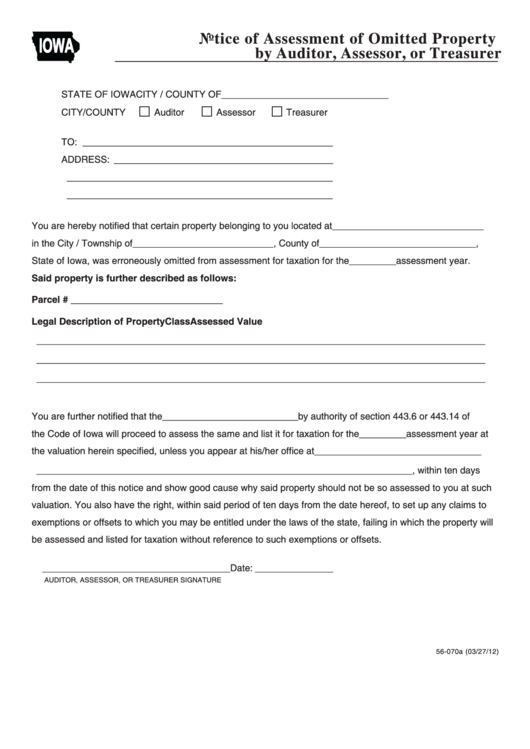

Notice of Assessment of Omitted Property

IOWA

by Auditor, Assessor, or Treasurer

STATE OF IOWA

CITY / COUNTY OF ________________________________

CITY/COUNTY

Auditor

Assessor

Treasurer

TO: ________________________________________________

ADDRESS: __________________________________________

___________________________________________________

___________________________________________________

You are hereby notified that certain property belonging to you located at _____________________________

in the City / Township of ___________________________ , County of ______________________________ ,

State of Iowa, was erroneously omitted from assessment for taxation for the _________ assessment year.

Said property is further described as follows:

Parcel # _____________________________

Legal Description of Property

Class

Assessed Value

______________________________________________________________________________________

______________________________________________________________________________________

______________________________________________________________________________________

You are further notified that the __________________________ by authority of section 443.6 or 443.14 of

the Code of Iowa will proceed to assess the same and list it for taxation for the _________ assessment year at

the valuation herein specified, unless you appear at his/her office at ________________________________

________________________________________________________________________ , within ten days

from the date of this notice and show good cause why said property should not be so assessed to you at such

valuation. You also have the right, within said period of ten days from the date hereof, to set up any claims to

exemptions or offsets to which you may be entitled under the laws of the state, failing in which the property will

be assessed and listed for taxation without reference to such exemptions or offsets.

____________________________________

Date: _______________

AUDITOR, ASSESSOR, OR TREASURER SIGNATURE

56-070a (03/27/12)

1

1 2

2