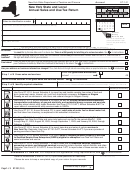

Sales tax identification number

A15

Page 4 of 4 ST-101 (2/15)

Annual

Add Sales and use tax column total (box 14) to Total special

Step 6

of 9 Calculate taxes due

axes due

T

taxes (box 15) and subtract Total tax credits, advance payments,

and overpayments (box 16). Enter result in box 17.

17

Box 14

Box 15

Box 16

+

=

$

$

$

amount

amount

amount

If you are filing this return after the due date and/or not paying the full

Step 7

of 9 Calculate vendor collection credit

amount of tax due, STOP! You are not eligible for the vendor collection

or pay penalty and interest

credit. If you are not eligible, enter 0 in box 18 and go to 7B.

7A

Vendor collection credit

$

Box 14 amount

+

$

Box 15 amount

=

+

Enter the amount from Schedule FR, as instructed on the schedule (if any).

=

Be sure to enter this amount as a positive number.

×

5% (.05) (credit rate)

Vendor collection credit

=

**

$

VE 7706

18

** In box 18, enter the amount calculated up to $200.

OR

Pay penalty and interest if you are filing late

Penalty and interest

19

7B

Penalty and interest are calculated on the amount in box 17, Taxes due. See

in instructions.

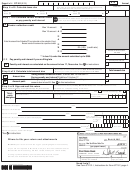

Make check or money order payable to New York State Sales Tax.

Step 8

Total amount due

of 9 Calculate total amount due

Write on your check your sales tax ID#, ST-101, and FY 2015.

Taking vendor collection credit? Subtract box 18 from box 17.

20

8A

Amount due:

Paying penalty and interest? Add box 19 to box 17.

Enter your payment amount. This amount should match your

21

8B

Amount paid:

amount due in box 20. See

in the instructions.

Step 9

of 9 Sign and mail this return

Must be postmarked by Friday, March 20, 2015, to be considered filed on time.

Please be sure to keep a completed copy for your records.

See below for complete mailing information.

Do you want to allow another person to discuss this return with the Tax Dept?

Yes

No

(see instructions)

(complete the following)

Third –

Designee’s name

Designee’s phone number

Personal identification

party

(

)

number (PIN)

designee

Designee’s e-mail address

Printed name of taxpayer

Title

Taxpayer’s e-mail address

Daytime

(

)

Signature of taxpayer

Date

telephone

Firm’s employer

*

Printed name of preparer’s firm

identification number

(or yours if self-employed)

Preparer’s

*

Preparer’s address

PTIN

Preparer’s

NYTPRIN

*

Preparer’s e-mail address

NYTPRIN

excl. code

Daytime

(

)

Signature of preparer, if other than taxpayer

telephone

*See

in instructions

Where to file your return and attachments

March 10

, 2015

New York State Sales Tax

X,XXX.XX

Web File your return at (see Highlights in instructions).

(your payment amount)

(If you are not required to Web File, mail your return and attachments to:

NYS Sales Tax Processing, PO Box 15169, Albany NY 12212-5169)

If using a private delivery service rather than the U.S. Postal

00-0000000

ST-101 FY 2015

Service, see Publication 55, Private Delivery Services.

Don’t forget to write your sales tax ID#,

Don’t forget to

ST-101, and FY 2015.

sign your check

Need help?

10000402150094

See Form ST-101-I, Instructions for Form ST-101, page 4.

1

1 2

2 3

3 4

4