Reset Form

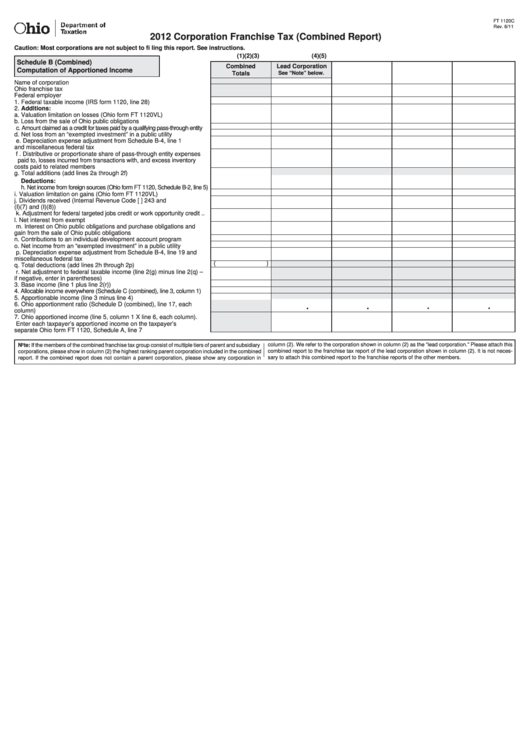

FT 1120C

Rev. 6/11

2012 Corporation Franchise Tax (Combined Report)

Caution: Most corporations are not subject to fi ling this report. See instructions.

(1)

(2)

(3)

(4)

(5)

Schedule B (Combined)

Combined

Lead Corporation

Computation of Apportioned Income

See “Note” below.

Totals

Name of corporation ...................................................................................

Ohio franchise tax I.D. number ...................................................................

Federal employer I.D. number ....................................................................

1. Federal taxable income (IRS form 1120, line 28) ...................................

2. Additions:

a. Valuation limitation on losses (Ohio form FT 1120VL) ........................

b. Loss from the sale of Ohio public obligations .....................................

c. Amount claimed as a credit for taxes paid by a qualifying pass-through entity

d. Net loss from an “exempted investment” in a public utility .................

e. Depreciation expense adjustment from Schedule B-4, line 1

and miscellaneous federal tax adjustments........................................

f . Distributive or proportionate share of pass-through entity expenses

paid to, losses incurred from transactions with, and excess inventory

costs paid to related members ...........................................................

g. Total additions (add lines 2a through 2f) .............................................

Deductions:

h. Net income from foreign sources (Ohio form FT 1120, Schedule B-2, line 5)

i. Valuation limitation on gains (Ohio form FT 1120VL) .........................

j. Dividends received (Internal Revenue Code [I.R.C.] 243 and

R.C. 5733.04(I)(7) and (I)(8))..............................................................

k. Adjustment for federal targeted jobs credit or work opportunity credit ..

l. Net interest from exempt U.S. obligations ..........................................

m. Interest on Ohio public obligations and purchase obligations and

gain from the sale of Ohio public obligations ......................................

n. Contributions to an individual development account program ............

o. Net income from an “exempted investment” in a public utility ............

p. Depreciation expense adjustment from Schedule B-4, line 19 and

miscellaneous federal tax adjustments...............................................

(

)

q. Total deductions (add lines 2h through 2p).........................................

r. Net adjustment to federal taxable income (line 2(g) minus line 2(q) –

if negative, enter in parentheses) .......................................................

3. Base income (line 1 plus line 2(r)) ..........................................................

4. Allocable income everywhere (Schedule C (combined), line 3, column 1) ....

5. Apportionable income (line 3 minus line 4).............................................

.

.

.

.

6. Ohio apportionment ratio (Schedule D (combined), line 17, each

column) ...................................................................................................

7. Ohio apportioned income (line 5, column 1 X line 6, each column).

Enter each taxpayer’s apportioned income on the taxpayer’s

separate Ohio form FT 1120, Schedule A, line 7 ....................................

column (2). We refer to the corporation shown in column (2) as the “lead corporation.” Please attach this

Note: If the members of the combined franchise tax group consist of multiple tiers of parent and subsidiary

combined report to the franchise tax report of the lead corporation shown in column (2). It is not neces-

corporations, please show in column (2) the highest ranking parent corporation included in the combined

sary to attach this combined report to the franchise reports of the other members.

report. If the combined report does not contain a parent corporation, please show any corporation in

1

1 2

2 3

3 4

4 5

5 6

6