:

.......... 61

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3