Form 70-099 - Iowa Vending Machine Monthly Tax Return (Sticks Assembled)

ADVERTISEMENT

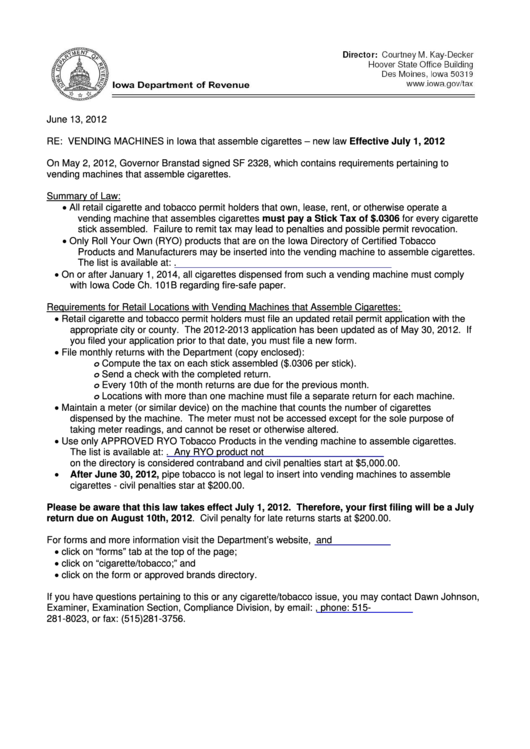

June 13, 2012

RE: VENDING MACHINES in Iowa that assemble cigarettes – new law Effective July 1, 2012

On May 2, 2012, Governor Branstad signed SF 2328, which contains requirements pertaining to

vending machines that assemble cigarettes.

Summary of Law:

All retail cigarette and tobacco permit holders that own, lease, rent, or otherwise operate a

vending machine that assembles cigarettes must pay a Stick Tax of $.0306 for every cigarette

stick assembled. Failure to remit tax may lead to penalties and possible permit revocation.

Only Roll Your Own (RYO) products that are on the Iowa Directory of Certified Tobacco

Products and Manufacturers may be inserted into the vending machine to assemble cigarettes.

The list is available at:

On or after January 1, 2014, all cigarettes dispensed from such a vending machine must comply

with Iowa Code Ch. 101B regarding fire-safe paper.

Requirements for Retail Locations with Vending Machines that Assemble Cigarettes:

Retail cigarette and tobacco permit holders must file an updated retail permit application with the

appropriate city or county. The 2012-2013 application has been updated as of May 30, 2012. If

you filed your application prior to that date, you must file a new form.

File monthly returns with the Department (copy enclosed):

o Compute the tax on each stick assembled ($.0306 per stick).

o Send a check with the completed return.

o Every 10th of the month returns are due for the previous month.

o Locations with more than one machine must file a separate return for each machine.

Maintain a meter (or similar device) on the machine that counts the number of cigarettes

dispensed by the machine. The meter must not be accessed except for the sole purpose of

taking meter readings, and cannot be reset or otherwise altered.

Use only APPROVED RYO Tobacco Products in the vending machine to assemble cigarettes.

The list is available at: Any RYO product not

on the directory is considered contraband and civil penalties start at $5,000.00.

After June 30, 2012, pipe tobacco is not legal to insert into vending machines to assemble

cigarettes - civil penalties star at $200.00.

Please be aware that this law takes effect July 1, 2012. Therefore, your first filing will be a July

return due on August 10th, 2012. Civil penalty for late returns starts at $200.00.

For forms and more information visit the Department’s website,

and

click on “forms” tab at the top of the page;

click on “cigarette/tobacco;” and

click on the form or approved brands directory.

If you have questions pertaining to this or any cigarette/tobacco issue, you may contact Dawn Johnson,

Examiner, Examination Section, Compliance Division, by email:

, phone: 515-

dawn.johnson@iowa.gov

281-8023, or fax: (515)281-3756.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4