Form Pub Ks-1520 - Kansas Exemption Certificates Page 43

ADVERTISEMENT

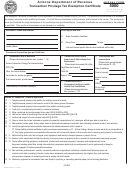

KANSAS DEPARTMENT OF REVENUE

U.S. GOVERNMENT, FEDERAL AGENCY OR INSTRUMENTALITY EXEMPTION CERTIFICATE

The undersigned purchaser certifies that the tangible personal property or service purchased from:

Seller

:

_________________________________________________________________________________________________

Business Name

Address:

_________________________________________________________________________________________________

Street, RR, or P.O. Box

City

State

Zip + 4

is exempt from Kansas sales and compensating use and transient guest tax for the following reason:

K.A.R. 92-19-77 exempts all direct purchases by the United States, its agencies or instrumentalities for their use,

except when federal law provides that a particular agency or instrumentality will be subject to a state’s tax laws. To

qualify as a direct purchase, each bill, contract or other evidence of the transaction must be made out to the United

States, its agency or instrumentality, and payment must be made by a federal check, warrant or voucher.

Description of tangible personal property or services purchased: ___________________________________

__________________________________________________________________________________________

The undersigned understands and agrees that if the tangible personal property or services are used other than as stated

above or for any other purpose that is not exempt from sales, compensating use, or transient guest tax, the undersigned

purchaser becomes liable for the tax.

Purchaser

: _________________________________________________________________________________________________

Name of Federal Entity

Address:

_________________________________________________________________________________________________

Street, RR, or P.O. Box

City

State

Zip + 4

Authorized Signature: _____________________________________________________

Date

: ___________________

THIS CERTIFICATE MUST BE COMPLETED IN ITS ENTIRETY.

WHO MAY USE THIS CERTIFICATE? Any agency or branch of the U.S. Government may use this certificate, such as the U.S. Post Office,

Internal Revenue Service, Department of Agriculture, Secret Service, FBI, American Red Cross, Federal Aviation Administration, and all

branches of the armed forces. The word “National” or “Federal” in the title of the entity does NOT necessarily mean it is an agency of the

federal government. For example, Federal Credit Unions are exempt, but National Banks are not federal agencies and thus are not exempt.

WHAT PURCHASES ARE EXEMPT? Any item of tangible personal property or labor services (except as noted below) may be purchased

by the federal government or any of its agencies exempt from sales and transient guest tax with this certificate. If the charges are billed

directly to and paid directly by the federal government, the transaction is exempt from Kansas sales tax as a direct purchase.

Sales made to and paid for by an agent, employee, or other representative of the United States, its agencies or instrumentalities are

TAXABLE, even when the agent or employee: 1) is on official business on behalf of the U. S. or any federal agency, 2) is on per diem

(allowance for daily expenses), 3) is on an expense account, or will otherwise be reimbursed by the federal agency, or 4) has or will

receive federal moneys, credits, or other assets to pay for the transaction. For example, a federal employee on per diem must pay sales

tax on car rentals, unless using one of the centrally-billed federal credit cards discussed below.

Exception for sleeping room rentals: The rental of sleeping rooms by hotels, motels, accommodation brokers, etc. to the federal government, its

agencies, officers or employees is exempt from sales tax when the room rental is made in association with the performance of official federal government

duties. This sales tax exemption on indirect purchases by federal employees applies ONLY to the rental of sleeping rooms. Transient guest tax is still

due when a federal government employee pays for the sleeping room.

Federal Credit Cards: The General Services Administration (GSA) issues “GSA SmartPay” credit cards to federal employees for official

use. Purchases by a federal employee with a “For Official Government Fleet Use Only” or “For Official Government Purchase Use Only”

Voyager, VISA, or MasterCard are exempt because these cards are centrally billed to the federal government. Purchases made using a

“For Official Government Travel Use Only” VISA or MasterCard are exempt only if the sixth digit of the account number is a 0, 6, 7, 8 or 9;

if the sixth digit is 1, 2, 3, or 4, the charge is taxable. Purchases made with a “For Official Government Use Only” MasterCard (an

integrated use card) are exempt if the purchase is tangible personal property or fuel, repair services and other items related to vehicles,

airplanes and boats. Other purchases, such as travel expenses, are taxable if the sixth digit of the account number is a 1, 2, 3, or 4, and

exempt if the sixth digit is 0, 6, 7, 8, or 9. For a more complete discussion of federal credit card transactions, obtain the policy document

entitled “Federal Credit Cards.” It is available from our offices or from the Policy Information Library on our web site:

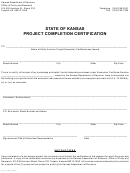

CONSTRUCTION, REPAIR OR REMODELING PROJECTS. This certificate may also be used to purchase labor services exempt from

sales tax. HOWEVER, when the U. S. government or its agencies contracts for the repair, remodeling, or construction of a real property

project, it must request and obtain a Project Exemption Certificate from the department so that the contractor (such as a carpenter,

electrician, or plumber) may purchase materials for the project exempt from sales tax. In the absence of a Project Exemption Certificate,

only the contractor’s labor services are exempt as a direct purchase.

RETAINING THIS CERTIFICATE. Sellers should retain a completed copy of this certificate in their records for at least three years from the

date of sale. A seller is relieved of liability for the tax if it obtains a completed exemption certificate from a purchaser with which the seller

has a recurring business relationship. A certificate need not be renewed or updated when there is a recurring business relationship

between the buyer and seller. A recurring business relationship exists when a period of no more than 12 months elapses between sales

transactions.

ST-28G (Rev. 1/09)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49