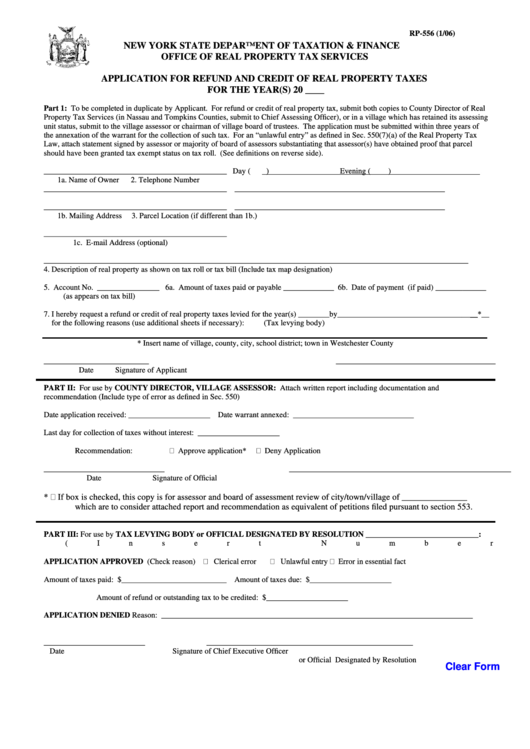

RP-556 (1/06)

NEW YORK STATE DEPARTMENT OF TAXATION & FINANCE

OFFICE OF REAL PROPERTY TAX SERVICES

APPLICATION FOR REFUND AND CREDIT OF REAL PROPERTY TAXES

FOR THE YEAR(S) 20 ____

Part 1: To be completed in duplicate by Applicant. For refund or credit of real property tax, submit both copies to County Director of Real

Property Tax Services (in Nassau and Tompkins Counties, submit to Chief Assessing Officer), or in a village which has retained its assessing

unit status, submit to the village assessor or chairman of village board of trustees. The application must be submitted within three years of

the annexation of the warrant for the collection of such tax. For an “unlawful entry” as defined in Sec. 550(7)(a) of the Real Property Tax

Law, attach statement signed by assessor or majority of board of assessors substantiating that assessor(s) have obtained proof that parcel

should have been granted tax exempt status on tax roll. (See definitions on reverse side).

_______________________________________________

Day (

)

Evening (

)

1a. Name of Owner

2. Telephone Number

_______________________________________________

______________________________________________________

_______________________________________________

______________________________________________________

1b. Mailing Address

3. Parcel Location (if different than 1b.)

_______________________________________________

1c. E-mail Address (optional)

_____________________________________________________________________________________________________________

4. Description of real property as shown on tax roll or tax bill (Include tax map designation)

5. Account No. ________________ 6a. Amount of taxes paid or payable _____________ 6b. Date of payment (if paid) _____________

(as appears on tax bill)

7. I hereby request a refund or credit of real property taxes levied for the year(s) ________by____________________________________*__

for the following reasons (use additional sheets if necessary):

(Tax levying body)

* Insert name of village, county, city, school district; town in Westchester County

___________________________

_________________________________________

Date

Signature of Applicant

PART II: For use by COUNTY DIRECTOR, VILLAGE ASSESSOR: Attach written report including documentation and

recommendation (Include type of error as defined in Sec. 550)

Date application received: _____________________

Date warrant annexed: _______________________________

Last day for collection of taxes without interest: _____________________

Deny Application

Recommendation:

Approve application*

_______________________________

_________________________________________________________

Date

Signature of Official

*

If box is checked, this copy is for assessor and board of assessment review of city/town/village of _______________

which are to consider attached report and recommendation as equivalent of petitions filed pursuant to section 553.

PART III: For use by TAX LEVYING BODY or OFFICIAL DESIGNATED BY RESOLUTION _____________________________:

(Insert Number or Date)

Clerical error

Unlawful entry

Error in essential fact

APPLICATION APPROVED (Check reason)

Amount of taxes paid: $___________________________

Amount of taxes due: $_____________________

Amount of refund or outstanding tax to be credited: $_____________________

APPLICATION DENIED Reason: ________________________________________________________________________________

__________________________

_____________________________________________________

Date

Signature of Chief Executive Officer

or Official Designated by Resolution

Clear Form

1

1 2

2