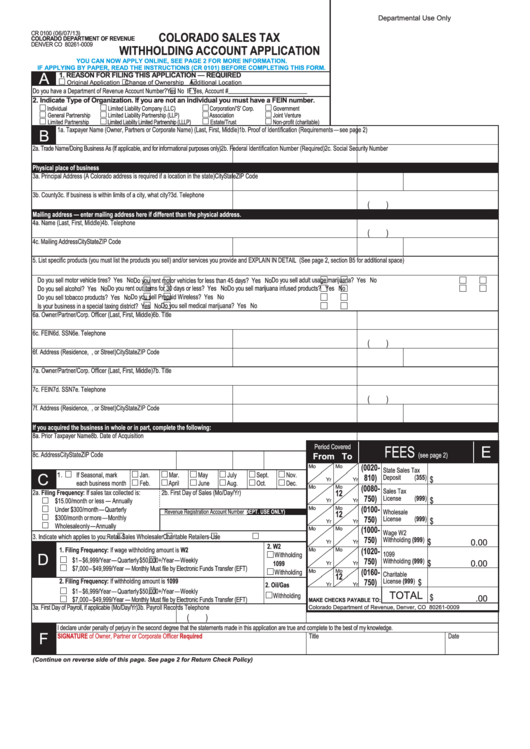

Form Cr 0100 - Colorado Sales Tax Withholding Account Application

ADVERTISEMENT

Departmental Use Only

CR 0100 (06/07/13)

COLORADO sALEs TAX

COLORADO DEPARTMENT OF REVENUE

DENVER CO 80261-0009

wiTHHOLDiNg ACCOUNT APPLiCATiON

YOU CAN NOw APPLY ONLiNE, sEE PAgE 2 FOR MORE iNFORMATiON.

iF APPLYiNg bY PAPER, READ THE iNsTRUCTiONs (CR 0101) bEFORE COMPLETiNg THis FORM.

A

1. REAsON FOR FiLiNg THis APPLiCATiON — REQUiRED

Original Application

Change of Ownership

Additional Location

No IF Yes, Account # ___________________________

Do you have a Department of Revenue Account Number?

Yes

2. indicate Type of Organization. if you are not an individual you must have a FEiN number.

Individual

Limited Liability Company (LLC)

Corporation/'S' Corp.

Government

General Partnership

Limited Liability Partnership (LLP)

Association

Joint Venture

Limited Partnership

Limited Liability Limited Partnership (LLLP)

Estate/Trust

Non-profit (charitable)

1a. Taxpayer Name (Owner, Partners or Corporate Name) (Last, First, Middle)

1b. Proof of Identification (Requirements — see page 2)

B

2a. Trade Name/Doing Business As (If applicable, and for informational purposes only)

2b. Federal Identification Number (Required)

2c. Social Security Number

Physical place of business

3a. Principal Address (A Colorado address is required if a location in the state)

City

State

ZIP Code

3b. County

3c. If business is within limits of a city, what city?

3d. Telephone

(

)

Mailing address — enter mailing address here if different than the physical address.

4a. Name (Last, First, Middle)

4b. Telephone

(

)

4c. Mailing Address

City

State

ZIP Code

5. List specific products (you must list the products you sell) and/or services you provide and EXPLAIN IN DETAIL (See page 2, section B5 for additional space)

Do you sell motor vehicle tires?

Yes

No

Do you sell adult usage marijuana?

Yes

No

Do you rent motor vehicles for less than 45 days?

Yes

No

Do you rent out items for 30 days or less?

Yes

No

Do you sell marijuana infused products?

Yes

No

Do you sell alcohol?

Yes

No

Do you sell Prepaid Wireless?

Yes

No

Do you sell tobacco products?

Yes

No

Do you sell medical marijuana?

Yes

No

Is your business in a special taxing district?

Yes

No

6a. Owner/Partner/Corp. Officer (Last, First, Middle)

6b. Title

6c. FEIN

6d. SSN

6e. Telephone

(

)

6f. Address (Residence, P.O. Box, or Street)

City

State

ZIP Code

7a. Owner/Partner/Corp. Officer (Last, First, Middle)

7b. Title

7c. FEIN

7d. SSN

7e. Telephone

(

)

7f. Address (Residence, P.O. Box, or Street)

City

State

ZIP Code

if you acquired the business in whole or in part, complete the following:

8a. Prior Taxpayer Name

8b. Date of Acquisition

FEES

E

Period Covered

8c. Address

City

State

ZIP Code

From To

(see page 2)

(0020-

Mo

Mo

State Sales Tax

C

1.

If Seasonal, mark

Jan.

Mar.

May

July

Sept.

Nov.

810)

Deposit

(355)

$

Yr

Yr

each business month

Feb.

April

June

Aug.

Oct.

Dec.

(0080-

Mo

Mo

Sales Tax

12

2a. Filing Frequency: If sales tax collected is:

2b. First Day of Sales (Mo/Day/Yr)

750)

License

(999)

$

$15.00/month or less — Annually

Yr

Yr

(0100-

Under $300/month — Quarterly

Mo

Mo

Wholesale

Revenue Registration Account Number

(DEPT. UsE ONLY)

12

$300/month or more — Monthly

750)

License

(999)

$

Yr

Yr

Wholesale only — Annually

(1000-

Mo

Mo

Wage W2

3. Indicate which applies to you:

Retail-Sales

Wholesaler

Charitable

Retailers-Use

750)

Withholding (999)

$

0.00

Yr

Yr

2. w2

1. Filing Frequency: If wage withholding amount is w2

(1020-

Mo

Mo

D

1099

Withholding

$1 – $6,999/Year — Quarterly

$50,000+/Year — Weekly

750)

Withholding (999)

$

0.00

1099

Yr

Yr

$7,000 – $49,999/Year — Monthly

Must file by Electronic Funds Transfer (EFT)

(0160-

Withholding

Mo

Mo

Charitable

12

2. Filing Frequency: If withholding amount is 1099

750)

License

(999)

$

2. Oil/gas

Yr

Yr

$1 – $6,999/Year — Quarterly

$50,000+/Year — Weekly

TOTAL

Withholding

$

.00

$7,000 – $49,999/Year — Monthly

Must file by Electronic Funds Transfer (EFT)

MAkE CHECks PAYAbLE TO:

3a. First Day of Payroll, if applicable (Mo/Day/Yr)

3b. Payroll Records Telephone

Colorado Department of Revenue, Denver, CO 80261-0009

(

)

I declare under penalty of perjury in the second degree that the statements made in this application are true and complete to the best of my knowledge.

F

sigNATURE of Owner, Partner or Corporate Officer Required

Title

Date

(Continue on reverse side of this page. See page 2 for Return Check Policy)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2