2

2

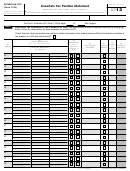

2013 Schedule RT

Page

of

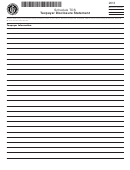

Part II Subtraction Modification for Related Entity Expenses Eligible for Deduction

An expense added back to income and reported in Part I is eligible for a deduction if either Condition A, Condition B, or

Condition C applies. In general, Condition B and Condition C are each indicators that Condition A is likely to be true.

However, Condition A may be true independently from Conditions B and C.

Condition A

All three of the following statements are true:

•

The primary motivation for the transaction was one or more business purposes other than avoiding or

reducing state income or franchise taxes,

•

The transaction changed the taxpayer's economic position in a meaningful way apart from tax effects,

and

•

The expenses were paid, accrued, or incurred using terms that reflect an arm's-length relationship.

Condition B

The related entity to which the taxpayer paid, accrued, or incurred the expense was subject to a tax on

or measured by net income or gross receipts in Wisconsin or in another jurisdiction, and the tax base

included the income received from the taxpayer for the expenses, in the manner described in sec.

71.80(23)(a)2., Wis. Stats. See the explanation of Condition B in the Schedule RT instructions for details.

Condition C

The related entity to which the taxpayer paid, accrued, or incurred the expense was a conduit through

which the taxpayer indirectly paid the expense to an unrelated entity or to a qualifying holding company

or subsidiary of a qualifying holding company, as described in sec. 71.80(23)(a)1., Wis. Stats. See the

explanation of Condition C in the Schedule RT instructions for details.

Using the guidelines given above, enter the amount of each type of expense eligible for a deduction on lines 6a through

6d below:

.00

6a Total interest expenses that qualify for deduction. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6a

6b Total rent expenses that qualify for deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6b

.00

6c Total management fees that qualify for deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6c

.00

6d Total intangible expenses that qualify for deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6d

.00

7

Total subtraction modification. Add lines 6a through 6d. This is the amount of the

expenses you reported on Part I, line 5 that you may deduct as a Wisconsin subtraction

modification . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

.00

Note: The Department of Revenue retains the right to make adjustments to the amount deducted if the requirements of sec. 71.80(23),

Wis. Stats., are not met or if the department determines that:

•

Distribution, apportionment, or allocation of income, deductions, credits, or allowances between or among related entities

is otherwise necessary in order to prevent evasion of taxes or clearly to reflect the income of any such entities as provided

under secs. 71.10(1), 71.30(2), or 71.80(1)(b), Wis. Stats., or

•

The transactions that produced the deduction lack economic substance, as provided under secs. 71.10(1m), 71.30(2m), and

71.80(1m), Wis. Stats.

1

1 2

2