Form Pub Ks-1520 - Kansas Exemption Certificates Page 9

ADVERTISEMENT

Nonprofit corporations who provide nursing or foster

Noncommercial Residential. State Exempt: Gas and

care for children, the elderly, or disabled may also

electricity used in your home for nonbusiness

purposes. (Local sales tax applies). State & Local

be exempt from paying sales tax on their utilities.

Exempt: Water used in your home for nonbusiness

To qualify, the Court of Tax Appeals (COTA) must

purposes.

first have granted the nonprofit corporation an

exemption from real estate property tax.

CONDOMINIUMS AND APARTMENT

COMPLEXES. State Exempt: Gas and

Exempt Utility Uses

electricity used in the apartment or

condominium for nonbusiness residential

Electricity, gas, water and heat used in these

purposes (local sales tax applies). State & Local Exempt:

industries and ways are exempt from sales tax:

Water used in the apartment or condominium for

nonbusiness residential purposes.

• Consumed in production

• Ingredient or component part

Providing Taxable Services. To qualify, the service

• Irrigation of crops

must be subject to sales tax. Utilities used by those

• Movement in interstate commerce

who provide nontaxable services, such as a doctor,

• Providing taxable services

lawyer, accountant, or childcare center are

• Severing of oil

TAXABLE.

NOTE: Agricultural and noncommercial residential use of electricity,

HOTELS. Exempt: Utilities actually used

gas or heat are exempt from the state sales tax, but are subject to

any applicable local (city and/or county) sales tax in effect at the

in the rooms occupied by hotel guests.

customer’s location. Agricultural and noncommercial residential use

Taxable: Utilities for lobbies, conference

of water is exempt from both sale and local sales tax.

rooms, hallways, administrative offices,

swimming pools, and parking lots.

Use these general guidelines and illustrations to

determine if a portion of the utilities used by your

Severing of Oil. Exempt: Electricity or gas to power

business is exempt. Unless part of an integrated

pumps that remove oil or gas from the ground.

production operation, utilities used to light, heat, cool,

Taxable: Electricity or gas for lighting and other

clean, or maintain equipment, buildings, or business

nonextraction purposes at the pump station.

facilities are TAXABLE.

Obtaining a Utility Exemption

Agricultural. State Exemption: Gas and electricity use

related to farming or ranching, such as the electricity

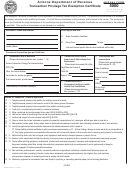

To request an exemption for electricity, gas or water

needed to operate milking machines or to run a

used in your business you must complete Statement

grain auger. (Local sales tax applies). Water use

for Sales Tax Exemption on Electricity, Gas or Water

related to farming and ranching is exempt from both

Furnished Through One Meter (ST-28B).

state and local sales tax.

You will need to complete a form for each utility meter

Consumed in Production. The utility use must meet

on which you are requesting an exemption. Follow these

the consumed in production criteria on page 8.

steps to obtain an exemption on your utility.

Exempt: Utilities used to operate tools and

manufacturing machinery. Taxable: Utilities to light,

1) Using the instructions and examples that

heat or cool a nonproduction area.

accompany the form, determine your exempt

percentage. You may need the assistance of a

Ingredient or Component Part. The utility use must

plumber or electrician to complete the formula.

meet the definition of an ingredient or component

2) Give the original completed form to your utility

part on page 8. Exempt: Water to make soft drinks

company along with all the workpapers and

or other beverages. Taxable: Water used to clean

documents used to compute your “Exempt

vats and brewing equipment.

Percent.” Be sure to keep a copy of the form and

Irrigation of Crops. Exempt: Electricity or other power

your work papers for your records.

sources to run an irrigation pump or water applied

3) The utility company may forward your exemption

to growing crops.

request to KDOR for review before granting the

exemption.

Movement in Interstate Commerce by Railroad or

Public Utility. Exempt: Electricity or gas used to

4) Once approved, the utility will grant the exemption.

pump or push oil or gas through an interstate

IMPORTANT: When there is a change in your

pipeline, provided the pipeline is registered with the

“Exempt Percent,” it is your responsibility to

Federal Energy Regulatory Commission. Taxable:

immediately file a revised utility exemption form with your

Utilities used by non-interstate pipelines. Utilities

utility provider.

used to operate railroad signal lights and switches;

9

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49