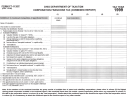

FT 1120C

Rev. 10/12

Page 6

following year. The overpayment of one member cannot be netted

form FT 1120C contains limitation schedules to ensure that the

and earlier qualifying purchases for which the taxpayer claimed

against the balance due of any other member.

litter tax does not exceed $5,000 for the combined group.

a credit on earlier reports.

Sharing the $0 to $50,000 Tax Bracket; Litter Tax Limitation.

Credits Separately Determined and Used. Unless the statute

For new manufacturing machinery and equipment purchased

All Ohio taxpayer corporations that as of Jan. 1 of the report year

that provides for the credit specifi cally states otherwise, each

after Dec. 31, 2000 a “qualifying controlled group” must compute

meet the ownership or control requirements to fi le as members of

taxpayer in the combined group must separately determine and

the 7.5%-13.5% manufacturer’s credit (grant) on a consolidated

a combined report must share one $0 to $50,000 taxable income

use any franchise tax credits to which the taxpayer is entitled.

basis, and for new manufacturing machinery and equipment

bracket to which the 5.1% rate applies. Such related taxpayers

purchased before Jan. 1, 2001, a qualifying controlled group can

Note: For taxable years ending on or after July 1, 2005, the R.C.

must share the $0 to $50,000 taxable income bracket regardless

elect to compute the 7.5%-13.5% manufacturer’s credit (grant)

5733.33 manufacturer’s credit converted to a nonrefundable

of whether those related taxpayer corporations actually fi le a

on a consolidated basis. See R.C. 5733.33(I) and 122.173(I).

grant administered by the Ohio Development Services Agency.

combined report (see R.C. 5733.06(F)). Each taxpayer’s Ohio

The term “qualifying controlled group” means two or more

For franchise tax report years 2007 and thereafter, only the grant

taxable income that exceeds the prorated amount is taxable at the

corporations that meet the R.C. 5733.052(A) ownership and

is available because the taxable years for all taxpayers for all

higher franchise tax and litter tax rates. Related taxpayers must

control requirements to fi le a combined franchise tax report

such report years will end after the June 30, 2005 effective date

prorate the $0 to $50,000 bracket on Ohio form FT OTAS, Ohio

(whether or not the corporations actually fi le a combined report).

of the new law. This is so even for the 1/7 amounts from 2005

Taxpayer Affi liation Schedule. The proration, however made, ap-

See R.C. 5733.04(M).

plies to both the franchise tax and the litter tax. In addition, Ohio

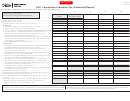

Schedule B-3 (Combined) – Related Entity and Related Member Adjustments

The related member adjustments apply to all corporations that

asset. The excess related entity loss adjustment is limited to

the total gain from the sale or other disposition of the asset. The

pay interest expense or intangible expense to certain related

that portion of each loss actually allocated to Ohio on line 10 or

excess related entity gain adjustment is limited to that portion of

members.

apportioned to Ohio on line 9.) If an excess related entity loss

each gain actually allocated to Ohio on line 10 or apportioned to

is attributable to a loss that was allocated in whole or in part to

Ohio on line 9.) If an excess related entity gain is attributable to an

Lines 1, 2, 4, 6 and 10 – Follow the Schedule B-3 line instructions

Ohio, the excess related entity loss is allocable on line 19. If an

apportionable gain, the excess related entity gain is apportionable

in the Ohio corporation franchise tax report instruction booklet. For

excess related entity loss is attributable to an apportionable loss,

on line 13.

each corporation included in the combined report enter the line

the excess related entity loss is apportionable on line 12.

item amounts in the column for that corporation. Enter in column

Enter on line 13 each corporation’s total apportionable excess

(1) the sum of the amounts of columns (2) through (5).

Enter on line 12 as a positive number each corporation’s total

related entity gain. Enter in column (1) the sum of the amounts

apportionable excess related entity loss. Enter in column (1) the

in column (2) through (5).

Line 8 – Enter each corporation’s Ohio apportionment ratio from

sum of the amounts in columns (2) through (5).

Schedule D (combined), line 17. Enter in column (1) the sum of

Enter on line 20 each corporation’s total allocable excess related

the amounts in columns (2) through (5).

Enter on line 19 as a positive number each corporation’s total

entity gain.

allocable excess related entity loss.

Lines 12 and 19 – Review the instructions for Schedule B-3,

Line 14 – Follow the Schedule B-3, line 13 instructions contained

line 11 in the Ohio corporation franchise tax report instruction

Lines 13 and 20 – Review the instructions for Schedule B-3, line

in the Ohio corporation franchise tax report instruction booklet

booklet. Also, analyze the related entity losses deducted from each

12, in the Ohio corporation franchise tax report instruction booklet.

but do not determine the R.C. 5733.055 limitation on a separate

corporation’s federal taxable income on lines 1 and 2, above. For

Also, analyze the related entity gains added to each corporation’s

company basis. The R.C. 5733.055 limitation is determined on a

each related entity loss deducted, determine the excess related

federal taxable income on lines 1 and 2, above. For each related

combined basis on line 15, Schedule B-3 (combined). For each

entity loss, if applicable. (Excess related entity loss is the amount

entity gain added, determine the excess related entity gain, if

corporation included in the combined report, enter the line item

by which the loss actually allocated or apportioned to Ohio and

applicable. (Excess related entity gain is the amount by which

amount in the column for that corporation. Enter in column (1) the

to other states that impose a tax on or measured by net income

the gain actually allocated or apportioned to Ohio and to other

sum of the amounts in columns (2) through (5).

exceeds the total loss from the sale or other disposition of the

states that impose a tax on or measured by net income exceeds

1

1 2

2 3

3 4

4 5

5 6

6