Instructions For Form Cr 0100 - Colorado Sales Tax Withholding Account Application

ADVERTISEMENT

CR 0101 (06/07/12)

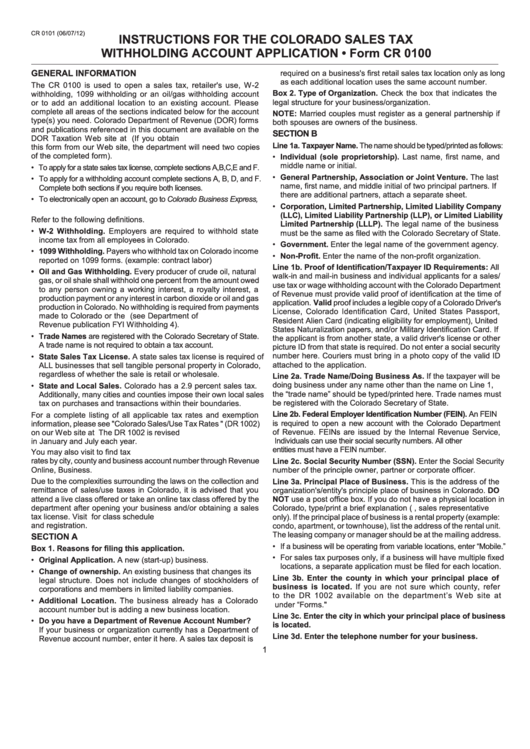

INSTRUCTIONS FOR THE COLORADO SALES TAX

WITHHOLDING ACCOUNT APPLICATION • Form CR 0100

GENERAL INFORMATION

required on a business's first retail sales tax location only as long

as each additional location uses the same account number.

The CR 0100 is used to open a sales tax, retailer's use, W-2

Box 2. Type of Organization. Check the box that indicates the

withholding, 1099 withholding or an oil/gas withholding account

legal structure for your business/organization.

or to add an additional location to an existing account. Please

complete all areas of the sections indicated below for the account

NOTE: Married couples must register as a general partnership if

type(s) you need. Colorado Department of Revenue (DOR) forms

both spouses are owners of the business.

and publications referenced in this document are available on the

SECTION B

DOR Taxation Web site at (If you obtain

Line 1a. Taxpayer Name. The name should be typed/printed as follows:

this form from our Web site, the department will need two copies

of the completed form).

• Individual (sole proprietorship). Last name, first name, and

middle name or initial.

• To apply for a state sales tax license, complete sections A,B,C,E and F.

• General Partnership, Association or Joint Venture. The last

• To apply for a withholding account complete sections A, B, D, and F.

name, first name, and middle initial of two principal partners. If

Complete both sections if you require both licenses.

there are additional partners, attach a separate sheet.

• To electronically open an account, go to Colorado Business Express,

• Corporation, Limited Partnership, Limited Liability Company

(LLC), Limited Liability Partnership (LLP), or Limited Liability

Refer to the following definitions.

Limited Partnership (LLLP). The legal name of the business

• W-2 Withholding. Employers are required to withhold state

must be the same as filed with the Colorado Secretary of State.

income tax from all employees in Colorado.

• Government. Enter the legal name of the government agency.

• 1099 Withholding. Payers who withhold tax on Colorado income

• Non-Profit. Enter the name of the non-profit organization.

reported on 1099 forms. (example: contract labor)

Line 1b. Proof of Identification/Taxpayer ID Requirements: All

• Oil and Gas Withholding. Every producer of crude oil, natural

walk-in and mail-in business and individual applicants for a sales/

gas, or oil shale shall withhold one percent from the amount owed

use tax or wage withholding account with the Colorado Department

to any person owning a working interest, a royalty interest, a

of Revenue must provide valid proof of identification at the time of

production payment or any interest in carbon dioxide or oil and gas

application. Valid proof includes a legible copy of a Colorado Driver's

production in Colorado. No withholding is required from payments

License, Colorado Identification Card, United States Passport,

made to Colorado or the U.S. Government (see Department of

Resident Alien Card (indicating eligibility for employment), United

Revenue publication FYI Withholding 4).

States Naturalization papers, and/or Military Identification Card. If

• Trade Names are registered with the Colorado Secretary of State.

the applicant is from another state, a valid driver's license or other

A trade name is not required to obtain a tax account.

picture ID from that state is required. Do not enter a social security

number here. Couriers must bring in a photo copy of the valid ID

• State Sales Tax License. A state sales tax license is required of

attached to the application.

ALL businesses that sell tangible personal property in Colorado,

regardless of whether the sale is retail or wholesale.

Line 2a. Trade Name/Doing Business As. If the taxpayer will be

doing business under any name other than the name on Line 1,

• State and Local Sales. Colorado has a 2.9 percent sales tax.

the “trade name” should be typed/printed here. Trade names must

Additionally, many cities and counties impose their own local sales

be registered with the Colorado Secretary of State.

tax on purchases and transactions within their boundaries.

Line 2b. Federal Employer Identification Number (FEIN). An FEIN

For a complete listing of all applicable tax rates and exemption

is required to open a new account with the Colorado Department

information, please see "Colorado Sales/Use Tax Rates " (DR 1002)

of Revenue. FEINs are issued by the Internal Revenue Service,

on our Web site at The DR 1002 is revised

Individuals can use their social security numbers. All other

in January and July each year.

entities must have a FEIN number.

You may also visit to find tax

rates by city, county and business account number through Revenue

Line 2c. Social Security Number (SSN). Enter the Social Security

Online, Business.

number of the principle owner, partner or corporate officer.

Due to the complexities surrounding the laws on the collection and

Line 3a. Principal Place of Business. This is the address of the

remittance of sales/use taxes in Colorado, it is advised that you

organization's/entity's principle place of business in Colorado. DO

attend a live class offered or take an online tax class offered by the

NOT use a post office box. If you do not have a physical location in

department after opening your business and/or obtaining a sales

Colorado, type/print a brief explanation (e.g., sales representative

tax license. Visit for class schedule

only). If the principal place of business is a rental property (example:

and registration.

condo, apartment, or townhouse), list the address of the rental unit.

The leasing company or manager should be at the mailing address.

SECTION A

• If a business will be operating from variable locations, enter “Mobile.”

Box 1. Reasons for filing this application.

• For sales tax purposes only, if a business will have multiple fixed

• Original Application. A new (start-up) business.

locations, a separate application must be filed for each location.

• Change of ownership. An existing business that changes its

Line 3b. Enter the county in which your principal place of

legal structure. Does not include changes of stockholders of

business is located. If you are not sure which county, refer

corporations and members in limited liability companies.

to the DR 1002 available on the department’s Web site at

• Additional Location. The business already has a Colorado

under “Forms."

account number but is adding a new business location.

Line 3c. Enter the city in which your principal place of business

• Do you have a Department of Revenue Account Number?

is located.

If your business or organization currently has a Department of

Line 3d. Enter the telephone number for your business.

Revenue account number, enter it here. A sales tax deposit is

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2