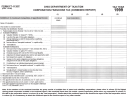

FT 1120C

Rev. 10/12

Page 4

(1)

(2)

(3)

(4)

(5)

Schedule B-3 (Combined)

Combined

Related Entity/Member Adjustments

Lead Corporation

Totals

Name of corporation ...................................................................................

1. Related entity gains (losses) from sale of investments in stock

or debt. R.C. 5733.04(I)(12)(a) ............................................................

2. Related entity gains (losses) from sale of other intangible

property. R.C. 5733.04(I)(12)(b) ..........................................................

3. Total related entity gains (losses). (Add lines 1 and 2.) .......................

4. Allocable portion of line 3 ....................................................................

5. Apportionable related entity gains (losses). (Line 3 minus line 4.) ......

6. Interest expense and intangible expense paid to related

members. R.C. 5733.04(I)(13) and 5733.042 .....................................

7. Add lines 5 and 6.................................................................................

.

.

.

.

.

8. Ohio apportionment ratio (Schedule D (combined), line 17,

each column) .......................................................................................

9. Apportioned income (line 7, column 1 X line 8, each column) ............

10. Related entity gains (losses) allocable to Ohio ...................................

11. Add lines 9 and 10, each column ........................................................

12. Apportionable excess related entity loss (if loss taxed in all

states exceeds total loss). R.C. 5733.054(B) ......................................

(

)

(

)

(

)

(

)

(

)

13. Apportionable excess related entity gain (if gain taxed in all

states exceeds total gain). R.C. 5733.054(A)......................................

14. Related members’ net interest income and net intangible income

(

)

(

)

(

)

(

)

(

)

taxed by other states. R.C. 5733.055 ..................................................

15. Enter the lesser of (a) line 14 (combined) or (b) the product of

(

)

line 6 (combined) times line 8 (combined)...........................................

16. Total of lines 12, 13 and 15 .................................................................

.

.

.

.

17. Each taxpayer’s proportionate share of the combined Ohio appor-

1.000000

tionment ratio. Divide line 8, each column by line 8, column 1............

18. Multiply line 16 by line 17, each column ..............................................

19. Allocable excess related entity loss (if loss deducted in all

states exceeds total loss). R.C. 5733.054(B) ......................................

(

)

(

)

(

)

(

)

20. Allocable excess related entity gain (if gain taxed by all states

exceeds total gain). R.C. 5733.054(A) ................................................

21. Related entity and related member adjustment. Sum of lines 11,

18, 19 and 20, each column. Enter each taxpayer’s amount on the

taxpayer’s separate Ohio form FT 1120, Schedule A, line 10 .............

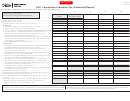

1

1 2

2 3

3 4

4 5

5 6

6