2013 Schedule RB

Page

2 of 2

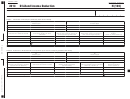

Subtract line 8 from line 7. Fill in the result on line 9. But, if line 8 is a negative

9

amount, fill in the amount from line 7. This is the amount that may be claimed

as a subtraction on Wisconsin Schedule WD for capital gain from the

relocated business . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

PART III – SHAREHOLDERS, PARTNERS OR MEMBERS OF A TAX-OPTION (S)

CORPORATION, PARTNERSHIP, OR LIMITED LIABILITY COMPANY

Name of partnership, limited liability company (LLC), or tax-option (S) corporation that has relocated to

10

Wisconsin and date of the relocation to Wisconsin .

Fill in your share of the income, deductions, and other items from Wisconsin

11

Schedule 3K-1 or 5K-1 that relates to amounts earned or incurred after the

business relocated to Wisconsin . Do NOT include amounts reported on

federal Schedule D . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

Fill in your share of any capital gain or (loss) from the relocated business

12

from Schedule 3K-1 or 5K-1 that was attributable to the sale of business

assets that occurred after the business relocated to Wisconsin . . . . . . . . . . . 12

Combine lines 11 and 12. (If line 13 is zero or a negative amount, your

13

deduction is zero (-0-). Do not complete lines 14 and 15) . . . . . . . . . . . . . . . . 13

Fill in the smaller of the amount on line 11 or line 13. If line 14 is greater than

14

zero, this is your deduction for income from the relocated business. Complete

line 15 if line 12 shows a capital gain . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

Subtract line 14 from line 13. Fill in the result on line 15. But, if line 14 is a

15

negative amount, fill in the amount from line 13. This is the amount that may

be claimed as a subtraction for capital gain from the relocated business

(see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

PART IV – CORPORATIONS THAT RELOCATED TO WISCONSIN (NOT INCLUDING TAX-

OPTION (S) CORPORATIONS)

If you qualify for the credit, check box 16 and see the instructions for line 23

16

of Form 4, line 12 of Form 4T, or line 10 of Form 5 . . . . . . . . . . . . . . . . . . . . . 16

1

1 2

2