8880

OMB No. 1545-0074

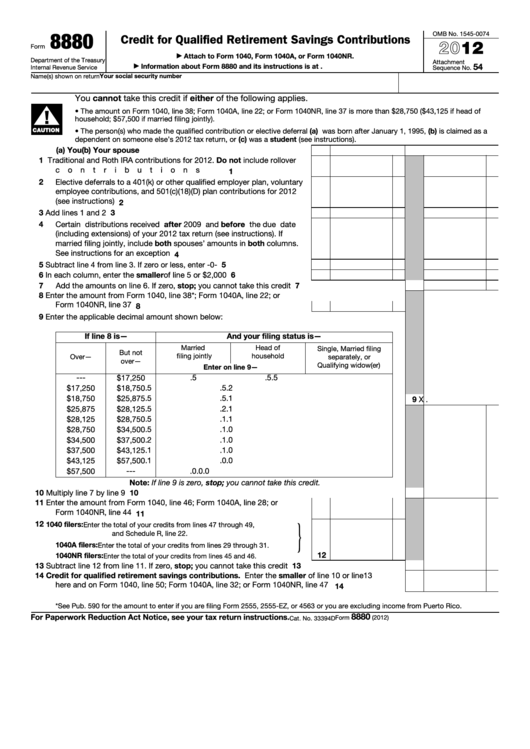

Credit for Qualified Retirement Savings Contributions

2012

Form

Attach to Form 1040, Form 1040A, or Form 1040NR.

▶

Department of the Treasury

Attachment

54

Information about Form 8880 and its instructions is at

Internal Revenue Service

▶

Sequence No.

Your social security number

Name(s) shown on return

You cannot take this credit if either of the following applies.

▲

!

• The amount on Form 1040, line 38; Form 1040A, line 22; or Form 1040NR, line 37 is more than $28,750 ($43,125 if head of

household; $57,500 if married filing jointly).

• The person(s) who made the qualified contribution or elective deferral (a) was born after January 1, 1995, (b) is claimed as a

CAUTION

dependent on someone else’s 2012 tax return, or (c) was a student (see instructions).

(a) You

(b) Your spouse

1

Traditional and Roth IRA contributions for 2012. Do not include rollover

contributions .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

1

2

Elective deferrals to a 401(k) or other qualified employer plan, voluntary

employee contributions, and 501(c)(18)(D) plan contributions for 2012

(see instructions)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2

3

Add lines 1 and 2

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3

4

Certain distributions received after 2009 and before the due date

(including extensions) of your 2012 tax return (see instructions). If

married filing jointly, include both spouses’ amounts in both columns.

See instructions for an exception .

.

.

.

.

.

.

.

.

.

.

.

.

4

5

5

Subtract line 4 from line 3. If zero or less, enter -0-

.

.

.

.

.

.

.

6

In each column, enter the smaller of line 5 or $2,000

.

.

.

.

.

.

6

7

Add the amounts on line 6. If zero, stop; you cannot take this credit

7

.

.

.

.

.

.

.

.

.

.

8

Enter the amount from Form 1040, line 38*; Form 1040A, line 22; or

Form 1040NR, line 37 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8

9

Enter the applicable decimal amount shown below:

If line 8 is—

And your filing status is—

Married

Head of

Single, Married filing

But not

filing jointly

household

Over—

separately, or

over—

Qualifying widow(er)

Enter on line 9—

---

$17,250

.5

.5

.5

.5

.5

.2

$17,250

$18,750

.5

.5

.1

$18,750

$25,875

9

X .

$25,875

$28,125

.5

.2

.1

.5

.1

.1

$28,125

$28,750

.5

.1

.0

$28,750

$34,500

$34,500

$37,500

.2

.1

.0

.1

.1

.0

$37,500

$43,125

.1

.0

.0

$43,125

$57,500

$57,500

---

.0

.0

.0

Note: If line 9 is zero, stop; you cannot take this credit.

10

10

Multiply line 7 by line 9

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

11

Enter the amount from Form 1040, line 46; Form 1040A, line 28; or

Form 1040NR, line 44 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

11

}

12

1040 filers:

Enter the total of your credits from lines 47 through 49,

and Schedule R, line 22.

1040A filers:

Enter the total of your credits from lines 29 through 31.

12

1040NR filers:

Enter the total of your credits from lines 45 and 46.

13

Subtract line 12 from line 11. If zero, stop; you cannot take this credit .

13

.

.

.

.

.

.

.

.

.

14

Credit for qualified retirement savings contributions. Enter the smaller of line 10 or line 13

here and on Form 1040, line 50; Form 1040A, line 32; or Form 1040NR, line 47 .

.

.

.

.

.

.

14

*See Pub. 590 for the amount to enter if you are filing Form 2555, 2555-EZ, or 4563 or you are excluding income from Puerto Rico.

8880

For Paperwork Reduction Act Notice, see your tax return instructions.

Form

(2012)

Cat. No. 33394D

1

1 2

2