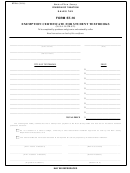

Form St-126 - Exemption Certificate For The Purchase Of A Racehorse Page 2

ADVERTISEMENT

Page 2 of 2 ST-126 (1/12)

Instructions

Who should use this form

Need help?

If you are purchasing a racehorse, the purchase may be exempt

from sales and use taxes provided the racehorse is either

Visit our Web site at

a thoroughbred or standardbred and otherwise meets the

• get information and manage your taxes online

qualifications on the front of this form.

• check for new online services and features

The exemption is provided for in Tax Law section 1115(a)(29).

For more information, see TSB-M-95(6)S, Sales Tax Exemption

Telephone assistance

for Purchases of Racehorses.

Sales Tax Information Center:

(518) 485-2889

To the purchaser

To order forms and publications:

(518) 457-5431

Complete this certificate and give it to the seller. A separate

Form ST-126 is required for each racehorse purchased. The

Text Telephone (TTY) Hotline (for persons with

racehorse being purchased must meet the requirements on the

hearing and speech disabilities using a TTY): If you

front of this form and must be purchased with the intent that

have access to a TTY, contact us at (518) 485-5082.

it will be entered in an event on which pari-mutuel wagering is

If you do not own a TTY, check with independent

authorized by law.

living centers or community action programs to find

A horse that is considered to be at least four years old that

out where machines are available for public use.

has never raced in an event on which pari-mutuel wagering is

authorized by law is not eligible for this exemption.

Persons with disabilities: In compliance with the

Americans with Disabilities Act, we will ensure

that our lobbies, offices, meeting rooms, and

To the seller

other facilities are accessible to persons with

This transaction is exempt from sales tax as long as the

disabilities. If you have questions about special

purchaser gives you a properly completed exemption certificate

accommodations for persons with disabilities, call

no later than 90 days after the transfer of the horse. After this

the information center.

90-day period, both you and the purchaser assume the burden

of proving the sale was exempt.

Privacy notification

If you accept an improperly completed exemption certificate,

The Commissioner of Taxation and Finance may collect and

you become personally liable for any sales and use tax (plus

maintain personal information pursuant to the New York State

any penalty and interest charges) that may be due, unless the

Tax Law, including but not limited to, sections 5-a, 171, 171-a,

certificate is corrected within a reasonable period of time.

287, 308, 429, 475, 505, 697, 1096, 1142, and 1415 of that Law;

Keep this exemption certificate for at least three years after

and may require disclosure of social security numbers pursuant

the due date or filing date (whichever is later) of the last tax

to 42 USC 405(c)(2)(C)(i).

return that it relates to. For each exempt sale that you make

This information will be used to determine and administer tax

to a particular customer, you must be able to produce the

liabilities and, when authorized by law, for certain tax offset and

corresponding exemption certificate. Also, you must retain

exchange of tax information programs as well as for any other

documentary proof of the horse’s age for three years.

lawful purpose.

Misuse of this certificate

Information concerning quarterly wages paid to employees

Misuse of this exemption certificate with the intent to avoid

is provided to certain state agencies for purposes of fraud

tax may subject you to serious civil and criminal sanctions in

prevention, support enforcement, evaluation of the effectiveness

addition to the payment of any tax and interest due. These

of certain employment and training programs and other

include:

purposes authorized by law.

• A penalty equal to 100% of the tax due;

Failure to provide the required information may subject you to

• A $50 penalty for each fraudulent exemption certificate

civil or criminal penalties, or both, under the Tax Law.

issued;

This information is maintained by the Manager of Document

• Criminal felony prosecution, punishable by a substantial fine

Management, NYS Tax Department, W A Harriman Campus,

and a possible jail sentence; and

Albany NY 12227; telephone (518) 457-5181.

• Revocation of your Certificate of Authority, if you are

required to be registered as a vendor. See TSB-M-09(17)S,

Amendments That Encourage Compliance with the Tax Law

and Enhance the Tax Department’s Enforcement Ability, for

more information.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2