Electronic Media Transmittal Form - Georgia Department Of Labor Page 2

ADVERTISEMENT

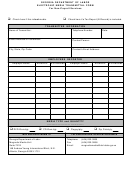

ELECTRONIC MEDIA TAX RECORD FORMAT

(DOL-4, Part II) HEREIN REFERRED TO AS “N” RECORD

POSITION

FIELD NAME

TYPE/SIZE

DESCRIPTION

1

Designator

A-1

Enter the letter “N”.

2-9

Account

N-8

Enter the 8 digit GDOL employer account

number. Numeric only; omit hyphens,

spaces and check digit.

10

Quarter

N-1

Enter the quarter for which this report

applies. Numeric only; 1, 2, 3, or 4 are the

only valid entries.

11-14

Year

N-4

Enter the 4 digit year for which this report

applies. Numeric only.

15-19

Number Employees

N-5

Enter the number of covered workers during

the pay period that includes the 12th day of

the first month of the quarter. Numeric only.

20-24

Number Employees

N-5

Enter the number of covered workers during the

pay period that includes the 12th day of the

second month of the quarter. Numeric only.

25-29

Number Employees

N-5

Enter the number of covered workers during

the pay period that includes the 12th day of

the third month of the quarter. Numeric only.

30-40

Total Wages

N-11

Enter the reporting quarter total gross wages

from line 2 of Part II of the DOL-4. Right

justify and zero fill.

(Enter $5,512,432.10 as 00551243210)

41-51

Non-Taxable Wages

N-11

Enter the reporting quarter non-taxable wages

from line 3 of Part II of the DOL-4. Right

justify and zero fill.

(Enter $5,432.10 as 000543210)

52-62

Taxable Wages

N-11

Enter the reporting quarter taxable wages

from line 4 of Part II of the DOL-4. Right

justify and zero fill.

(Enter $5,432.10 as 000543210)

63-71

Remittance

N-9

Enter amount of remittance from line 10 of

Part II of the DOL-4. Right justify and zero fill.

(Enter $12,432.10 as 001243210)

72-80

Constant

9

Enter 9 spaces.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7